Wide-bandgap (WBG) semiconductor materials such as silicon carbide (SiC) and gallium nitride (GaN) are best positioned to address emerging power electronics performance needs in electric vehicles (EVs), with SiC displacing silicon as early as 2020, according to Lux Research.

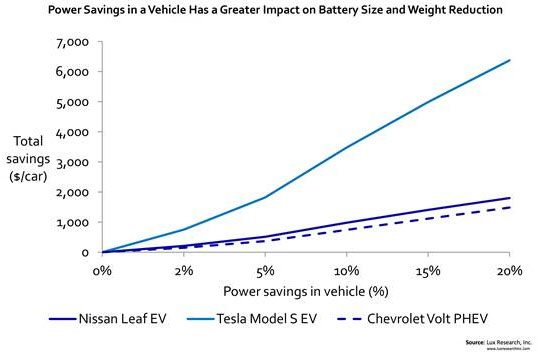

As silicon struggles to meet higher performance standards, WBG materials are benefiting critically from evolving battery economics, says the market analyst firm. On the Tesla Model S, for example, a 20% power saving can result in gains of over $6000 in battery cost, or 8% of the vehicle's cost.

"Efficient power electronics is key to a smaller battery size, which in turn has a positive cascading impact on wiring, thermal management, packaging, and weight of electric vehicles," notes Lux Research analyst Pallavi Madakasira, lead author of the report 'Silicon vs. WBG: Demystifying Prospects of GaN and SiC in the Electrified Vehicle Market' (part of the Lux Research Energy Electronics Intelligence service).

"In addition to power electronic modules, opportunities from a growing number of consumer applications – such as infotainment and screens – will double the number of power electronic components built into a vehicle," she adds.

Lux Research analysts evaluated system-level benefits that WBG materials are bringing to the automotive industry, and predicted a timeline for commercial roll-outs of WBG-based power electronics. Their findings include the following:

Lower power saving threshold for EVs. At 2% power savings, if battery costs fall below $250/kWh, then SiC diodes will be the only economic solution in EVs requiring a large battery, such as the Tesla Model S. However, for plug-in electric vehicles (PHEVs), the threshold power saving needs to be a higher 5%. SiC ahead in road to commercialization. SiC diodes lead GaN in technology readiness and will attain commercialization sooner, based on the current Technology Readiness Level (TRL). Based on the TRL roadmap, SiC diodes will be adopted in vehicles by 2020. Government funding is driving WBG adoption. The USA, Japan and the UK, among others, are funding R&D in power electronics. The US Department of Energy's Advanced Power Electronics and Electric Motors is spending $69m this year and defining performance and cost targets; the Japanese government funds a joint industry and university R&D program that includes Toyota, Honda and Nissan.