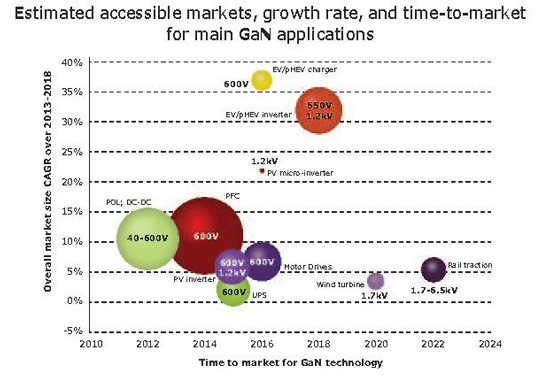

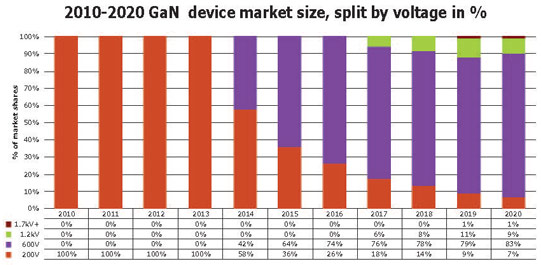

Based on a scenario where electric vehicles and hybrid electric vehicles (EV/HEV) begin adopting gallium nitride (GaN) in 2018-2019, the ramp-up of the GaN power device market will be quite impressive starting in 2016, at an estimated compound annual growth rate (CAGR) of 80% to almost $600m in 2020, leading to approximately 580,000 x 6" wafers being processed, according to the report 'Power GaN Market' from market analyst fim Yole Développement.

The power supply/PFC (power factor correction) segment will dominate the sector from 2015-2018, ultimately representing 50% of device sales, forecasts Yole. At that point, automotive will then catch up.

In UPS (uninterruptible power supply) applications, the medium-power segment is likely to be very much in line with the GaN value proposition, and savings at system level will be demonstrated, reckons Yole. "GaN technology could grab up to 15% of market share in this field by 2020," it believes.

Room for extra cost in motor drive applications is unlikely, hence the incentives to implement new technologies such as GaN have to be serious and strong, says Yole. Considering the possible improvement in conversion efficiency, and augmented by the predicted price parity with silicon solutions by 2018, Yole expects GaN to start being implemented at a slow rate in motor control applications by 2015-2016, reaching about $45m in revenue by 2020.

The photovoltaic (PV) inverters segment has already adopted silicon carbide (SiC) technology, and products are now commercially available. It is possible that GaN could partially displace SiC due to better price positioning. However, now that SiC is in place, qualifying GaN may be more challenging.

GaN power sector taking shape, despite limited revenue

Recent announcements show that the GaN industry is taking shape as mergers, acquisitions and license agreements are settled. The agreement of Transphorm and Fujitsu to merge their GaN power device businesses (announced last November), in addition to Transphorm's exclusive licensing of Furukawa's IP portfolio, are positive signs that GaN technology is spreading across the value chain, reinforcing the leaders' market position but likely leaving the weakest players by the wayside, reckons Yole.

The market research firm forecasts that 2014 will only generate $10-12m in device sales (in addition to R&D contracts etc). Such moderate business means that only the strongest will survive, and that several early-birds will see their cash-flow swiftly dissipate.

Yole expects that GaN business will really ramp up in 2016, exceeding the 'psychological threshold' of $50m in revenue. The key question is, how can GaN survive the next 1.5-2 years? "At the risk of being overly pessimistic, we are afraid some companies will not survive, and will either be acquired or go bankrupt," the firm adds.

GaN to be power-supply-centric before addressing automotive applications

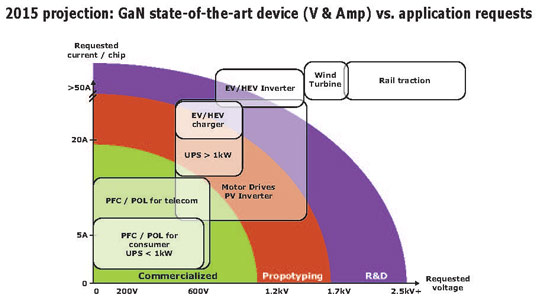

Currently, the GaN power sector is centered mainly on low-voltage DC-DC converters (typically point-of-loads, or POL) using available 200V-rated devices. Unfortunately, this business generates just a few million dollars in revenue. However, thanks to the introduction of 600V devices this year, GaN will grow quite rapidly in power-supply and PFC applications where technical added-value and economics are obvious, says Yole.

"After simulating several case-studies, we have concluded that even though today's market price for GaN devices exceeds the price for silicon devices, efficiency improvements and electricity bill savings can overcome this extra cost in less than one year for a 300W, 24/7 operation power supply (data server type)," says Yole. "By 2018, the same power supply could be even cheaper than its silicon counterpart thanks to the reduction in passives (capacitor, self-induction) cost, along with switching frequency increase," it adds. "Therefore, we see the PFC segment taking off by 2015, and achieving an 80% CAGR over 2016-2020."

Other applications such as PV inverters and, to a lesser extent, motor controls, will see GaN begin capturing market share by 2015-2016.

The next big thing will unquestionably be the EV and HEV segments, where GaN could definitely play a role in power systems such as low-voltage (14V to 200-400V) DC-DC converters, and later for battery chargers (on-board 3.6 and 7.2kW first, and then off-board 50kW+), reckons Yole. "However, we don't see any chance for GaN to enter power-train inverters (60kW+) before 2019-2020, due to the current lack of high-current devices and the projected price," it adds.

Technology's credibility affected by delays related to 600V and e-mode introduction

GaN devices rated at 600V were announced and promoted more than two years ago. However, only a few select customers have had access to 600V for qualification purposes. The majority of the power electronics community has been unable to source such devices. This has probably affected the credibility of GaN technology, and opened the door for the main competing technology (SiC) to continue expanding its industry presence, notes Yole.

Similarly, the availability of normally-off (enhancement-mode) GaN transistors has also been over-promoted, meaning that real devices with stable, reliable specifications took time to diffuse from off-the-shelf.

Despite all this, it now seems that the main players have caught up with their original roadmap, and devices are now available on the market, concludes Yole.