G-III Apparel Group Ltd. reported fourth-quarter earnings that came in well short of Wall Street targets.

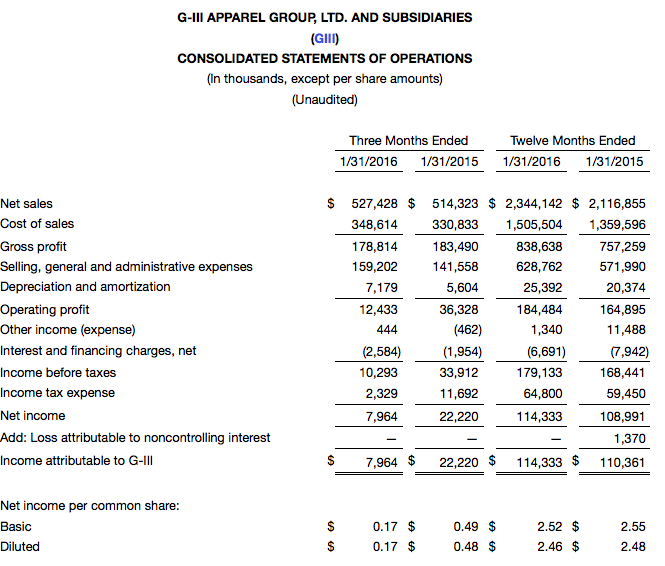

For the fourth quarter ended Jan. 31, 2016, G-III reported that net sales increased by 3 percent to $527.4 million from $514.3 million in the fourth quarter last year and that net income per diluted share was 17 cents per share compared to 48 cents in the fourth quarter last year. Wall Street's average estimate had been 42 cents a share.

The increase in net sales was the result of strength in many of the company's wholesale businesses and G.H. Bass retail, offset in part, by lower sales and higher promotion costs with respect to outerwear in our wholesale and Wilsons Leather retail businesses. The weaker outerwear sales in the fourth quarter are the primary reason that its sales and profits for the full year were lower than previously forecasted.

Net sales for the fiscal year ended Jan. 31, 2016 were up 11 percent to $2.34 billion from $2.12 billion in the prior year. The full year sales growth was driven by strong performances from many of the company's wholesale businesses, as well as by growth in G.H. Bass & Co. comparable store sales.

On an adjusted basis, excluding items resulting in other income in the current fiscal year equal to $0.02 per share, net of taxes, and in the prior year equal to $0.22 per share, net of taxes, non-GAAP net income per diluted share for the full year increased 8 percent to $2.44 per share from $2.26 in the prior fiscal year.

The company reported GAAP net income for the fiscal year ended Jan. 31, 2016, of $114.3 million, or $2.46 per diluted share, compared to $110.4 million, or $2.48 per diluted share, in the prior year. For the fiscal year ended January 31, 2016, adjusted EBITDA increased by 13 percent to $210.1 million from $186.6 million in the prior fiscal year.

The company had forecast net sales of approximately $2.40 billion. It expected net income to be between $124 million and $131 million, or a range between $2.67 and $2.82 per share. The company forecast non-GAAP net income per diluted share for the full 2016 fiscal year to increase to between $2.65 and $2.80 for the 2015 fiscal year.

Morris Goldfarb, G-III's chairman, chief executive officer and president, said, "Fiscal 2016 was a very strong year for us, although we were disappointed by our wholesale and retail outerwear business, which was heavily impacted by the warmest winter ever recorded. That said, we had excellent performances from our non-outerwear Calvin Klein businesses, as well as our dress and team sports businesses. We have significantly expanded our relationship with the Tommy Hilfiger brand and increased our financial investment and partnership with the Karl Lagerfeld brand. We will be making significant investments in these brands going forward. Our organization is energized by the opportunities in front of us and excited to take advantage of our opportunities in fiscal 2017."

Outlook

Also today, G-III Apparel Group issued guidance for the fiscal year ending January 31, 2017. For fiscal 2017, the company is forecasting net sales of approximately $2.56 billion and net income between $120 million and $125 million, or between $2.55 and $2.65 per diluted share. The company is also projecting EBITDA for fiscal 2017 to be between $228 million and $236 million.

For the first fiscal quarter ending April 30, 2016, the company is forecasting net sales of approximately $475 million and net income between $0.1 million and $2.4 million, or between $0.00 and $0.05 per diluted share. This compares to net sales of $433 million and net income of $6.8 million, or $0.15 per diluted share, reported in the first quarter of fiscal 2016.

G-III is a leading manufacturer and distributor of outerwear, dresses, sportswear, swimwear, women's suits, women's performance wear, footwear, luggage, women's handbags, small leather goods and cold weather accessories under licensed brands, our own brands and private label brands. G-III sells swimwear, resort wear and related accessories under our own Vilebrequin brand. G-III also sells outerwear, dresses and performance wear under our own Andrew Marc and Marc New York brands and has licensed these brands to select third parties in certain product categories. G-III has fashion licenses under the Calvin Klein, Karl Lagerfeld, Kenneth Cole, Cole Haan, Guess?, Tommy Hilfiger, Jones New York, Jessica Simpson, Vince Camuto, Ivanka Trump, Ellen Tracy, Kensie, Levi's and Dockers brands. Through our team sports business, we have licenses with the National Football League, National Basketball Association, Major League Baseball, National Hockey League, Hands High, Touch by Alyssa Milano and more than 100 U.S. colleges and universities. Our other owned brands include Bass, G.H. Bass, G-III Sports by Carl Banks, Eliza J, Black Rivet and Jessica Howard. G-III also operates retail stores under the Wilsons Leather, Bass, G.H. Bass & Co., Vilebrequin and Calvin Klein Performance names.