According to Yole Développement's new market research report 'LED Front-End Manufacturing Trends' (which covers substrates, epitaxy, lithography, plasma etching & deposition, PVD and testing), the LED substrate is one of the key factors impacting the LED front-end industry.

This impact is manifested in the following ways:

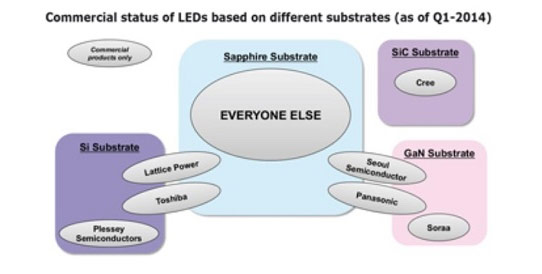

Increased demand for larger-diameter sapphire wafers, with big players (such as LG, Sharp or Osram) moving to 6" wafers and Taiwanese players moving to 4" wafers. Increased demand for patterned sapphire substrates (PSS), which have now become mainstream in the industry (87% share, as of first-quarter 2014) even if some questions remain concerning the strategies of key patent holders. The development of gallium nitride-on-silicon (GaN-on-Si) and GaN-on-GaN LEDs, with both technologies having begun mass production in some companies (such as Soraa for GaN-on-GaN, or Toshiba for GaN-on-Si). However, market penetration of these alternative substrates will be secondary to future improvements in terms of performance and cost. Otherwise, GaN-on-Si and GaN-on-GaN LEDs will not be able to fully compete with sapphire-based LEDs.

The impact of the sapphire industry on the LED sector is likely to grow in the future because of the partnership in fourth-quarter 2013 between GT Advanced Technologies Inc (GTAT) and Apple to set up a large ($1bn) sapphire manufacturing plant which, with a capacity roughly doubling the industry's existing qualified sapphire capacity, could totally modify the structure and evolution of the sapphire and LED industries in the next few years, reckons Yole.

Increased competition to accelerate new LED MOCVD reactor development

Epitaxy has been of core interest to the LED front-end industry, and has seen the entry of several new players in the metal-organic chemical vapour depsotion (MOCVD) reactor market since 2011/2012, notes Yole. Even if increased competition has not really affected the market leaders (Aixtron, Veeco and Taiyo Nippon Sanso), it has forced them to accelerate development of the next generation of MOCVD tools to leverage market entry barriers. This generation of MOCVD reactors should focus on cost of ownership (CoO) and see the emergence of enhanced designs (with new heating systems, new gas-flow designs, and increased automation etc), says Yole.

Regarding lithography, plasma etching & deposition, PVD and testing, mostly incremental evolutions have occurred (such as improvements in throughput, and reductions in average selling price), reflecting saturation in technological development, notes Yole.

Flip-chip technology as the new battleground

As flip-chip gradually matures, LED makers are actively developing this technology as it provides several advantages, such as larger light-emitting area and highest luminosity, better heat dissipation, adjustable dimensions, and the elimination of wire-bonding.

While this technology has been in the hands mostly of a few big LED makers (such as Cree or Lumileds), in 2013 Taiwanese manufacturers (mainly Epistar, FOREPI and Genesis Photonics) also started to develop it.

In 2014, flip-chip technology should also make its way into the mid-power LED market. In third-quarter 2013, Lumileds announced plans to introduce flip-chip technology into the mid-power LED market, as devices in this sector have drawn the most attention from the general lighting market in 2013. Indeed, following the industry overcapacity of 2011/2012, mid-power LEDs have become mainstream in interior lighting applications.

From technology-oriented to cost-oriented manufacturing

LED manufacturing still uses methods and practices - such as manual wafer handling, with operators moving wafers with tweezers in (not so) cleanrooms - that would be considered outdated in most semiconductor industries. However, the emergence of LED 'giants' (such as Cree, Osram, Lumileds, Samsung and LG) have facilitated and sped up the adoption of manufacturing paradigms from the IC industry in order to reduce overall manufacturing cost and increase product quality. These factors include the following:

the transition from batch processing to single-wafer processing; automation, cluster tools, full cassette-to-cassette operation; statistical process control (SPC), defect management etc; a reduction of SKUs (stock-keeping units); and enterprise management systems (EMS).

As a result, the gap will widen between Tier-1 players and other players, pushing forward industry consolidation, forecasts Yole.