Air freight rates from Asia are expected to rise through to the end of the year following four months of stable pricing, according to a report published by shipping consultancy Drewry.

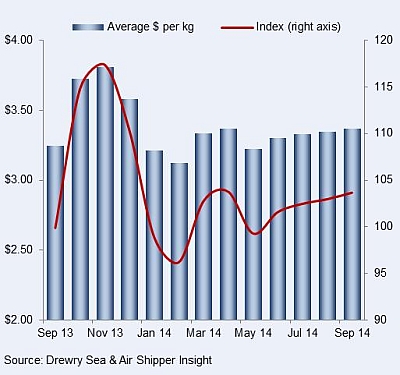

Drewry’s East-West Air Freight Price Index, a weighted average of air freight rates across 21 East-West trades, rose 0.7 points in September to 103.7 points (see graph below). The increase in pricing brought the index up to within just 0.1 points of April’s high and 3.8 points above last year’s level, indicative of the recovery in airfreight over the past 12 months.

Drewry’s east-west air freight price index.

The air freight price benchmarking reveals that rates did not rise as much as expected, given the anticipated boost of new consumer electronics products coming onto the market.

“Given the anticipated tailwinds from new product launches through September, the sluggish expansion in the index suggests some softening in underlying demand relative to capacity,” said Simon Heaney, senior manager of supply chain research at Drewry. “However, we expect pricing to rise on key origin Asian routes into North America and Europe as the trade ramps up for end of year peak season.”

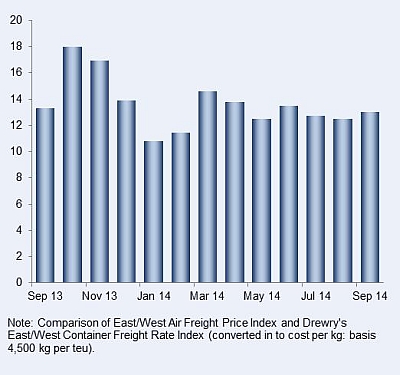

The rise in air freight pricing relative to much weaker container shipping rates served to increase the differential in pricing between the two modes. Hence, Drewry’s East-West Air Freight Price Multiplier, which measures the relationship between the cost of shipping by air relative to sea on East-West trades, gained 0.5 points in September to x13. This still left the multiplier index well above the seasonal norm of x11.

Drewry east-west air freight price multiplier.

“In the short term, Drewry expects capacity availability to tighten through peak season by comparison with recent years,” added Heaney. “However, as the trade moves into next year, the outlook appears more uncertain with overall trade growth expected to slow.”