It’s everyone’s least-favorite time of year again: tax time. For the less-tidy among us, this means a mad scramble to pull together receipts and documents and forms. But no matter how well-organized you are, there’s always a sense that you could be missing out on money you’re entitled to. And if you’re a small business owner, you just might be right. Here are a few of the office tax deductions you just might be overlooking.

1. Health Insurance

“I’ve isolated the problem. People keep stealing your quarters for laundry.”

Do you have fewer than 25 employees, and cover at least half the cost of their healthcare premiums? You might be entitled to use the Small Employer Health Care Credit. Check the IRS site to find out if you qualify.

2. Your Car

That would buy about a pint of gas.

You have two choices when it comes to writing off the use of your car: you can use the standard deduction for mileage, or you can keep track. As Wealthpilgrim.com points out, choosing the later might also enable you to write off depreciation on your vehicle. You might as well get paid for all those potholes you hit while you were driving around for work.

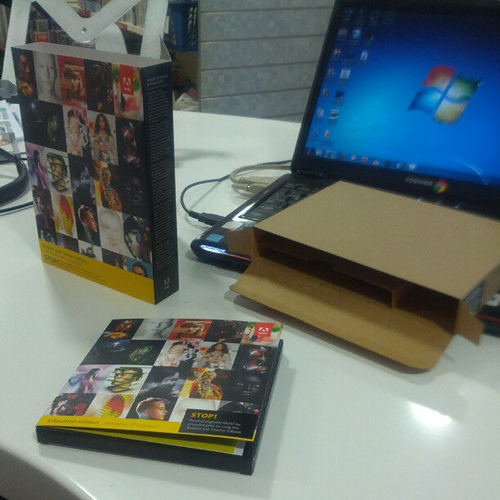

3. Software

Tiny discs, huge boxes.In the old days (i.e., last year) you had to depreciate the cost of business-related software over three years. Not so this year! In glorious tax year 2012, you can write off your software in the year that you buy it. This saves you, your accountant, or your tax software the trouble of trying to remember when you starting keeping track.

4. The Cost of Doing Your Taxes

Do not let the cat prepare your taxes. We don’t care how cute he is.

If you’re using an accountant, a qualified tax preparer, or any reputable tax preparation software, you’re probably covered here. But just in case, here’s a reminder: you are entitled to a deduction for the cost of preparing your taxes.

5. Child Labor

Pictured: A freeloader.

“Say what?” Yes, you heard us. Employing your kids is good for more than just teaching them not to come crying for handouts all the time. The tax experts at Bankrate.com write, “Depending upon how much you paid them, they might be able to avoid income taxes. Plus, there is no Social Security tax when you hire your child who is 17 or younger and you can deduct the salary as a business expense.” One caveat, however: this break only works if you’re a sole proprietor or a partnership — and the partner is your spouse.

Images: 401(k) 2013/Flickr, images of money/Flickr, Betchaboy/Flickr, deerwooduk/Flickr, audiinsperation/Flickr