While stock and bond traders fretted over the US fiscal cliff and its potential impact on broader markets earlier this week, Chinese iron ore buyers were unconcerned, continuing to push the price of Australia's biggest export higher on the back of strong data from China.

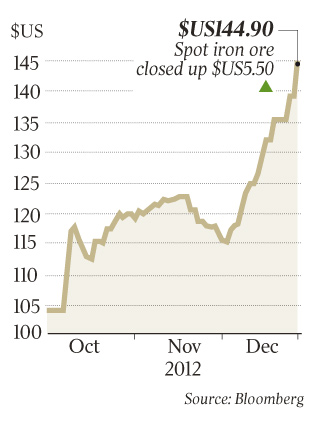

The price of the steelmaking ingredient at Chinese import ports finished $US5.50 higher at $US144.90 a tonne on Monday, according to the closely watched steel index, leaving prices 5 per cent higher for the year.

This marked an incredibly strong finish to 2012 after what seemed to be a disastrous year for iron ore miners in September, when prices hit a three-year low of $US86.90. The price is now approaching the 2011 averages of $US150 and bodes well for iron ore companies, WA royalty revenues and national tax revenues.

Iron ore prices jumped 25 per cent in December, making it the best monthly performance since the index started monitoring spot iron ore prices in 2008.

When trading resumes this morning on the Australian Securities Exchange, dedicated iron ore miners such as Fortescue Metals Group and Atlas Iron are expected to be the biggest beneficiaries of the latest surge.

The price move will also support the diversified mining giants BHP Billiton and Rio Tinto, whose bottom lines are heavily affected by iron ore price moves because of their big iron ore units in Western Australia's Pilbara region. Illustrating the effect the move could have on the big miners' profits, a $US10-per-tonne rise in the average ore price over a year increases BHP's and Rio's net profit by more than $US1 billion ($960 million).

Since the September lows, iron ore prices are up $US58 a tonne, or 68 per cent.

The driver for Monday's price rise was said to be a strong performance by China's manufacturing sector, which, as measured by the HSBC Purchasing Managers index, is looking the healthiest it has in two years.

The index, published on Monday, came in at 51.5 for December, the highest since May 2011 and up from 50.5 in November. A reading above 50 shows the sector is expanding.

China's iron ore market is closed until Friday for the New Year holidays, but sentiment is expected to remain strong when trading resumes.

One Shanghai analyst told Metal Bulletin most analysts in China were expecting prices to reach $US150 a tonne this month.