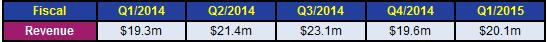

For first-quarter 2015, AXT Inc of Fremont, CA, USA, which makes gallium arsenide, indium phosphide and germanium substrates and raw materials, has reported revenue of $20.1m, up 2.5% on $19.6m last quarter and 4% on $19.3m a year ago.

Despite dipping slightly from 25.4% last quarter, gross margin of 23.7% is still up on 14.1% a year ago. After rising from $5.1m a year ago, operating expenses are up further, from $5.6m last quarter to $6.5m, due largely to professional fees associated with an internal investigation of certain potential related-party transactions doubling from $0.6m to $1.2m.

Net loss was $1m ($0.03 per diluted share), up from $311,000 ($0.01 per diluted share) last quarter but halved from $2m ($0.06 per diluted share) a year ago. During the quarter, cash and investments hence fell slightly from $48.9m to $47.5m.

"As we move into 2015, our goal is to take advantage of developing market conditions in our business," says CEO Morris Young. "Gallium arsenide has stabilized and addresses a market with numerous applications and dynamic opportunities. Indium phosphide is growing and we are investing in ways to capitalize on industry demand," he adds. "Additionally, we see catalysts for growth this year in several of our target markets and believe that we continue to benefit from our unique vertical integration. In total, our diversified revenue base, solid competitive positioning and lower cost structure give us renewed optimism for our direction and prospects."