U.S. jewelry and watch sales rose 4.3 percent year on year in July, according to preliminary government calculations, representing the strongest monthly gain so far this year. Earlier this month, and beginning with June's provisional sales data, the government revised sector growth lower for each of the previous five months.

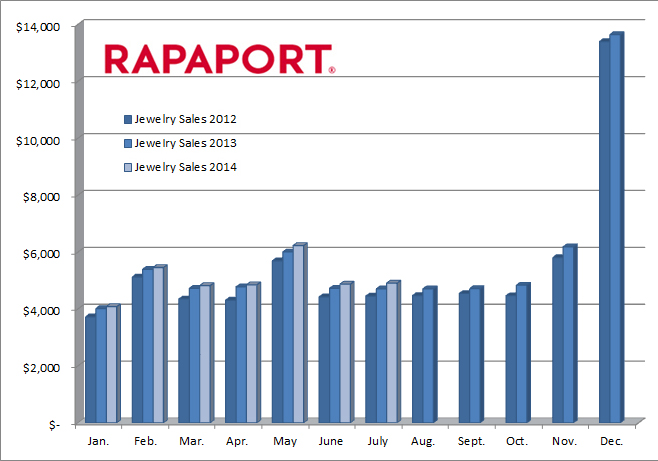

The jewelry and watch sector also benefited from weak inflation pressure in July as the U.S. consumer price index (CPI) for jewelry declined 4.5 percent, while the CPI for watches was down 0.5 percent. According to Rapaport News calculations, jewelry sales in July for all retail outlets increased 4.1 percent year on year to $4.907 billion. Read more after the chart.

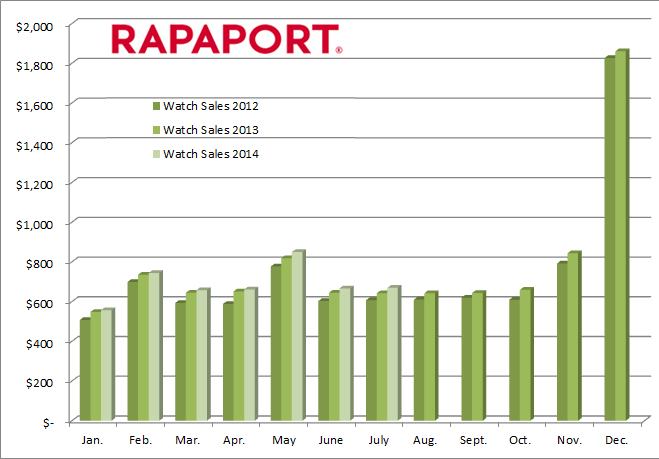

Watch sales in July rose 5.2 percent year on year to $669 million. Jewelry and watch sales in the first seven months of 2014 have risen 2.6 percent to $40.021 billion with jewelry sales of $35.218 billion and watch sales of $4.802 billion, according to Rapaport News calculations. Read more after the chart.

Meanwhile, advanced sales estimates from U.S. department stores declined 2.8 percent year on year to $12.341 billion in July. However, retail sales estimates for all products and services jumped 4.2 percent to $446.3 billion. Retail trade sales rose 3.4 percent and nonstore retail sales increased 6.7 percent during the month.

Retail sales were mixed in other major economies during July. Hong Kong's retail sales declined 3.1 percent during the month due to weaker tourist spending overall and a drop in demand for jewelry and luxury goods. ANZ economist Raymond Yeung told MarketWatch that the luxury segment in China is depressed and this could ultimately pressure commercial rentals in Hong Kong's high-end shopping destinations.

Germany, Europe's largest economy, recorded a 0.7 percent year-on-year increase in retail sales for July. However, sales growth missed expectations and economists noted that total receipts fell 1.4 percent compared with June, which was the largest month-to-month decline to be posted since January 2012. The country's retail sector has experienced a 1.3 percent increase in retail sales for the first seven months of the year.

Japan recorded a 0.5 percent year-on-year increase in retail sales for July at $114 billion (JPY 11.8 trillion); however, the larger retailers reported consumer spending weakness.

Economic news from the U.K. signaled a burst of consumer spending at retailers in August, leading CBI to conclude that retail sales should accelerate again in September.

Katja Hall, CBI's deputy director general, said, “The high streets have been bustling with shoppers this summer and it is good to see firms so optimistic about their business prospects for the next three months -- higher than at any time since 2002. Retailers looking forward to stronger growth in September are keeping their shelves well-stocked in anticipation.”