Machine vision uses machines to measure and judge instead of human eyes. Typical machine vision systems can be divided into PCB machine vision system and embedded machine vision system (smart cameras).

In 2015, the global machine vision market size approximated USD4.2 billion, up 10.5% year on year. The United States is the world's largest machine vision market with the share of above 50%, followed by Japan.

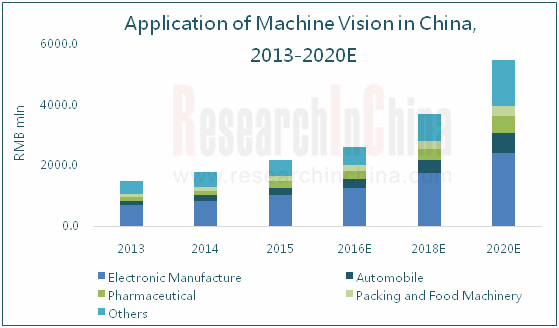

China machine vision industry started late with a small market base, but grows by leaps and bounds (it has been in a rapid development period since 2009), and has become the third-largest machine vision market following the United States and Japan. In 2015, Chinese machine vision market was worth RMB2.2 billion (about USD350 million), accounting for 8.3% of the global total and growing at 22.2% (higher than the global average). During 2016-2020, Made in China 2025 will boost Chinese machine vision market to maintain the growth rate of around 20%.

Chinese machine vision system is mainly applied in semiconductor and electronic manufacturing (accounting for 46.4% in 2015), especially SMT, AOI/AXI devices and connector detection. In addition, automobiles and pharmaceuticals consumed 10.9% and 9.7% respectively of machine vision system in 2015.

Source: Global and China Machine Vision System Industry Report, 2016-2020

Most foreign machine vision vendors enjoy superiority in the industry chain ranging from core components (light source, lens, cameras, frame grabbers, image processing software, etc.) to system integration, but Chinese counterparts do not have advantages in terms of software and hardware (they primarily purchase hardware), therefore they mostly focus on machine vision system integration and equipment manufacturing.

Currently, machine vision vendors in the United States and Japan act as the world's absolute leaders. Among them, Japan Keyence ranks first in both industrial scale and market share (market share: 12.7% in 2015). Unlike the international market, China machine vision industry has not formed a distinct competitive pattern yet. Therefore, a number of listed companies embarked on the layout of machine vision business in 2015 in order to seize the machine vision market.

In May 2015, Maxonic Automation Control and Denmark Scape collaborated to make a layout for 3D vision and robotics business.

Ningbo Cixing acquired 68% stake in Suzhou Dinnar (main business: automated assembly lines, vision inspection equipment) in April 2015 and will develop machine vision controllers via Suzhou Tuce, a subsidiary of Suzhou Dinnar.

In June 2015, Hikvision launched industrial stereo cameras and area array cameras suitable for robot positioning and guide of intelligent factories, product defect detection, etc..

Global and China Machine Vision System Industry Report, 2016-2020 focuses on the followings:

Global machine vision development environment, market size, market structure (the market in major producing countries), patents, competitive pattern, etc;

China’s machine vision development environment, market situation, patents, cost structure, competitive pattern, development trends, etc;

Market overview, major vendors and the like of major machine vision components (light source, lens, industrial cameras, frame grabbers, image processing software, system integration, etc.);

Main machine vision applications (semiconductor and electronic manufacturing, automotive, pharmaceutical, food packaging, etc.);

Operation, layout in china, machine vision business and so forth of 8 global and 12 Chinese machine vision vendors.