RATTLED investors are on high alert after the stockmarket suffered its worst week in a year and the Australian dollar slid to a 12-month low on fresh concerns about the slowing pace of global economic growth.

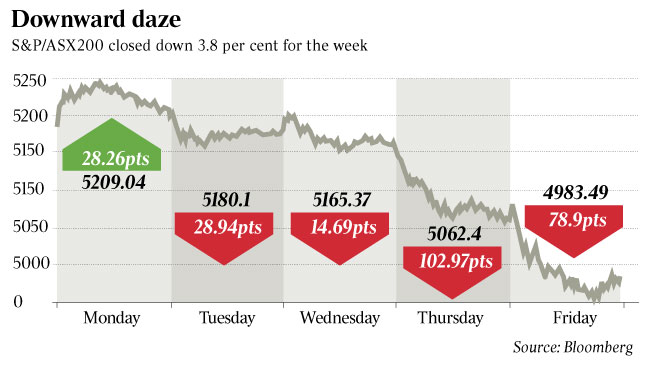

Capping a wild week for investors, the S&P/ASX 200 yesterday slumped below the symbolic 5000 point threshold, falling 1.56 per cent to 4983.5, while the broader All Ordinaries gave up 1.52 per cent to 4964.3.

The dive marked the fourth straight session in the red and took the S&P/ASX 200's decline for the week to 3.8 per cent as profit warnings pick up ahead of the upcoming reporting season.

The market started the month at 5191 points, suggesting the adage "sell in May and go away" may again weigh in coming months.

While mining services firms have been pole-axed by the hastened pullback in mining investment, fears are growing of broader weakness across the economy in retail and building materials.

Markets were mixed across Asia as global investors reacted to hints from Fed chairman Ben Bernanke this week he may wind down $US85 billion ($87.8bn) a month of money-printing earlier than expected, with the Japanese market recovering some of Thursday's more than 7 per cent fall and Hong Kong down just 0.23 per cent.

A sharper than expected fall in Chinese manufacturing this month into contractionary territory, as measured by HSBC's flash PMI, also continued to weigh on sentiment, pushing shares in Rio Tinto and BHP Billiton down more than 1 per cent.

But high-yielding stocks such as the banks and Telstra continued to drive the sell-off after recently hitting record highs and as overseas bond rates rallied. ANZ slumped 8.5 per cent in the week, as Citi analysts highlighted the risks that could cause the "so-called bubble" to burst.

"I think it just shows some of the rallies we've seen in the last couple of months in those yields stocks and sectors was really just hot money going into a momentum trade and it's just used the excuse of Bernanke's comments, the Chinese PMI and Japanese bond yields to correct an over-bought position," said Anton Tagliaferro, investment director at Investors Mutual.

"But I think it will settle down, to be honest, in the next couple of weeks. At the end of the day world growth is going to remain slow and investors are still going to want income."

Mr Tagliaferro added the fall in the banks had made their yields look "a bit more attractive than a couple of weeks ago".

UBS sales trader Rob Taubman said the falls in the banks pointed to "structural issues" causing offshore investors to assess their positions, such as the fall in the dollar and the rise in

US bond yields, reducing the appeal of the local market's dividend yield.

"The problem is, if you're going to benchmark Australian stocks relative to US stocks you're going to find Australian prices are expensive on a valuation basis," he added. "I think we continue to be at risk of earnings downgrades coming through. That will be the pattern through into the reporting season, so this has got a little bit of time to run."

Late yesterday, the Australian dollar was trading at about 12-month lows of US96.64c, after falling as low as US95.93c in early trade, far from its value of $US1.0357 at the start of the month. A raft of banks, including UBS and HSBC, have taken the knife to forecasts for the Australian dollar, with Credit Suisse predicting it would fall to US92c in three months and US85c in 12 months. Traders are also increasingly recommending shorting the Australian dollar to be on the right side of the widely expected decline as commodity prices cool and flows from offshore ease.

"The global currency war is escalating, the central banks are winning and the US dollar bull market is gaining momentum," said HSBC.

After car company Ford this week withdrew from manufacturing in Australia, Macquarie economists yesterday warned that a "weaker currency won't immediately restore growth".

Investors will turn their attention to the March-quarter private capital expenditure data out on Thursday for an insight into the extent the non-mining economy is moving in to replace the peak in mining investment, as the Reserve Bank is trying to achieve.

But a sustained depreciation of the Australian dollar is likely to cause inflation to rise and lessen the scope for the Australian central bank to cut official interest rates further, Merrill Lynch economists said yesterday.