The LED industry is now fully embracing the fast-growing lighting market as (based on revenues) LED lighting has become the largest sector among LED applications, surpassing LCD backlighting in 2014, and is expected to be the major driver of the market in coming years, according to Clark Tseng of the Industry Research & Statistics Group at global industry association Semiconductor Equipment and Materials International (SEMI). Driven by robust demand forecast from lighting applications, the LED industry is geared toward another phase of capacity expansion after the previous peak observed in 2011, he adds.

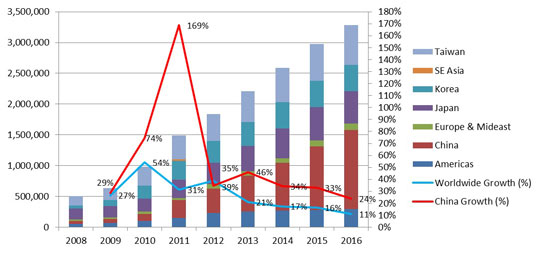

Figure 1- Installed LED epi capacity by region (4"-equivalent per month) Source: SEMI Opto/LED Fab Forecast, April 2015

According to SEMI's Opto/LED Fab Forecast report, global LED epitaxy monthly capacity reached 2.5 million (4" substrate equivalent) at the end of 2014 and will surpassed 2.9 million at the end of 2015, showing mid-teen percentage growth in both 2014 and 2015 (Figure 1).

China, however, is showing a more aggressive expansion plan, with double the growth rate compared to the worldwide growth rate throughout 2013-2016. China's LED epitaxy capacity is expected to reach 1 million (4" equivalent) per month at the end of 2015 and 1.28 million in 2016, accounting for 35% and almost 40% of global capacity, respectively.

The capacity growth is driven primarily by new metal-organic chemical vapor deposition (MOCVD) installation and partially by migration to larger substrate sizes. Specifically, new reactors have doubled the capacity compared to earlier models that were available on the market not too long ago, further boosting the capacity growth rate. Regarding the size of substrate, SEMI expects the 4" substrate to become the mainstream production size this year, surpassing 2" substrates, while 6" substrates are also gaining more share at Tier 1 and Tier 2 manufacturers. However, 8" gallium nitride on silicon (GaN-on-Si) capacity will still be limited to a handful of suppliers in the foreseeable future, reckons SEMI.

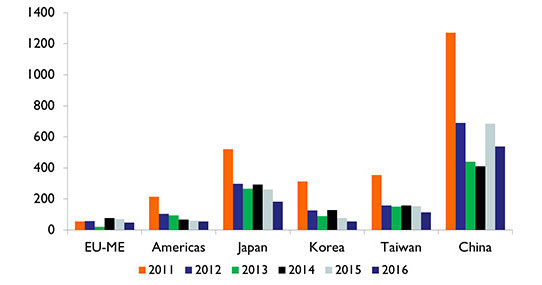

Figure 2 - LED epi/chip equipment spending by region, 2011-2016 (in millions). Source: SEMI Opto/LED Fab Forecast, April 2015

Looking at the trend in LED epitaxy and chip process equipment spending (Figure 2), there is a major difference between the 2011 investment spree and 2015. Back in 2011, almost all regions were boosting their capital expenditure as they tried to seize a bigger share of the market. Overall investment into LED front-end facilities reached a staggering $2.7bn worldwide in 2011, with China representing about 46% of that. However, that also resulted in oversupply and consequently a slowdown in the LED equipment market afterwards. In contrast, the investment recovery in 2015 seems much more disciplined, with only China expecting to see big growth over 2014, says SEMI. Total equipment spending is forecasted to reach $1.35bn in 2015, followed by a correction in 2016 to $1bn. China will contribute over half of worldwide investment in 2015 and 2016. Sanan Opto, Elec-Tech, HC SemiTek, Aucksun and Changelight are among the few to see bigger investment in SEMI's forecast. Some of the expansions in China are also from Taiwanese LED suppliers.

On the other hand, other regions are showing a slowdown in investment. The leading players will still spend on capacity expansion and technologies but at a more disciplined pace. Japan and Taiwan are the two regions that remain committed to investing and adding new capacity. SEMI expects major investment to come from leading players such as Nichia, Toshiba, Epistar and Lextar.

China's LED industry is still supported by government subsidies, even though they are now more subdued. SEMI forecasts that the LED lighting market is big enough to consume all the new capacity coming online. It is more concerned about the mounting pressure of price erosion on LED component suppliers. With the rise of mid-power LED chips which are applicable to many of the lighting solutions, Chinese LED suppliers will be able to gain a sizable share of the LED lighting market, it is reckoned. That could drive out some of the value of high-power LED components, which is the sector that leading suppliers still dominate.

Overall, the scale of investment in 2015 and 2016 is still within the range of market acceptance, given the even faster LED lighting growth forecast, says SEMI. The concern regarding oversupply could be eased somewhat, considering that real utilization rates at some of the older fabs are not particularly high. "We expect further consolidation at epi/chip suppliers will gradually help bring healthier supply/demand dynamics going forward," concludes the report.