Fewer executives are planning to make a capital investment in their business during the coming months, with investment expectations among Australian businesses fading in the lead-up to the middle of the year.

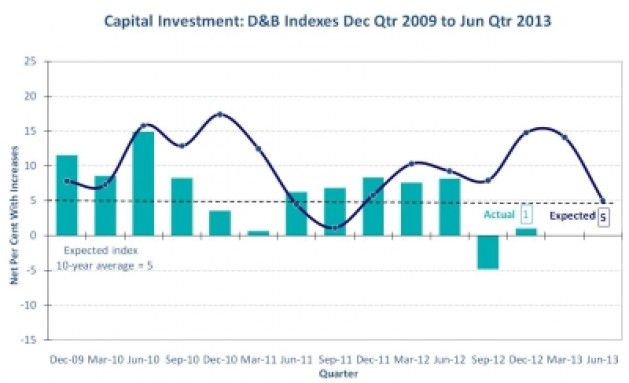

Amid a broad drop-off in business expectations for the June 2013 quarter, Dun & Bradstreet's National Business Expectations Survey shows the outlook for capital investment moving down nine points to an index of five, its lowest point since the September 2011 quarter.

The lower investment outlook brings the index closer to the level of recent activity, with actual capital investment during the December 2012 quarter below the 10-year average, at an index of one.

Investment expectations dropped most significantly in the manufacturing sector, with the index among non-durables manufacturers at negative one for the quarter ahead. The outlook for retailers is also in negative territory, while the capital investment index for wholesalers is flat.

A varying economic recovery appears responsible for the continuing mood of caution among businesses, which is in turn blunting investment plans. D&B's survey finds that just seven per cent of executives intend to seek finance or credit to grow their business in the quarter ahead. Additionally, more than 40 per cent of businesses expect to take advantage of the low interest rate levels to pay down their debt, as opposed to the eight per cent who plan to increase their borrowings.

"What we are seeing is a business community that is still wary, still looking for sustained improvement in the state of the economy," said Danielle Woods, Dun & Bradstreet's director of corporate affairs.

"At the moment, the economic performance is patchy and businesses are responding with a more conservative approach; limiting non-essential investments, avoiding the use of additional credit and reducing their debts where possible.

"With overseas markets continuing to produce mixed news, lingering effects of the global financial crisis still present here and a Federal Election approaching, businesses appear to be adopting a wait-and-see approach.

"It is apparent that this will only shift once we see a more uniform recovery, signs of which we will look for in our September quarter outlook," she added.

In line with a reduced investment outlook, the Business Expectations Survey reveals a fall in the June quarter outlook for sales, selling prices, employment, inventories and profits. The findings confirm that while sections of the economy are showing some positive signs – noticeably the Australian sharemarket – business sentiment remains conservative.

The outlook for stock levels has been significantly pulled back from the highs of the Christmas period, and fewer businesses are expecting to increase their sales and profits in the next three months. The sales expectations index has retreated to 13, its lowest point since the March 2012 quarter, and down sharply since the December quarter. These corrections can be largely attributed to consumers' continued preference for paying down debt and increasing their savings, over discretionary spending.

Further limiting the consumer appetite for spending, D&B's employment expectations index has drifted lower for the June quarter, to a score of zero. While the latest ABS employment figures show more than 70,000 jobs were created in February, D&B's forward-looking index suggests near-term employment will be flat. With the actual employment index tracking below expectations for the past three quarters, levels of unemployment look set to remain a factor in consumer spending and subsequently business growth.

According to Stephen Koukoulas, economic advisor to Dun & Bradstreet, the Business Expectations Survey provides a check to some of the recent favourable news on the economy.

"Feedback from the business sector is that the economy is at risk of a significant cooling in activity into the middle of 2013, with weak credit growth and subdued economic activity the main concerns," Mr Koukoulas said.

"With weakness in the outlook for capital investment concentrated in manufacturing, it is clear the very high level of the Australian dollar continues to cast a negative impact on significant parts of the economy.

"While some cooling in business investment has been anticipated for some time, the flow through to softer profits, employment and sales is unwelcome. The low interest rates currently prevailing are helping firms and households reduce debt, which bodes well for the medium term, but in the short term, there appears to be downside risks to growth," he added. (56)