Microsoft’s decision to increase the costs of volume licensing agreements demonstrates the power software suppliers wield over their customers.

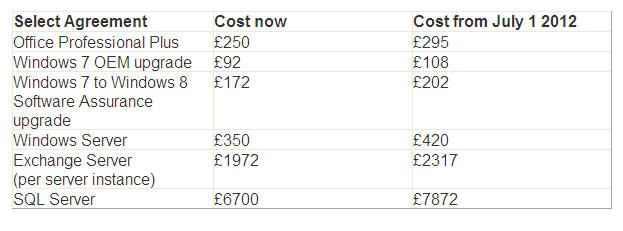

In May Microsoft announced that volume licensing will see between 7.5% and 33.5% price hikes from July to bring UK prices in line with the Euro region.

Or as the supplier put it: “From July, these moves will establish and maintain price consistency in Europe as a single market and, in general, Microsoft’s global foreign exchange policy is to maintain stable local prices.”

But at the beginning of this month Microsoft amended the price hike and businesses now face paying up to 25.5% more for their software.

The slight reductions on the original plan meant small businesses with under 250 users, that buy an Open Agreement, will see an increase of 1.7%. This compares with 7.5% announced originally announced.

Enterprise Agreement licensing costs, which were originally planned to increase 25.7%, will rise 18.7%. Meanwhile, Select Agreement prices are upped 17.7% compared to the 24.6% originally planned.

Businesses have until the end of this month to buy at current price and secure for three years, before the July increases come into force.

Businesses using volume licensing agreements are some of the biggest in the world and Microsoft risks causing angst among some of its best customers.

David Roberts, executive director at the Corporate IT forum, has 100 members representing businesses that employ over 6 million people in the UK. He called the changes “expensive, heavy and an intensely irritating waste of valuable corporate energy.”

“One can't help but be in awe of the approach taken by certain suppliers of licensed software over their determination to increase revenue at any cost and by whatever means,” said Roberts.

He said members are already suffering stress as a result of Oracle increasing prices for slight variations in already licensed usage.

“Now it seems that Microsoft is up to its old tricks again of creating new reasons to extort money from loyal customers,” said Roberts.

He said he is aware of the problems faced by 10 member organisations as a result a private meeting among member organisations and senior licensing and legal experts.

One head of IT told computer Weekly it had renewed its Enterprise Agreement for three years before the announcement: “Had we not have done this, which was a coincidence, I would not be best pleased.”

“We have not got much choice in this area and for licences to go up is like being held to ransom.”

Mark Lewis, head of outsourcing at law firm Berwin Leighton Painsner, has corporate customers with Microsoft licences running into the tens of thousands.

“Any company in the current economic climate would feel an increase of about 10%,” Lewis said.

He said businesses will be paying extra attention to their licensing needs as the July deadline for fixing prices at their current rate approaches.

“They will look closely before they commit to three years,” Lewis said.

He said mid-sized companies could be hit hardest and piracy could increase as a result.

Nick Kirkland, CEO at CIO Connect, said the changes were not a major shock and agrees that businesses will look very closely at where their money is being spent.

“Within CIO Connect, nobody is surprised,” said Kirkland.

“It will drive a very tight audit on licence needs. As these costs go up businesses will make sure they do not have more licences than they need.”

Software asset management (SAM) will become a more pressing requirement as software companies increase prices and businesses want to cut unnecessary costs.

Unilever is a case in point. It automated the processes it uses to manage its software globally through a service and saved millions of pounds.

Since 2008, Unilever had been using software and services from software asset management (SAM) service provider Business Continuity Services (BCS).

Unilever has about 100,000 desktops and 10,000 servers, and uses SAM software known as Software Organiser. This takes audit data gleaned from scanning tools and matches it up to the company's software licences.

When Unilever ran an audit using BCS services, it found 60,000 different software products. Using the SAM services, it has rationalised this to 4,500 commercially licensable products and 800 that do not require licences but need to be managed.

Antony Attfield, practice lead in the software procurement consultancy at reseller Trustmarque, said some customers could look at renewing licences earlier to take advantage of lower costs now.

"But before you do a knee-jerk reaction, do the analysis on how you use the software, what entitlements you have and assess the options available. There may be 10-15 ways of buying Microsoft licences," he said.

The price changes: