Consistent improvements in technology and gradually lower costs will drive high-concentration photovoltaic (HCPV) systems to superior efficiencies, making HCPV an increasingly viable rival to conventional solar-generating solutions, according to the report ‘CPV on the Edge of Breakthrough’ from the solar research service at market analyst firm IHS Technology.

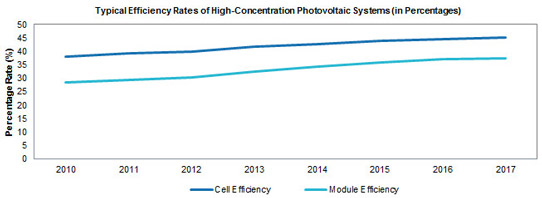

The cell efficiency of HCPV systems, currently at 40-42%, will exceed 45% by 2017, it is forecasted. Used with concentrating optics, such cells will then lead to commercial system efficiencies approaching 40%, compared with typically under 35% currently, as shown in the figure.

“Efficiency is the most important requirement in CPV technology in order to generate competitive energy costs,” says Karl Melkonyan, photovoltaic analyst at IHS. “With the solar industry continuing to be firmly engaged in a quest for ongoing improvements through the development of new technologies, the efficiency of HCPV cells will advance over the years,” he adds.

The anticipated improvements in HCPV systems are based on cell efficiencies having reached 44.7% in laboratory conditions, indicating that further advances are possible.

Even so, the gains in efficiency will have to be balanced against the additional manufacturing costs expected to be incurred when implementing the improvements, Melkonyan notes.

Top HCPV regions in the world

Driven by falling system prices, HCPV is gradually becoming attractive in several regions of the world, notes the report. IHS forecasts that the USA and Central America will install the greatest number of HCPV systems between 2012 and 2017, serving as the world’s biggest regional market. Installations for the region reached 54.1MW in 2012.

In fact, most HCPV suppliers are based in the USA, and their forays into the domestic US market will provide notice to rival conventional PV suppliers, says IHS. Mexico is also forecast to become a large part of this regional market, with plans in place for a 450MW installation.

Meanwhile, enormous growth will occur in South America, where the HCPV market is projected to surge by 560% from the time installations started in 2013 until 2017. The primary driver is Chile, which has the world’s highest solar irradiation levels.

But the greatest increase in the HPCV market will take place in the Middle East and Africa region, where installations - excluding South Africa (which is tracked separately because of its more advanced PV market) - will grow from just 1.8MW in 2012 to 155MW in 2017. Morocco and Saudi Arabia will be the main drivers.

China could also emerge as an important player soon as suppliers from the country grow in number, with parts of southwest China shaping up to become prime HCPV locations, reckons IHS.

Competitive landscape changing turbulently

Unable to keep pace with the dramatic cost and price reductions that conventional PV saw, many CPV pioneers faced financial difficulties in the course of the PV price collapse that took place in 2011 and 2012, notes the report. Many formerly leading companies - among them SolFocus and GreenVolts in California, as well as Opel Solar in Connecticut - ceased operations or became insolvent.

However, since 2013 the industry has regained stability, and advances in new technologies continue to reduce costs. Just the same, only a few survivors are left from that tumultuous period, and those that remain are the ones with large cash balances and the most cost-efficient technologies, says IHS.

Among the major players, the two biggest CPV manufacturers - Suncore Photovoltaics in China and Soitec Solar in France - will each be expecting HCPV installations of about 50MW by the end of 2014.

Suncore and Soitec - along with top-five suppliers Solaria and SunPower in California, and Magpower SA in Portugal - account for more than 80% of the CPV market at present. Two other manufacturers - Heliotrop in France and North Carolina-based Semprius - could also join the ranks of the top 10 this year, IHS reckons.

The HCPV supplier base will continue to change in the next five years as the current market is still in its early phases of growth, with several newcomers and start-ups expected to liven up the competition, IHS believes.