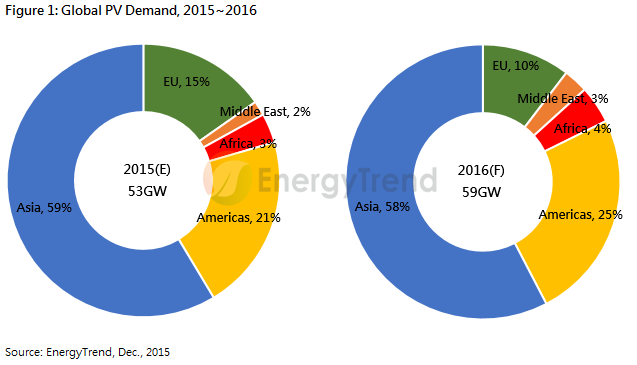

Spurred by major and emerging markets, global photovoltaic (PV) demand has grown substantially this year. According to the latest Gold Member Report by EnergyTrend, a division of TrendForce, installed capacity worldwide for 2015 is estimated at 53GW, amounting to a 20% year-on-year growth. Next year’s total installed capacity is expected to reach 59GW, up 11% in annual growth. EnergyTrend analyst Patrick Lin said that the global market will maintain strong growth momentum up to next year’s October on account of the installation rush in the U.S. Based on EnergyTrend’s analysis, China, the U.S. and Japan are projected to contribute 61% of global demand next year. China in particular has revised the deadlines for connecting the country’s PV power plants onto the grid as to spread next year’s demand more evenly, thus avoiding installation rush at the end of year. While demand growth will be significant in 2016, manufacturers will also undertake massive capacity expansion at the same time. Hence, there is a concern that after the installation boom in 2016, demand growth will flatten in 2017 and overcapacity will hurt the industry.

The following are some major trends influencing the PV industry in 2016:

Emerging markets will keep growing but there are uncertainties ahead

Lin said growth in the emerging markets has been considerable this year owing to carbon emission reduction policies. Total installed capacity of emerging markets for 2015 is estimated at almost 10GW. However, the overall installation progress in the emerging markets this year has fallen behind schedule. PV investments in these countries have been relatively low because of factors such as a lack of infrastructure, currency rate fluctuations and political risks. EnergyTrend expects that the emerging markets will keep enjoying tremendous growth in 2016, with the forecast installed capacity soaring by 50% year on year to about 15GW.

Among the emerging markets, India will still lead in installation growth next year, though it is unlikely to meet its target. India’s installed capacity next year is projected at just 5.5GW. With the exception of Chile and South Africa, both of which will reach the GW mark, other emerging markets will have installed capacities that range from 500MW to 300MW and under, respectively.

Profitability in the downstream market is being squeezed as governments reduce subsidies

Governments in major PV markets are cutting subsidies as installation costs have fallen, with PV power plants in some areas having almost the same LCOE (levelized cost of energy) as natural gas combined cycle plants and coal-fired power plants in the U.S. and Europe. Furthermore, system vendors are bargaining down module prices in order to reach their targeted rates of return for PV power plants. The emerging markets have become important export channels for module manufacturers and will help drive product sales. Nonetheless, module prices have been generally low and are forecast to slide slightly in next year’s off-peak season.

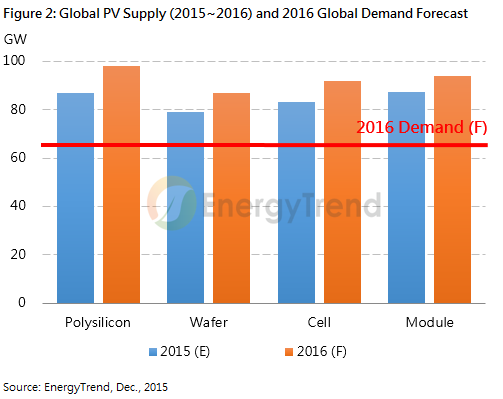

Industry-wide capacity expansion will take place as impacts of trade cases diminish

Though subsidy reductions in major markets will put pressure on module prices next year, demand will be more predictable as uncertainties caused by trade disputes start to recede. Capacity expansion will also take place across the industry. EnergyTrend analyst Corrine Lin stated that first- and second-tier manufacturers in China and Taiwan all have plans to increase cell and module production, either by expanding capacity at home or abroad. Chinese companies especially have been very proactive. This wave of capacity expansion will prevent the possibility of cell and module shortages in 2016, but it will also cause severe market oversupply for both products in 2017.

New technologies will reduce costs; mono-Si market share will increase

Material and production costs of cells have been falling for many years and there is now very little room for further reduction. Cell manufacturers instead now looking to reduce the overall costs of their products by raising efficiency (thus reducing the cost per watt). Mono-Si PERC cells, for example, have higher production costs but can also bring in much higher margins. Hence, this cell technology has become widely adopted. Based on EnergyTrend’s projection, demand for mono-Si cells will grow from 9.5GW this year to 14.5GW next year.

New grounds have also been broken in the manufacturing of modules. Glass-to-glass (G2G) module continues to grab’s market attention as this design technology can do away with aluminum frames and backsheets, thus improving the overall cost structure. In sum, there room for further price reduction in the next year’s module market is relatively large.