Export Quantity & Value for Chinese Major Food Additives in 2011 (Sorted by Value)

| Product Name | Quantity (KG) | Value (USD) | Year on Year (±%) | |

| Quantity | Value | |||

| 694,515,465 | 780,006,259 | -5.4 | 13.6 | |

| Vitamin E and its derivatives | 41,992,769 | 767,234,653 | 12.8 | 11.4 |

| Vitamin C and its derivatives | 108,479,551 | 561,823,595 | -5.4 | -29.6 |

| Salts & esters of citric acid | 117,003,665 | 136,069,527 | 0.1 | 17 |

| Sodium bicarbonate (Baking soda) | 397,098,811 | 108,126,847 | 11.6 | 43.7 |

| Benzoic acid and its salts and esters | 57,932,503 | 108,052,651 | 12 | 34.6 |

| Saccharin and its salt | 13,554,517 | 74,479,748 | 5.1 | 6 |

| Xylitol | 16,660,070 | 55,235,223 | 7.4 | 39.2 |

| Sodium cyclamate | 26,188,277 | 48,186,607 | -5.5 | -4.6 |

| Monosodium glutamate | 18,284,394 | 27,367,359 | -31.8 | -24.8 |

2009-2011 Chinese Citric Acid (HS: 29181400) Export Data Analysis

2009-2011 Major Importers of Chinese Citric Acid (Sorted by Import Value in 2011)

| No. | Countries/Regions | 2009 | 2010 | 2011 | |||

| Export Value (USD) | Proportion (%) | Export Value (USD) | Proportion (%) | Export Value (USD) | Proportion (%) | ||

|

| Total | 536,022,976 | 100% | 686,396,305 | 100% | 780,006,259 | 100% |

| 1 | India | 39,309,515 | 7.3% | 41,504,015 | 6.0% | 52,606,410 | 6.7% |

| 2 | Japan | 34,878,529 | 6.5% | 37,011,128 | 5.4% | 47,677,692 | 6.1% |

| 3 | Turkey↑ | 21,414,606 | 4.0% | 27,320,316 | 4.0% | 34,061,554 | 4.4% |

| 4 | Holland | 31,312,842 | 5.8% | 48,869,571 | 7.1% | 33,174,324 | 4.3% |

| 5 | Germany | 21,067,934 | 3.9% | 32,506,402 | 4.7% | 32,108,836 | 4.1% |

| 6 | Indonesia | 16,822,338 | 3.1% | 18,965,776 | 2.8% | 29,806,240 | 3.8% |

| 7 | Mexico↑ | 14,603,144 | 2.7% | 24,190,277 | 3.5% | 29,656,395 | 3.8% |

| 8 | Brazil | 11,282,349 | 2.1% | 24,374,857 | 3.6% | 27,486,023 | 3.5% |

| 9 | Russian Federation | 17,261,801 | 3.2% | 15,022,224 | 2.2% | 27,165,861 | 3.5% |

| 10 | USA↑ | 10,142,778 | 1.9% | 19,143,084 | 2.8% | 21,730,266 | 2.8% |

Note: "↑"indicates that the countries which proportion covered by import value in the total Chinese export values grew continuously from 2009 to 2011.

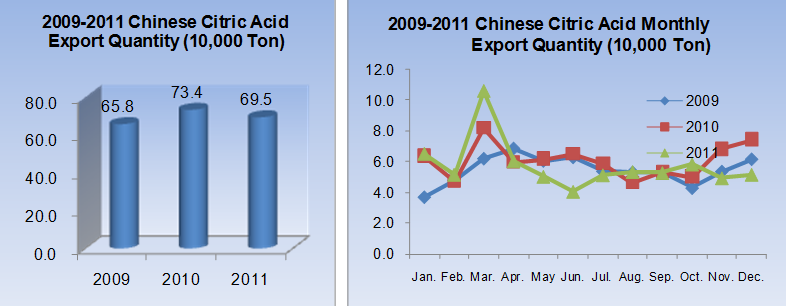

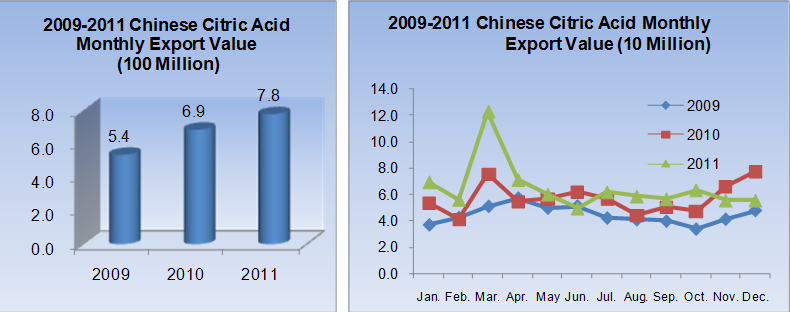

Total export values: The total export values of Chinese citric acid grew continuously from 2009 to 2011, with an obviously growth.

Total export quantities: the export quantities of Chinese citric acid in 2011 declined sharply year on year, with a drop of 4,000 tons and 5.4% year on year compared to 2010.

Average export unit price: in the past 3 years, the average export unit price of Chinese citric acid grew continuously, up 38% in 2011 in comparison with 2009.

Export seasonal variations: according to export quantity and value monthly trends, March reached the export peak of the whole year, the export quantities and values in February, August, September and October were little lower than those of other months.

Export markets: the major Chinese citric acid export markets had no clearly changes from 2009 to 2011. India, Japan, Turkey, Holland, Germany, Indonesia, Mexico, Brazil, Russian Federation and USA still were Chinese major export markets. In 2011, Chinese citric acid export values for the ten countries listed above occupied 43% of Chinese citric acid total export values in sum. However, the ranking orders of major export markets changed obviously, in which Holland changed the most. Holland was the third largest Chinese citric acid export market in 2009, and it exceeded India and ranked the first place in 2010, however, its export values were decreased significantly in 2011, ranked the fourth place only. In addition, in the past 3 years, the country which market share grew continuously was Mexico. What’s more, the export values’ proportions for Turkey, Indonesia, Brazil and USA also increased 0.4%, 0.7%, 1.4% and 0.9% respectively in 2011 compared to 2009, with an obvious growth.

In total, the export quantities of Chinese citric acid declined in 2011, because of the growth of the average export unit price, so the export values still maintained a rise of 13.6%. March reached the export peak in the whole year, but February, August, September and October were little lower than other months, while November recovered obviously. The related export companies should seize the export opportunity and prepare good enough in advance. In the field of export markets, it estimated that export data for India, Japan, Turkey, Mexico, USA, Indonesia and Brazil would maintain stable relatively in 2012, however, the export conditions for Holland and Germany were serious relatively.