In either a cautious or a more aggressive scenario, LED applications will be the key drivers for the bulk gallium nitride (GaN) market, reckons market research firm Yole Développement in its report 'Free-Standing & Bulk GaN Substrates for Laser Diode, LED and Power Electronics'.

According to Yole, there is no doubt that LED technology will take market share over the traditional lamp and tube business. Recent announcements from LED makers (e.g. of LEDs with luminous efficacy of >150lm/W entering production) prove that the performance roadmap is in line with expectations: LEDs perform as well and even better than traditional bulbs and tubes.

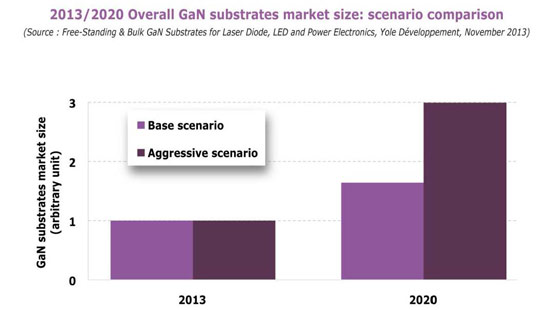

Native bulk GaN is emerging as an alternative to sapphire or silicon, allowing further improvement in LED performance. Despite potential performance benefits for ultra-high-brightness (UHB)-LEDs, massive adoption of GaN wafers remains hypothetical, says Yole. Taking into account the historical price reduction of bulk GaN substrates, a base scenario outlines where GaN-on-GaN LEDs will be limited only to niche markets. "If the GaN industry succeeds in replying to the cost pressure from LED makers and the price of 4" GaN wafers falls below the breakeven price, a more significant adoption could be forecast," says Dr Hong Lin, market & technology analyst, Compound Semiconductors, at Yole. "We see an about three times difference in terms of market volume for LED manufacturing between the two scenarios," he adds.

Demand for GaN substrates for LDs will probably fall below the 20,000 two-inch-equivalent (TIE) per year threshold in the coming years

Blu-ray applications currenty represent the largest market for blue laser diodes (LDs). This market will increase in the short term with the arrival of the new generation of game stations. However, Yole believes that this growth will not persist, as more and more people will play games and watch movies online instead.

Despite the recent rapid development of blue and green laser diodes, Yole sees two scenarios for the adoption of GaN-based laser diodes for the emerging projector market. Their price is the essential factor to consider.

Combining all applications, demand for 2" GaN substrates will be more than twice as much in the aggressive scenario than in the base scenario, says Yole. In the best case, demand would remain relatively stable until 2020.

In R&D, non-polar and semi-polar substrates have been proposed for LD manufacturing. In principle, the semi-polar approach seems to be the most promising in terms of device performance. However, in practice, c-plane-based devices still have better performance.

Graphic 1 Overall GaN substrate market size (2013/2020): comparison of scenarios.

Over 85% of commercial GaN wafers are produced by HVPE, dominated by Japanese firms

Currently, essentially all commercial GaN wafers are produced by hydride vapour phase epitaxy (HVPE), but the details of the growth process and separation techniques vary from company to company (e.g. ammonothermal growth at Mitsubishi Chemical, and the new acidic ammonothermal method at Soraa). Na-flux LPE growth seems promising, but Yole's analysts have not yet seen many GaN devices based on these substrates. It will take some time to convince the device producers, reckons the firm.

Non-polar and semi-polar substrates have attracted significant attention. However, the substrate size is still very small and unsuitable for mass production.

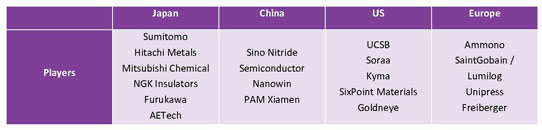

As of today, the GaN substrate market is heavily concentrated, with an 87% share held by Japanese firms. Non-Japanese players are currently in small-volume production or in the R&D stage, and it is too early for them to challenge the market leaders. Without exception, Japan will continue to dominate the bulk/free-standing (FS) GaN market in the coming years, reckons Yole.

Bulk GaN substrates for power electronics applications, a very challenging mission

The GaN power device industry probably generated less than $2.5m in revenues in 2012, says Yole. However, overall GaN activity has generated extra revenue, as R&D contracts, qualification tests and sampling for qualified customers have been extremely buoyant. Out of 20 established power electronics companies, 16 either are involved or will be involved in the GaN power device industry, reckons Yole.

Graphic: Worldwide players in GaN substrates.

Among the many substrates proposed for GaN power devices, bulk GaN is definitely beneficial to device performance. However, Yole remains quite pessimistic that bulk GaN can broadly penetrate the power electronics segment unless the cost of 4" bulk GaN wafers can be reduced to the $1500 range by 2020.

The main reason is that GaN power devices are positioned as a cost-effective solution, between incumbent silicon technology and the silicon carbide (SiC) technology that is ramping up. If the $1500 cost cannot be reached, then Yole assumes that no bulk GaN substrate will penetrate this market.