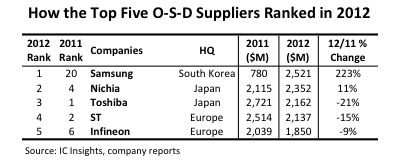

Samsung Electronics catapulted to the top of the optoelectronics supplier ranking in 2012 from 12th place in 2011 after it gained full ownership of Samsung LED, a 50-50 joint venture in light-emitting diodes that was created in 2009 between Samsung Electronics and affiliate Samsung Electro-Mechanics. In April 2012, the venture was absorbed into Samsung Electronics to strengthen and expand the use of high-brightness LEDs in displays, LCD TVs, and new solid-state lighting products. This transfer increased Samsung’s optoelectronics sales by 223% to $2.5 billion in 2012 compared to $780 million in 2011, according to the new 2013 edition of IC Insights’ O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes.

The LED operation added $1.5 billion to Samsung’s total revenues in 2012, based on the O-S-D supplier rankings in the new 350-page report, which becomes available in March 2013. The rest of Samsung’s optoelectronics sales come from CMOS image sensors, which generated $975 million in 2012—a 25% increase from 2011. The 2013 O-S-D Report shows Samsung as the second-largest supplier of CMOS image sensors in 2012, positioned between top-ranked OmniVision and third-place Sony. The 2013 O-S-D Report provides top 10 supplier rankings for the individual optoelectronics, sensors/actuators, and discrete semiconductor markets in addition to an overall top 30 list of companies selling O-S-D products in 2012.

Samsung’s huge increase in optoelectronics sales vaulted it to first place in IC Insights’ top 30 O-S-D ranking for 2012 from 20th in 2011. High-brightness white LED and blue-laser pioneer Nichia in Japan moved up to second place in the O-S-D ranking from fourth place in 2011 with an 11% increase in optoelectronics sales in 2012. In the 2012 O-S-D ranking, Toshiba and ST fell to third and fourth, respectively, due to steep sales declines in CMOS image sensors and double-digit drops in discretes. Toshiba and ST had been the No. 1 and No. 2 suppliers in the O-S-D marketplace since the middle of the last decade.

Suppliers of high-brightness LEDs generally moved higher in the overall O-S-D ranking in 2012 due to strong sales growth in lamp devices used for solid-state lighting systems. In addition to Samsung and Nichia moving up to the No. 1 and 2 positions in O-S-D, six other LED makers climbed higher in the top 30 ranking (Sharp, Osram, Philips, LG Innotek, Seoul Semiconductor, and Toyoda Gosei). U.S.-based Cree, which makes LEDs and radio-frequency/microwave power transistors, was unchanged in the top 30 O-S-D ranking at 17th place in 2012.

Among the significant changes in the O-S-D supplier rankings was ST climbing to first place in the sensors/actuators market in 2012 from fourth in 2011. ST’s sensor sales grew 19% in 2012 to $791 million. Hewlett-Packard fell to fourth place in sensors/actuators last year from the top spot in 2011 due to a 10% decline in sales of HP’s inkjet-printer actuators in 2012. In discrete semiconductors, Toshiba held on to its top position despite a 12% decline in discretes sales in 2012.