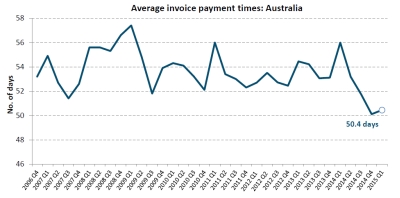

Despite an Australian economy growing at a moderate 2.3 per cent according to March quarter figures released by the ABS this month, the latest data on trade payments reveals that businesses are paying their invoices at the fastest rate on record.

Dun & Bradstreet’s Trade Payments Analysis reveals that average invoice payment times were 50.4 days during the first quarter of the year, down from 56 days a year earlier. While payment times slowed marginally quarter-on-quarter, the current rate is the fastest measured by Dun & Bradstreet for a Q1 period in the eight-year history of the data.

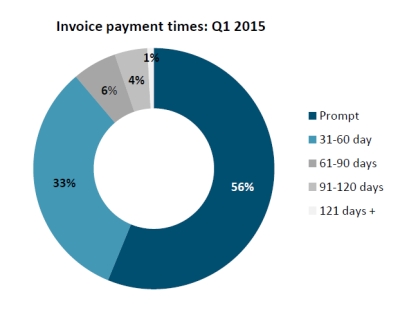

The sharp drop in payment times over the past 12-months has been driven by a jump in the percentage of invoices settled within 30 days, which lifted from 44 per cent to 56 per cent.

According to Gareth Jones, CEO of Dun & Bradstreet in Australia & New Zealand, the latest findings reflect the positive impact of low interest rates on cash flow and the improved efficiency of the business sector in the post-GFC environment.

“The lower cost of debt is certainly helping businesses to manage their repayments and control their cash flow in an operating environment of soft demand,” said Mr Jones.

“The protracted recovery since the global financial crisis has also forced businesses to become leaner and more efficient operations, with a greater flexibility in payment terms and conditions to improve the likelihood of timely payment.

“Despite the improvement, 44 per cent of commercial invoices in Australia are still being paid late, which withholds significant amounts of money from the financial system and places financial strain on supply chains,” Mr Jones added.

According to Dun & Bradstreet’s June Business Expectations Survey, 46 per cent of businesses would choose to miss a payment to a trade supplier if without enough money to cover all of their expenses. The survey also found that 34 per cent of businesses have had a customer or supplier become insolvent or otherwise unable to pay them during the past year.

The findings underscore the challenge facing businesses to ensure prompt payment for their goods and services.

Despite more limited financial reserves, businesses with between one and five employees paid their accounts in an average of 47.2 days during the first quarter of the year, three days faster than the national average. In comparison, those companies with more than 500 employees paid their bills more than a week later, at an average of 55.1 days.

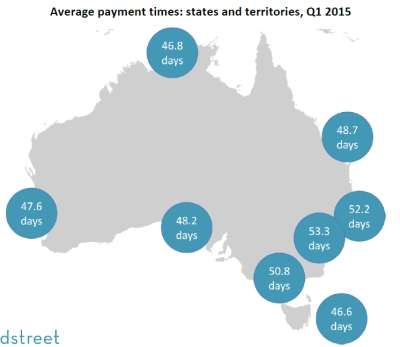

Although improving by four days from the year before, the ACT recorded the slowest average payment time of 53.3 days. Meanwhile, businesses in Tasmania were the fastest to pay their invoices, averaging 46.6 days during Q1 2015, down from 54.9 days at the same time last year.

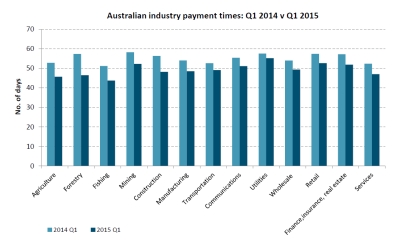

Across the country, businesses operating in the utilities sector were the slowest to pay their invoices, averaging 55.2 days, down from 57.5 days last year although up on the 51.9 days in the previous quarter. The retail and mining sectors were next slowest, averaging 52.6 days and 52.2 days respectively.

At the other end of the scale, businesses in the fishing industry averaged 43.7 days to complete their payments during Q1 2015. Businesses in agriculture and forestry averaged the next fastest payment times, at 45.7 days and 46.5 days respectively.

According to Stephen Koukoulas, economic adviser to Dun & Bradstreet, the improvement in trade payment times indicates healthy finances within the business sector.

“With firms paying their bills faster than the historical average, cash flow appears strong,” said Mr Koukoulas.

“The extremely low level of interest rates is certainly assisting, with the current period of very low wages growth helping many businesses build a stronger financial position.

“We will be watching with interest to see whether businesses can maintain lower payment times, or whether the slight quarter-on-quarter uptick develops into a trend given the soft economic performance expected for the remainder of 2015,” Mr Koukoulas noted.