Ask any retailer. We were blessed with great spring weather in North America this year, and now there aren’t nearly enough bikes in the channel to meet demand.

Dealers blame suppliers for not building the right number. Suppliers blame retailers for not ordering the right number. But guess what? This is a seasonal business. The number of bikes consumers want to buy each year is varies enormously depending on the weather. And until someone figures out how to predict the weather nine months ahead of time, we have to guess about the number of bikes.

This year we didn’t order or build nearly enough. And the whole industry is going to lose tens of millions of dollars in retail sales as a result.

Other years, the weather is bad (rainy weekends are an especially effective sales-killer) and we have way too much inventory. It ends up being discounted to make it go away and make room for next year’s models…and the whole industry loses tens of millions of dollars in retail sales as a result.

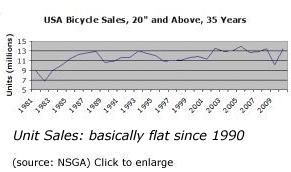

Now this may sound simplistic, but it’s one large reason for the fact that our sales (at least as measured in units) are so consistent year after year. It’s also one reason the profit margins at every point in the bicycle supply chain are so modest.

Too much, not enough, it doesn’t matter. We sell the same number of units each year, and each year we leave tens of millions of dollars on the table in exchange for the privilege.

Now as it happens, the lead time between when suppliers place a purchase order for more product and when those bikes actually show up in retailers’ showrooms is about four months. (Yes, I know it varies, but let’s keep this simple.)

So why do we order and make bikes as much as nine months before anyone wants to buy them? Can’t we get off of this merry-go-round and into a 4-month supply cycle?

Short answer: no.

Longer answer? Read on.

Reason #1: It’s The Money, Stupid

Even back in the day, when brands like Schwinn and Raleigh had their own factories in the USA, the industry had to balance seasonal demand with availability of frames and the stuff to put on them.

Currently there are four classes of players in complex mating dance that has to take place before a bike ever gets to a consumer, and they all have very different—and often directly competing—interests.

Moving upstream along the supply chain from the end consumer, we have retailers, the bike brands themselves, the Asian factories that supply them, and the equipment and materials suppliers who supply the factories.

You want to smooth out the product timing issues in the bike industry, you’re going to have to get all four of these players working together for the greater good. And for a variety of reasons, that ain’t likely to happen any time soon.

Risk and ordering flexibility. At the source-end of the supply chain, the people who actually make stuff—component suppliers, frame factories, and assembly plants—all want to level-load their production throughout the year for reasons of efficiency and cost savings.

Moving downstream along the channel, bike brands, retailers, and, ultimately, consumers all want product to magically appear in response to seasonal demand. And in between, no one wants to be left holding the inventory build-up that’s a necessary compromise to reconcile these competing interests.

But it’s not just the physical inventory that becomes complex to handle (although it is; more about that in Reason #2). even more arcane is the flow of money arrangements that pays for it all.

Follow the money. Generally, frames and assembly are paid for with letters of credit, where a bike brand’s bank pays factories (or the factories’ banks) for their products or services while the brand makes payment arrangements with its bank.

Arrangements among various fame and assembly factories typically follow the Japanese Keirestsu model: even for smaller players, a specific assembler almost always has at least some shared ownership with a framebuilder. The formerly keiretsu-based Asian component/equipment brands have become increasingly independent over the past 25 years with the longtime dominance of an ever-more-diversified Shimano leading the way, followed by the rise of the multinational SRAM collection of brands and the more recent high-end resurgent of Campagnolo.

Large bike brands have enough clout to deal directly with equipment vendors, while smaller brands most often handle those arrangements through their builder/assemblers.

As The Bike World turns. While components and equipment are becoming more economically independent, the organization of bike brands and the factories that make them has become increasingly keiretsu-like.

Giant wholly owns the Giant brand, of course. A significant investment by Merida in Specialized was announced in 1999. Following that announcement, Giant gradually stopped manufacturing Specialized bikes brand and grew increasingly close to Trek brand. Outside of the Big Three, outright vertical integration (ownership of brands and distribution organizations by factories) has become starting in about 2000.

So Giant’s factory builds for Giant and Trek brands; Merida and a few others build for Specialized, and there's a complex patchwork of lesser players on all sides of the game. For a more complete picture of who makes what for whom, see Bicycle Retailer’s reasonably-accurate-but-by-no-means-definitive annual map, reproduced at right.

The point of this whole soap-operatic patchwork of ownership and relationships is that bike brands can’t just make bikes as they’re needed, even though there is, in theory, enough Asian production capacity for it. The spiderweb of investment and alliances just won’t permit it.

Chinese New Year. Yes, Really. OK, we have to build up inventory. But have you ever wondered why all those bikes end up at retailers’ in November through January rather than, say March through April? It’s because production in Taiwan and China pretty much comes to a standstill for a couple weeks during the Lunar New Year, and it takes a couple weeks after that for everything to get back to normal.

So for an entire month starting sometime between January 21st and February 20th, bicycle production comes to a grinding halt for an entire month. which just happens to be about the worst possible time in terms of shipping bikes from Asia to the United States in time for Spring in the Western Hemisphere.

The same is true for every other warm-weather industry in the USA, too, but bicycles have the added double-whammy of being both bulky (and therefore expensive to ship and store) and low-profit items from the get-go.

And if you think the entire Chinese culture is going to reschedule a millennia-old holiday just to make things more convenient for a bunch of cyclists, well, good luck with that.