A SHOCK contraction in Chinese manufacturing and the prospect that the US Federal Reserve could soon unwind its quantitative easing measures rocked local markets yesterday, pushing the Australian dollar close to an annual low and wiping more than $32 billion from the stockmarket.

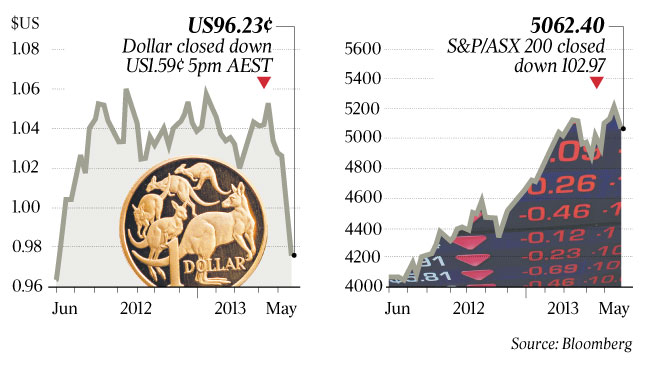

The dollar shed more than US1.5c to touch a low of US96.23c in Asian trading, before recovering slightly. Its rapid fall against the US dollar has undermined the Reserve Bank's case for more official interest rate cuts.

On the sharemarket, the benchmark S&P/ASX 200 index suffered its steepest one-day fall for two months. It finished the day 2 per cent down at 5062.40, bringing its total loss so far this week to 3.4 per cent.

A key economic report released yesterday suggested Chinese manufacturing activity had contracted in May, ending six months of expansion. HSBC's "flash" survey of purchasing managers in China eased to 49.6 in May from 50.5 a month earlier, where pundits had expected it to stay.

A figure above 50 denotes expansion, and a figure below 50 denotes contraction.

CommSec economist Savanth Sebastian said China's economy, which is crucial to Australia's fragile resources boom, was suffering "teething problems" as it achieved a soft landing because of structural imbalances.

The surprise China data sent Tokyo share prices plunging more than 7 per cent as investors panicked in the rush to take profits after months of sharp climbs. It was the Nikkei's biggest one-day fall since March 15, 2011, when a massive earthquake and tsunami roiled markets. The Nikkei index closed at 14,483.98, down 1143.28 points, or 7.32 per cent.

Hong Kong's Hang Seng index was also hammered, closing down 2.54 per cent at 22, 669.68 points. And last night European markets were also sharply lower, with the French CAC index down 2.6 per cent, Britain's FTSE index dropping 2 per cent and Germany's DAX sliding 2.9 per cent.

Conflicting signals from the US Federal Reserve fanned confusion among investors yesterday after Fed chairman Ben Bernanke had appeared cautious in his semi-annual testimony to the US Congress about the need to wind back the central bank's stimulus measures. However, board minutes from the Fed's last meeting, also released yesterday, suggested the bank's $US85 billion ($87.8bn) a month bond buying program could be progressively wound back as soon as next month.

The news sparked a sudden sell-off of the Australian dollar and local stocks. The dollar has fallen more than US7c this month against the greenback, almost breaching its low of US95.82c reached in June last year, on the prospect that the Fed's quantitative easing program would end.

"The further the currency falls, the less work the Reserve Bank has to do" said Tom Kennedy, an economist at JPMorgan, as traders pared back to 22 per cent the probability of another official rate cut next month.

In the US the Fed has promised to keep interest rates at ultra-low levels until unemployment falls below 6.5 per cent, but Mr Kennedy said its attachment to its easing program was less explicit.

David de Garis, a senior economist at National Australia Bank, said the uncertainty about QE left markets poised for more volatility around future releases of economic data.

"Neither Mr Bernanke nor his Federal Open Market Committee really know what they want, and they have been just as guilty of reacting to the latest economic data as the financial markets they seek to influence," he said.

UBS slashed its year-end forecast for the Australian dollar to US95c from $US1 yesterday. It said: "This time around portfolio inflows are too feeble to provide an effective counterbalance" to weathering commodity price weakness.

Goldman Sachs last week cut its 12-month forecast to US90c, from US98c, on bets capital flows into the currency would slow as the search for yield waned and prices of key commodities trended down.

Minutes from the RBA's May meeting, released earlier this week, confirm suspicions the bank had cut rates to historic lows to take pressure off the resurgent Australian dollar.