For full-year fiscal 2016 (ended 26 June), Cree Inc of Durham, NC, USA has reported revenue of $1.62bn, down slightly on $1.63bn for fiscal 2015, as growth in commercial lighting and stable LED revenue was offset by lower consumer lighting sales (as Cree shifted its product focus to premium bulbs) as well as the slowdown in the Wolfspeed Power & RF business (due mainly to customer delays for RF products).

Specifically, revenue for Lighting Products (mainly LED lighting systems and bulbs) fell by 2% from $906.5m to $889.1m (55% of total revenue). Revenue for LED Products (LED components, LED chips, and silicon carbide materials) rose by 1% from $602m to $610.8m (38% of total revenue) or flat year-on-year, excluding upfront license fees of $8m. Power & RF Product revenue fell by 6% from $123.9m to $116.7m (remaining 7% of total revenue).

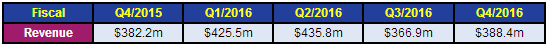

However, for fiscal fourth-quarter 2016, Cree has reported revenue of $388.4m, up 2% on $382.2m a year ago and 6% on $366.9m last quarter, as commercial lighting regained momentum (with Cree releasing nine new products or significant upgrades during the quarter). Specifically, Lighting Product revenue was $198.4m (51% of total revenue), down 13% on $229.1m (60% of total revenue) a year ago but up 5.7% on $187.7m last quarter. The double-digit growth in commercial lighting (as customer service improved significantly) more than offset the slowdown in consumer lighting as Cree reduced retail inventory (in preparation for its next-generation bulb to be launched in late fiscal Q1/2017). LED Product revenue was $159.1m (41% of total revenue), up 6% on $150.2m last quarter and up 30% on $122.2m (32% of total revenue) a year ago, benefiting from upfront LED-related IP license fees being recognized during the quarter. Power & RF Product revenue was $30.9m (8% of total revenue), roughly level with $30.8m a year ago but up 7% on $29m last quarter (and in line with targets).

On a non-GAAP basis, quarterly gross margin has grown further, from 20.9% a year ago and 30.6% last quarter to 30.8%. Specifically, LED Product gross margin has rebounded from just 7% a year ago and 34.7% last quarter to 35.1%. Lighting Product gross margin of 25.8% is up on 24.8% a year ago but down slightly from 26% last quarter, due to lower consumer margins related to product transition costs. Power & RF Product gross margin has fallen further, from 52.5% a year ago and 46.4% last quarter to 45%.

For full-year fiscal 2016, Lighting Product gross margin has risen from 26% to 27.2%, due primarily to factory cost reductions. LED Product gross margin rose from 31.7% to 34.8%, as Cree successfully restructured the business while navigating a challenging competitive environment. Power & RF Product gross margin fell from 54.7% to 48.1%, due mainly to costs associated with new product ramp ups and changes in product mix. Overall gross margin has risen from 29.8% for 2015 to 31.1% for 2016.

Quarterly operating expenses (OpEx) were $98.5m, cut from $108m a year ago but up slightly on $96.5m last quarter.

For fiscal Q4/2016, operating income was $21.5m (operating margin of 5.5% of revenue), up from $16.5m (4.5% margin) last quarter and compared with an operating loss of $28.4m (-7.4% margin) a year ago. Full-year operating income has risen from $66.1m (4% margin) for fiscal 2015 to $101.7m (6.3% margin) for fiscal 2016, driven by improved margins in Lighting and LEDs combined with lower OpEx that more than offset lower Power & RF margin.

Likewise, net income was $18.9m ($0.19 per diluted share), up from $16.9m ($0.17 per diluted share) last quarter and compared with a net loss of $20.7m ($0.19 per diluted share) a year ago. Full-year net income has risen from $70.5m ($0.63 per diluted share) for fiscal 2015 to $87.9m ($0.86 per diluted share) for fiscal 2016.

Cash generated from operations fell from $87.6m last quarter to $64.6m. In addition to patent spending of about $3.4m (down from the usual $5m), spending on property, plant & equipment (PP&E) has been more than halved from $47.9m last quarter to $20.3m, slashing total capital expenditure from $53m to $23.7m (down from $34.7m a year ago). Free cash flow was hence $40.8m, up from $34.7m a year ago and compared with -$6.3m last quarter. During the quarter, cash and investments fell by $15m to $605m.

"Fiscal 2016 was a year of progress towards our goal to build a more focused and valuable LED lighting technology company," says chairman & CEO Chuck Swoboda. "We successfully restructured the LED business, improved commercial lighting fundamentals, refocused our consumer business on premium LED bulbs, and unlocked significant value with the agreement to sell Wolfspeed [to Infineon Technologies AG of Munich, Germany for $850m in cash]."

For fiscal first-quarter 2017 (ending 25 September 2016), Cree targets consolidated revenue (including both continued and discontinued Wolfspeed operations) of $356-378m. Consolidated non-GAAP net income is expected to fall to $10-16m ($0.10-0.16 per diluted share).

For continuing operations specifically, revenue is expected to fall to $310-330m, as Lighting backlog is tracking behind the equivalent point in fiscal Q4/2016. "While the business fundamentals are improving, Q1 Lighting revenue is targeted to be 5-10% lower sequentially as we continue to rebuild the commercial project pipeline that was disrupted in fiscal Q3," says chief financial officer Michael McDevitt. LED revenue is targeted to be in a similar range (excluding the upfront license fees recognized in fiscal Q4). Gross margin should rise sequentially. Operating expenses should be similar to fiscal Q4. Net income is targeted to be $6-11m ($0.06-0.11 per diluted share). Targets do not include any estimated change in the fair value of Cree's Lextar investment.

For discontinued operations (Wolfspeed), the targets are revenue of $46-48m (similar to fiscal Q4), and net income of $4-5m ($0.04-$0.05 per diluted share).