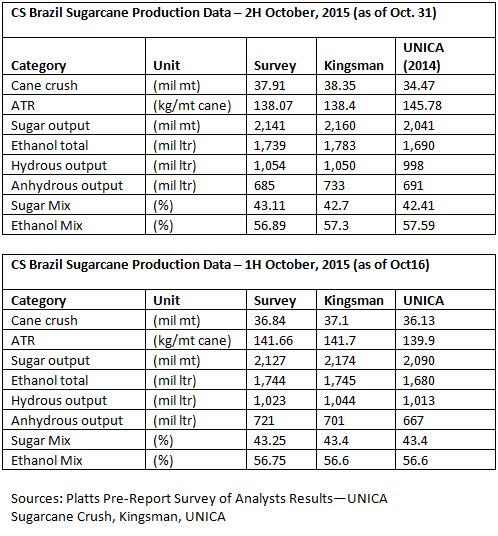

Sugarcane crush volumes in the key Center-South region of Brazil in the second half of October are expected to total 37.91 million mt, according to a Platts survey of analysts.

The consensus estimate accounts for an average of three days of crush lost to rain.

Wider analyst expectations for cane crush spanned 36.2 million mt to 40.2 million mt. Brazilian sugarcane industry group UNICA is expected to release its bi-monthly sugarcane harvest data in the next few days.

The poll of analysts forecasts total recoverable sugar (ATR) 138.07 kg/mt, with a wider range of 136.5-140 kg/mt.

Claudiu Covrig, senior analyst at Platts agricultural analytics unit Kingsman, said that even though peak output has passed for the season, the region could yet produce some surprises in the figures. "This time the surprise might come from the level of ATR Unica shows," he said. "Different mills told us the ATR levels measured for H2 October were even higher than in the previous fortnight."

"A recovery in the ATR level is not usual for this time of the year as we have already passed the peak [recorded H1 September] and we are on a seasonal downward trend for ATR levels. If so, this could have contributed to a higher sugar mix than expected," he said.

Kingsman analysts forecast a slightly higher cane crush of 38.35 million mt and an ATR of 138.4 kg/mt, down 1.50 kg/mt from first half of October.

According to the Platts survey of industry analysts conducted in the first week of November, the sugar mix in H2 October is expected to be 43.11%, down 0.70 percentage points on the year.

In terms of ethanol production, the average of analysts' expectations pointed to total output of 1.739 billion liters, which would be an increase of 59 million liters compared from H1 October. This would take cumulative ethanol production since the start of the season on April 1 to 23.609 billion liter, up 1.41% from the same period a year earlier. Hydrous ethanol production is expected to reach 1.054 billion liters, an increase of 5.61% year on year in H2 October, taking cumulative production to 14.721 billion liters, 9.95% higher year on year.

This additional production may be not relevant when compared to the boosted demand in the domestic market. Latest data from the country's National Petroleum Agency, showed that hydrous ethanol consumption in January-September totaled 13.1 billion liters, up 42% on the year, and a record high for the period.

The Platts hydrous ethanol ex-mill Ribeirao Preto assessment averaged Real 1,769/cu m ($469.38/cu m) in October, up 20.5% from the September average and up 35.9% on the year. Despite the hike on ex-mill hydrous prices, October's domestic sales are expected to be higher year on year as consumption remains strong at the pumps.

Kingsman estimates that hydrous consumption in Brazil should reach 17 billion liters this year, up 31% from 2014. Hydrous fuel production is expected to total nearly 16.2 billion liters, up 16% year on year.

H2 October anhydrous output is expected to be 685 million liters, up 18 million liters from the previous two-week period. Lower consumption of gasoline, capped by higher consumption of hydrous ethanol, has sparked a cumulative production plunge in anhydrous ethanol.

Accumulated anhydrous production is expected to reach 8.843 billion liters, down 10.35% from the same point a year earlier. Brazilian Gasoline C is a blend of gasoline A with 27% anhydrous ethanol.