The recovery in air freight volumes from a weak first half of last year continued into 2016, although subdued underlying global trade conditions suggest another modest year for volumes growth, reports the IATA.

Ongoing strong capacity growth is keeping the freight load factor and yields under pressure.

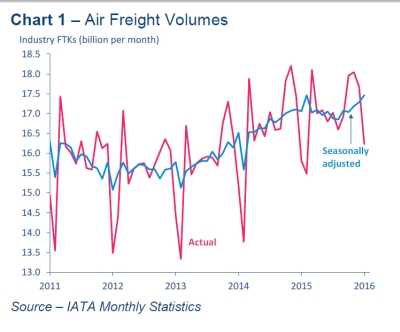

It is worth noting at the outset that any analysis of the industry at this time of the year can be complicated by shifts in the timing of Chinese New Year. Nonetheless, the first monthly reading from 2016 points to a reasonably solid start of the year for the freight side of the business. Global air freight volumes grew by 2.7% year-on-year in January 2016 – the fastest pace seen since April last year. More notably, perhaps, the recovery in seasonally-adjusted freight tonne kilometres (FTK) from the weak patch seen during the first half of 2015 has continued. Indeed, total FTK in January finally surpassed the seasonally-adjusted peak level reached in February 2015, when air freight across the Pacific was boosted by disruption to seaport activity on the west coast of the US. (See Chart 1.)

Underlying conditions remain subdued

Looking ahead, the absence of any particularly strong demand tailwinds suggests that air freight volumes are set for another year of just modest growth in 2016 as a whole. Indeed, the broader backdrop remains one where global trade growth is weak by historical standards, continuing to grow broadly in line with global GDP (rather than around twice the pace that used to be considered ‘normal’.) Admittedly, world trade volumes bounced back strongly in the second half of 2015 from the firm downward trend seen earlier in the year.

Moreover, given the extent of the declines seen in H1 2015, annual trade growth is likely to pick up sharply over the coming months too (IATA expects to see annual trade growth in the region of 5-6% during Q2 2016). But the key point is that the upward trend in world trade volumes was actually rather modest in the second half of the year – around 2% on an annualised basis.

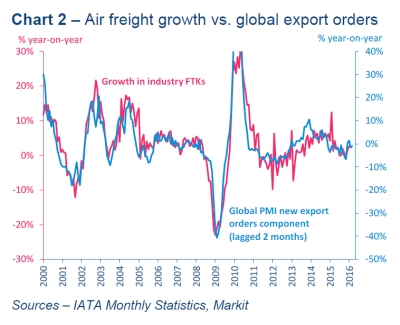

Moreover, while business surveys show that global export orders are increasing modestly, the long-standing historical relationship with air freight volumes appears to rule out a surge in growth anytime soon either. (See Chart 2.)

Load factors remain under pressure

Meanwhile, growth in the amount of capacity coming into the market has continued to far outstrip that of demand, and is keeping pressure on yields and revenues.

Industry-wide available tonne kilometres increased by 7.0% year-on-year in January. All told, the downward trend in the seasonally-adjusted industry-wide freight load factor that was a feature throughout most of 2015 appears to have bottomed out over recent months. But at 41.3% in January, the industry-wide load factor was 1.8 percentage points lower than in was in the same month a year ago.

Taking a closer look at international freight volumes carried by airlines grouped according to their region of registration, the strongest annual growth in January was seen by Middle Eastern airlines (8.7% year-on-year). This pace of growth was nearly four times that of the next fastest group (Europe), although slower than the 11.5% gain seen in 2015 as a whole. Growth in freight carried by Middle Eastern airlines continues to be helped by large-scale network and fleet expansion by the region’s carriers.

Freight volumes carried by other major players in the industry also increased relative to January 2015, albeit at much more modest rates. FTK carried by European carriers were 2.2% higher than in January 2015, although this was flattered somewhat by the weakness and volatility seen at the start of last year. The upward trend in volumes is modest, and annual growth looks likely to fall back into negative territory next month.

Recent falls in business surveys so far this year underline the fragility of economic situation in the region.

Annual volume growth for North American and Asia Pacific carriers in January was slower still (1.9% and 0.2% respectively). That said, the bigger picture is that these carriers have accounted for the bulk of the recovery in seasonally adjusted industry-wide freight volumes seen since the middle of last year.

The resumption of the upward trend in international FTK in Asia comes in spite of a weak backdrop of total trade to and from the region. According to the Netherlands CPB, emerging Asian trade contracted in month-on-month terms throughout the second half of 2015. Moreover, notwithstanding the spike at the time of the seaport disruption in early 2015, US trade data show that eastbound air freight on the Pacific route declined throughout the rest of the year, too.

North American freight volumes have risen particularly strongly in seasonally adjusted terms over the past few months. Judging from US trade data, this appears to relate to a sharp rise in air imports from Europe, largely of electrical machinery goods, towards the end of the year, as opposed to out-bound exports, which are struggling with the strong dollar.

By contrast, freight volumes carried by African and Latin American airlines both fell in annual terms in January, by 0.9% and 3.4% respectively. (It must be noted, however, that such airlines are just a small part of the overall freight industry, carrying less than 4.5% of industry volumes between them.)

The largest economies in both regions – notably Brazil, Nigeria and South Africa – are highly dependent on energy industries and have all been hit hard by the slump in global commodity prices over the past 18 months or so.

Load factors lower across the board

International freight load factors in January 2016 were lower than they were in the same month in 2015 in all six regions.

The rise in North American freight volumes in seasonally adjusted terms over recent months came alongside steady growth in freight capacity. As a result, while the North American international load factor is still some way below the industry figure, it is the only notable case to have improved markedly in recent months.