The latest Manpower Employment Outlook Survey results show hiring sentiment for the start of 2013 will remain cautious, with Australian employers reporting a Net Employment Outlook of +8%, unchanged quarter-over-quarter and six percentage points weaker than this time last year. The outlook continues to hover at its weakest level since 2009, but the transport sector is starting to show signs of improvement.

The survey, which measures over 2,200 Australian employers' hiring intentions for the coming quarter, found that 13 per cent plan to decrease hiring for the first quarter in 2013, 20 per cent plan to increase and two-thirds (66 per cent) will make no change. Employers' hiring intentions, which have been trending downward since mid-2011, have now stabilised.

"The outlook of +8% for two consecutive quarters indicates the slowdown in employer sentiment could be here to stay," said Lincoln Crawley, managing director of ManpowerGroup Australia and New Zealand.

"What we had hoped was a short-term dip in the jobs market may in fact be the 'new norm'. With the exception of Victoria and Tasmania, the outlook in each state and territory has fallen. However, we are seeing pockets of demand and jobs growth, where 'micro-sectors' in certain industries are strong while the rest of the market is subdued. We expect this 'multi-speed' labour market to continue."

"For example, while jobs in resources are down overall, the oil and gas industry remains strong, with an expanding pipeline of projects that will drive demand for workers throughout 2013. Recent figures from the Queensland Minerals Council bear this out: while 5,000 coal jobs were lost in the state, 7,000 coal seam gas jobs were created in the first half of 2012," he said.

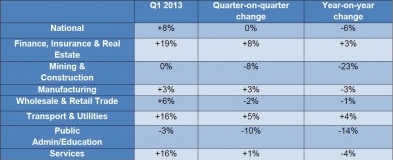

Overall,Australia's economic juggernaut in the form of the mining & construction industry sector took another hit this quarter, dropping eight percentage points to an Outlook of 0%: the weakest forecast since Quarter 3 in 2009. The drop-off follows reports of declining demand amid lower prices for commodities such as iron ore and coal.

The finance, insurance & real estate jobs market has bucked the downward trends, rising eight percentage points to an outlook of +19%.

"Whilst an uptick in finance sector jobs is somewhat surprising, it shows that employers are responding quickly to market changes. For example, risk and compliance roles are growing as the industry struggles with changes to legislation around super and financial advice. Similarly, financial sales roles are in up, as organisations invest in new products to diversify in a tough market," Mr Crawley said.

"As always, skilled trade workers and engineers are still in high demand, including mechanical fitters, sheet metal workers, electricians and a range of roles that work in resources sector construction."

Employers in the public administration & education sector reported the biggest decline in job prospects — as well as the only negative sector forecast — with hiring intentions dropping 10 percentage points quarter-on-quarter, to an outlook of -3%.

"Budgets are under pressure in most states due to lower tax revenues, and this is leading to cuts to public service staff and a freeze on recruitment in government departments and frontline services," Mr Crawley said.

Hiring intentions in the wholesale & retail trade sector fell two percentage points quarter-on-quarter to an outlook of +6%, reflecting the continued challenges in the sector.

"January is usually a busy time for the sector, so these results reflect retailers' uncertainty around how the 'sales season' will play out," Mr Crawley said.

The services and the transportation & utilities sectors both increased their hiring intentions to an outlook of +16%.

"These sectors have been quiet achievers this year, with steady but strong hiring outlooks being maintained in spite of difficult employment conditions facing the broader Australian economy. Notably, both sectors' hiring intentions showed very little change through the implementation of the carbon tax, despite fears that it would lead to job losses," Mr Crawley said.

Among the states,Victoriais the surprise performer where employers reported a four percentage point increase from last quarter. The outlook stands at 11%, showing signs of a tentative recovery with results picking up gradually over the last three quarters.

Employers inNew South Wales,Queenslandand South Australian reported similar weak outlooks of +6%, +5% and +5%, respectively. The outlook in these states each dropped two percentage points quarter-on-quarter, and represented the least optimistic job prospects since the global financial crisis began.

Mr Crawley said employers should not become complacent about their workforce planning, as shortages still exist for certain skills and job families.

"It's important for employers to continue to invest in internal training and development programs in order to build the talent they have and attract and retain the talent they will need to be successful in 2013.

"For industries where we are seeing a lot of volatility, good workforce planning and strategies can help combat the fluctuations, and optimise their workforces to run at the most efficient and effective levels,'' Mr Crawley said.