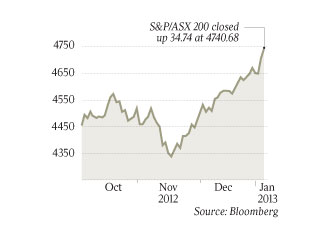

The sharemarket moved the dial a click further to boom conditions by closing at a 19-month high thanks to growing interest in blue chips and miners, and a strong tailwind from the US market's fiscal resolution-driven 2.35 per cent, 308-point rise on Wednesday.

As the Commonwealth Bank broke through the $100 billion capitalisation barrier with a 52c rise to $63.24, thanks to the continuing search for dividend yield as interest rates fall, the S&P/ASX 200 index closed up 34.8 points at 4740.9, which represents a climb of almost 2 per cent in the first two trading days of the year.

Shane Oliver, head of strategy at AMP Capital Investors, said that "two out of three big drags on our equity market are being removed" in terms of concerns about China and Australia's comparatively high interest rates, likely to drop sharply this year. Chinese manufacturing data came through strongly on Monday.

"The only one left is the high Australian dollar," he said, noting that while the market had climbed by more than 15 per cent since July 1, "our market has essentially underperformed global markets since our dollar passed US dollar parity in 2009".

Dr Oliver said that while some of the interest in mining stocks was most probably coming from overseas, "the upward pressure on the equity market in Australia is primarily local as local investors chase yield and start to feel they may be missing out on a long awaited leg-up in the equity market".

Veteran commentator and economist Don Stammer said there was more to Australia's strong day than the US tax resolution at the 11th hour in Washington. "Fears of a slowdown in global growth have lessened," he said.

"Australian investors' search for yield has intensified further, and is giving support to shares with good dividend streams.

"And there's a negative sentiment towards each of the three major currencies: the US dollar, the euro and the yen."

However, he warned that sentiment may be running ahead of actual earnings performance.

"The rise mainly reflects the hunt for yield and the massive creation of liquidity by the major central banks," Dr Stammer said.

"As these are powerful forces, investors can reasonably expect further gains in share prices over 2013. But they should also keep an eye on corporate earnings, which are currently fairly flat."

The local market opened up 0.4 per cent, following a strong lead from Wall Street, and extended gains through the day with investors buoyed by the deal over the US fiscal cliff and firmer commodities prices during the overnight session.

The gold sector climbed by 3.17 per cent, metals and minerals companies rose 1.64 per cent and the materials sector advanced 1.5 per cent, according to IRESS data.

BHP Billiton, Rio Tinto and Fortescue Metals rose respectively 31c to $38.15, $1.63 to $69.25 and 12c to $5.04 now the ore price has climbed 67 per cent since September 5.

Telstra made another 4c to $4.48 as investors chased franked dividends, of which Telstra has a guaranteed flow.

BBY dealer Anson Rosewall said the S&P/ASX 200 index remained on track to hit 5000 in the coming months.

But Mr Rosewall cautioned that a pullback was possible before the upcoming corporate-earnings season in Australia and the US.