Last month’s credit crunch should be seen as part of Beijing’s effort to restrain runaway credit growth and investment and encourage consumption spending, according to the Export Finance and Insurance Corporation.

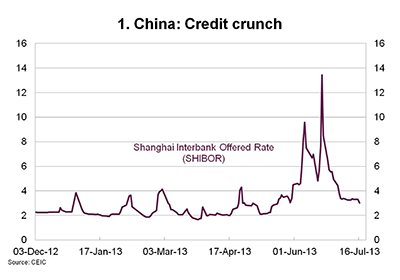

The late-June jump in China’s interbank lending rate (Chart 1), and the refusal of the People’s Bank of China to intervene, took markets by surprise. From targeting inflation at the end of 2011 to promoting growth in 2012, the central bank now appears to have switched again, reportedly concerned about the build-up of bad loans in the shadow banking system. Its action follows the circulation of several regulations in April directing banks to restrict lending to local government financing platforms. Taken together, these changes seem to herald a shift from double-digit loan growth to single-digit growth.

Though the seeming tolerance of the authorities for slower economic growth, supported by tighter and more discriminating lending, is worrying many Australian businesses, there are two further angles to consider. First, slower growth now is likely to stem asset price inflation and bad debt accumulation, and thereby reduce the risk of a ‘hard landing’ brought on by a subsequent bubble burst and credit crunch. Second, the authorities are taking initiatives to encourage consumption as they seek to restrain credit-driven investment. So the credit crunch shouldn’t just be seen as a short term growth drag, but as a measure aimed at rebalancing the economy to sustain longer-term growth.