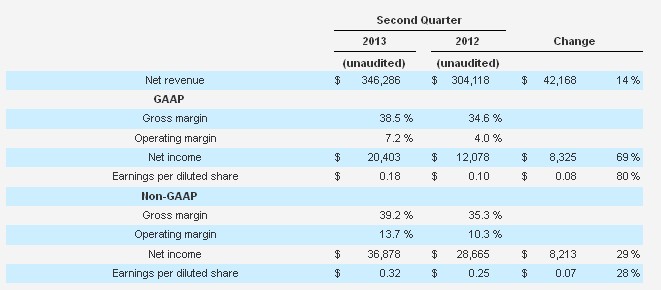

Cree, Inc. (Nasdaq: CREE), announced revenue of $346.3 million for its second quarter of fiscal 2013, ended December 30, 2012. This represents a 14% increase compared to revenue of $304.1 million reported for the second quarter of fiscal 2012 and a 10% increase compared to the first quarter of fiscal 2013. GAAP net income for the second quarter was $20.4 million, or $0.18 per diluted share, an increase of 69% year-over-year compared to GAAP net income of $12.1 million, or $0.10 per diluted share, for the second quarter of fiscal 2012. On a non-GAAP basis, net income for the second quarter of fiscal 2013 was $36.9 million, or $0.32 per diluted share, an increase of 29% year-over-year compared to non-GAAP net income for the second quarter of fiscal 2012 of $28.7 million, or $0.25 per diluted share.

“Fiscal Q2 was another strong quarter with record revenue and earnings per share that were higher than our target range due to stronger sales in both LEDs and Lighting combined with improved gross margins,” stated Chuck Swoboda, Cree Chairman and CEO. “Overall company backlog is in line with seasonal trends for our fiscal Q3. Longer term, we remain focused on driving adoption through innovation, and with our broad understanding of the technology levers from materials through systems, we see opportunities to move the market even faster than what has been experienced to date.”

Q2 2013 Financial Metrics

(in thousands, except per share amounts and percentages)

• Gross margin increased 170 basis points from Q1 of fiscal 2013 to 38.5% on a GAAP basis and increased 170 basis points to 39.2% on a non-GAAP basis.

• Cash and investments increased $69.5 million from Q1 of fiscal 2013 to $885.8 million.

• Accounts receivable (net) decreased $17.7 million from Q1 of fiscal 2013 to $144.6 million, with days sales outstanding of 38.

• Inventory increased $5.3 million from Q1 of fiscal 2013 to $185.0 million, with days of inventory declining to 78 days.

Recent Business Highlights:

• Achieved an LED industry milestone with the release of 200 lumen-per-watt XLamp® MK-R LED;

• Announced revolutionary new LM16 LED replacement lamp to obsolete energy-wasting halogen MR16 lamps;

• Introduced the XLamp XM-L2 LEDs, the industry's brightest, highest-performing single-die LEDs delivering 186 lumens per watt;

• Announced that more than 130 locations of convenience restaurant chain Sheetz, Inc. now feature state-of-the-art LED lighting by Cree;

• Released the industry's first fully qualified, production-ready, all SiC power module.

Business Outlook:

For its third quarter of fiscal 2013 ending March 31, 2013, Cree targets revenue in a range of $325 million to $345 million with GAAP gross margin targeted to be similar to Q2 and non-GAAP gross margin targeted to be 39.5%+/-. Our GAAP gross margin targets include stock-based compensation expense of approximately $2.4 million, while our non-GAAP targets do not. Operating expenses are targeted to be similar to Q2 on both a GAAP and non-GAAP basis. The tax rate is targeted at 17.0% for fiscal Q3. GAAP net income is targeted at $17 million to $23 million, or $0.15 to $0.20 per diluted share. Non-GAAP net income is targeted in a range of $35 million to $41 million, or $0.30 to $0.35 per diluted share. The GAAP and non-GAAP net income targets are based on an estimated 116.7 million diluted weighted average shares. Targeted non-GAAP earnings exclude expenses related to the amortization of acquired intangibles and stock-based compensation expense of $0.15 per diluted share.