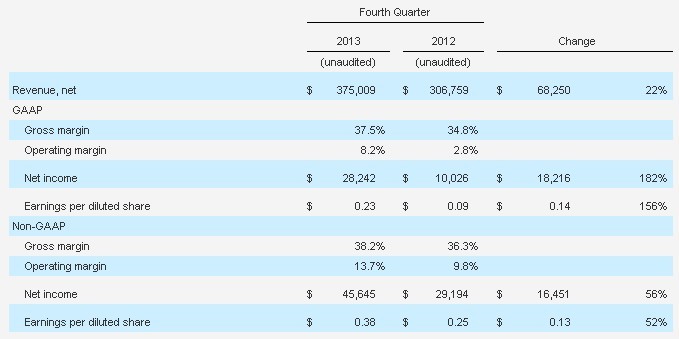

On Aug. 13, Cree, Inc., a market leader in LED lighting, announced revenue of $375.0 million for its fourth quarter of fiscal 2013, ended June 30, 2013. This represents a 22% increase compared to revenue of $306.8 million reported for the fourth quarter of fiscal 2012, and a 7% increase compared to the third quarter of fiscal 2013. GAAP net income for the fourth quarter was $28.2 million, or $0.23 per diluted share, an increase of 182% year-over-year compared to GAAP net income of $10.0 million, or $0.09 per diluted share, for the fourth quarter of fiscal 2012. On a non-GAAP basis, net income for the fourth quarter of fiscal 2013 was $45.6 million, or $0.38 per diluted share, an increase of 56% year-over-year compared to non-GAAP net income for the fourth quarter of fiscal 2012 of $29.2 million, or $0.25 per diluted share.

For fiscal year 2013, Cree reported revenue of $1.39 billion, which represents a 19% increase compared to revenue of $1.16 billion for fiscal 2012. GAAP net income was $86.9 million, or $0.74 per diluted share, an increase of 96% compared to $44.4 million, or $0.39 per diluted share, for fiscal 2012. On a non-GAAP basis, net income for fiscal year 2013 was $155.4 million, or $1.32 per diluted share, an increase of 42% compared to $109.2 million, or $0.95 per diluted share, for fiscal 2012. Cree generated $285.2 million of operating cash flow and $186.9 million of free cash flow (cash flow from operations less capital expenditures) during fiscal 2013.

"Our fiscal fourth quarter was a strong finish to a great year, with record revenue and good earnings growth in line with our targets," stated Chuck Swoboda, Cree Chairman and CEO. "Total company backlog is ahead of this point last quarter and we are targeting solid growth in LED lighting in Q1. Our new products have opened new applications, improved payback, and fueled growth in LED lighting. We remain focused on driving mass adoption and our goal of 100% upgrade to LED lighting."

Q4 2013 Financial Metrics

(in thousands, except per share amounts and percentages)

Gross margin decreased 60 basis points from Q3 of fiscal 2013 to 37.5% on a GAAP basis, and decreased 60 basis points to 38.2% on a non-GAAP basis. Cash and investments increased by $86.9 million from Q3 of fiscal 2013 to $1.0 billion. Accounts receivable, net increased by $10.6 million from Q3 of fiscal 2013 to $192.5 million, with days sales outstanding of 46. Inventory increased by $1.3 million from Q3 of fiscal 2013 to $197.0 million and represents 76 days of inventory.