The International Air Transport Association (IATA) has released its air cargo report and outlook.

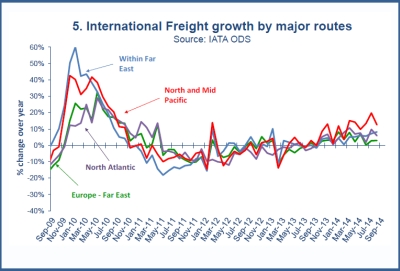

Air freight volumes continue to show solid gains on a year ago, supported by improving growth in trade in some regions, but weakness in load factors and yields continues to place downward pressure on financial performance.

Emerging Asia trade volumes have seen continual increase over the past six months, and in the US, optimism about the economic outlook is the highest it has been since the recession. These developments have supported growth in demand for air-freighted commodities like semi-conductors.

However, in Europe consumer confidence and trade activity have weakened due to the Russia-Ukraine crisis. Moreover, there has been no increase in global business confidence for the past several months, which casts doubts over the strength of the global economic upturn and prospects for continued trade growth. There have been notable declines in jet fuel prices since mid-2014 which should help reduce airline costs. But yields continue to decline slowly, putting a strain on financial performance. Yields could weaken further as new aircraft deliveries come into service in 2015. Cargo heads surveyed in October do not expected to see any improvement in yields during the year ahead, but they do anticipate continued growth in demand.

Economic situation: the global economic outlook for 2015 is for stronger growth than what is expected for 2014 overall, with notable improvements being anticipated in the US, Latin America and the Middle East/North Africa.

Traffic growth: traffic volumes are up 4-5% on a year ago, supported by solid growth in trade in some regions. Further growth could be dampened by trends in production, which continue to suggest a shift toward domestic activity.

The demand environment for air cargo is mixed. World trade volumes have shown solid gains in some regions. But there has been no further increase in business confidence over recent months, casting doubts over the strength of the global economic upturn and further growth in trade.

Demand drivers are mostly positive but show regional divergence. In China, consumer confidence remains stable and at post-recession highs in the US, but European consumers have become more pessimistic over recent months. Capital spending intentions of companies in the UK and Japan remain positive on balance, but have weakened slightly in Japan compared to Q2.

Capacity: load factors remain weak but aircraft utilisation rates have improved, despite some increases in the freighter fleet. Looking ahead, however, aircraft deliveries are set to increase by 6% in 2015 compared to 2014, which could place downward pressure on aircraft utilisation.

Competition: air freight rates are stable but show no improvement on a year ago. Sea freight rates are also flat on a year ago, despite strong growth in container shipping in most regions.

Revenue and yields: air freight yields continue to decline slowly, consistent with persisting weakness in load factors, keeping downward pressure on cargo business financial performance.

Costs: jet fuel prices have fallen significantly over recent months, now down 36% compared to the mid-year peak. Nominal wage rates continue to fall in Europe and China, but have been on the rise in the US.

Profitability outlook: consistent with some improvement in demand conditions in Q4 compared to H1, heads of cargo surveyed in October expect stronger growth in traffic over the next 12 months, but no change in yields.

Economic outlook & traffic growth

Expectations for global economic growth are improving. The global economic outlook for 2015 is for stronger growth than what is expected for 2014 overall, with notable improvements being anticipated in the US, Latin America and the Middle East/North Africa.

Despite recent impacts of the Russia-Ukraine crisis on the Eurozone recovery, the region is also expected to see some improvement in 2015 compared to 2014. But the US is expected to grow much more strongly than Europe, supported partly by looser bank lending standards. Nonetheless, tightening fiscal policy in both the US and Europe will ensure that growth remains well below that of emerging market economies.

Air freight volumes remain 4-5% above year ago levels, supported by cyclical improvements in economic growth. However, stronger economic growth in 2014 has not generated the expansion of international trade that it would have done in the past, as production has been on-shored. Although the relationship between trade and industrial production appears to be improving in terms of trade, that is mostly a result of a slowdown in domestic production rather than a notable acceleration in trade growth.