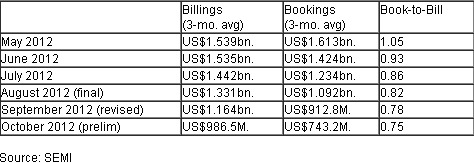

The October 2012 book-to-bill (B/B) ratio of North American semiconductor-equipment industry hit a 12-month low of 0.75, with the three-month average of worldwide bookings amounting to US$743.2 million in October and the three-month average of worldwide billings totaling US$986.5 million in the meantime.

SEMI, which represents the majority of the world’s semiconductor and LCD manufacturers, recently released the statistics. A B/B ratio of 0.75 means that US$75 worth of orders were received for every US$100 of products billed for the month.

According to the organization’s president and chief executive officer, Denny McGuirk, semiconductor industry investments remain muted as the industry enters the fourth quarter. But he added that investments in leading-edge technologies will continue to drive spending in the near term.

Taiwan’s industry executives pointed out that amid global economic slowdown silicon foundries are still relatively vigorous in equipment investments compared with DRAM chipmakers, which have either trimmed production scale or closed production plants to cope with tremendous loss.

Economic downbeat has promoted market research firm Gartner to cut down twice estimate for 2012 revenue of global semiconductor industry to a 3% contraction from a 0.6% increase year on year.

Equipment manufacturers estimated their industry would begin to recover at the end of the first quarter of 2013, when foundries will more vigorously invest in equipment than now.

Taiwan Semiconductor Manufacturing Co., Ltd. (TSMC), currently the world’s No.1 pure silicon foundry, has set aside US$8.3 billion for equipment investment in 2012, an increase of 13.98% over 2011’s US$7.29 billion. The No.2 foundry United Microelectronic Corp. (UMC) has budgeted US$2 billion in 2012 for equipment procurements, 25% more than the sum it spent in 2011.

Some institutional investors estimated that demands for 28nm foundry service will remain strong in 2013 thanks to the brisk market of mobile computing devices. TSMC is estimated to spend US$8-8.5 billion on expansion of advanced processes next year, including 20nm and 28nm processes.