The final ruling of U.S.’s review of 2012 anti-dumping and countervailing duties (AD/CVD) against certain Chinese PV cells addressed the importance of PV capacities in countries out of China and Taiwan. The AD/CVD rates for PV cells and the cost of PV modules will be crucial for PV manufacturers which aim to increase their market share in the U.S. market, and the demand in the U.S. will influence the future price trend. EnergyTrend estimates that Taiwan’s and China’s PV cell manufacturing capacity in third-party counties will cumulatively reach 4.5GW by the end of 2015, and the currently upward price trend could also be restricted.

The new AD/CVD tariffs on PV cells formed new thresholds for Chinese and Taiwanese PV exporters. To manufacturers with limited cash, the heavy tariffs create barriers for them to export PV products to the U.S. market. It is necessary for those who are trying to increase their market shares in the U.S. market to make PV modules with tax-free cells in the third countries – only by doing so, the module prices could be lower than PV modules using Taiwan- or China-made cells. As a result, the PV cell production capacity in the third countries again grabbed the attention of cross-strait PV manufacturers. Factors such as, if the PV cell production capacity in the third countries will be enough to satisfy the demand in the U.S. market, and when the full capacity will be realized, will all cause changes in the PV cells’ price trend in the second half of 2015.

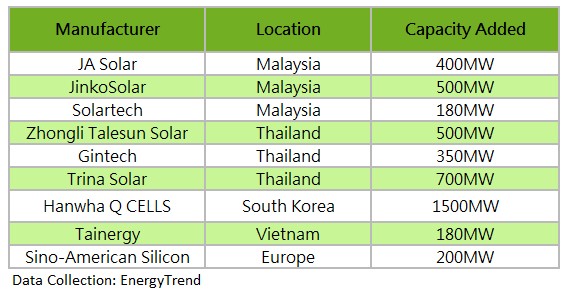

According to EnergyTrend’s research, several Chinese and Taiwanese PV manufacturers have started deploying new producing lines in Asian regions such as Southeastern Asia and South Korea. Simply in these regions, the additional PV cell production capacity is estimated to reach 4.5GW (capacity in India excluded), which will be sufficient for the U.S. market. As a result, the supply and demand in the U.S. would be balanced as long as all the capacity were realized as projected. The balance will also indicate to a possible downturn of Taiwan- and China-made PV cells’ price trend.

In China, the domestic demand is expected to increase in the second half of 2015, driving a upward trend in polysilicon’s quotes. Polysilicon’s spot price increased 1.26% to US16.1/kg during the past week.

Demand to high efficiency multi-si wafers is also stronger than the previous weeks. First-tier multi-si wafer manufacturers are mostly under full producing capacity, and the spot prices slightly raised 0.36% to average US$0.825/piece. Nonetheless, orders for mono-si wafers remained flat as most of the demands are from in-house OEM needs. As a result, spot price of mono-si wafer slightly dropped 0.52% to US$0.959/piece.

Price trend of PV cells continued to climb during this week. The conclusion of U.S.’s 20132 AD/CVD tariffs review triggered a 0.32% rise for Taiwan-made high efficiency multi-si PV cells up to US$0.313/W. Taiwan-made multi-si PV cells’ spot price also increased 0.34% to US$0.293/W. In contrast, spot price of China-made multi-si PV cells stuck at US$0.289/W.

Spot prices of PV modules generally remained except modules that will be exported to the U.S. However, the price impact could be limited since only few first-tier manufacturers would ship their PV modules to the U.S. market and most of them will export the products from overseas plants. In China, on the other hand, the strong demand will further drive the price trend of PV modules. High efficiency multi-si 260W PV modules’ average quote was US$0.538/W, and the 270-275W mono-si PV modules’ spot price was US$0.61/W.