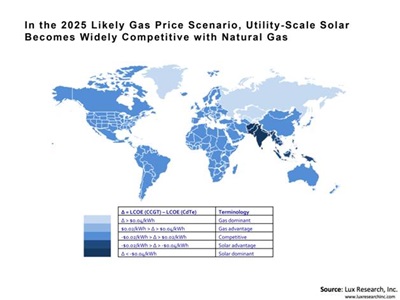

Solar-generated electricity will become just as cheap as that produced by natural gas in most parts of the world by 2025, according to a new analyst report.

Lux Research, which specializes in predicting the impact of emerging and “clean” technologies, says that ten major global regions will benefit from competitive, subsidy-free solar by the middle of the next decade – with the abundance of natural gas proving to be a help, rather than a hindrance, to solar adoption.

“Far from being bulldozed by cheap natural gas, unsubsidized utility-scale solar electricity will become cost-competitive with gas by 2025,” says the Boston-based think-tank.

“In fact, increased gas penetration actually benefits solar, by enabling hybrid gas/solar technologies that can accelerate adoption and increase intermittent renewable penetration without expensive infrastructure improvements.”

Lux research associate Ed Cahill writes in the report Cheap Natural Gas: Fracturing Dreams of a Solar Future that the levelized cost of energy (LCOE) from unsubsidized utility-scale solar will close the cost gap with combined cycle gas turbines (CCGT) to within $0.02 per kWh worldwide in 2025.

The competitiveness of solar will be led by a 39 per cent fall in utility-scale system costs by 2030 and assisted by barriers to shale gas production such as anti-fracking policies in Europe and the expected high capital cost of developing the technique in South America.

And despite the recent widespread adoption of fracking in North America and potentially in other regions, Cahill believes that this will ultimately serve as a route to solar adoption:

“On the macroeconomic level, a ‘golden age of gas’ can be a bridge to a renewable future as gas will replace coal until solar becomes cost competitive without subsidies,” he said. “On the microeconomic level, solar integrated with natural gas can lower costs and provide stable output.”

Higher module efficiencies: the key to competitive solar

In an alternative scenario that would be more beneficial for the solar industry, the renewable source could be competitive with natural gas as early as 2020 if gas prices head towards a cost of $9.30 per MMBtu - depending on the available solar resource.

But in what Lux sees as the most likely scenario, where gas prices remain above $7.60 per MMBtu, solar will be “broadly competitive” by 2025 in all ten regions analysed – including the Americas, Europe, Africa, China, the Middle East and Japan. India will see an even greater cost advantage for solar, while Russia looks to be the only major region where gas will remain much cheaper than solar.

The cost gap closes because the price of electricity derived from natural gas will always be driven by the cost of the fuel, while the price of solar power is driven by the capital expenditure required to build a system – and solar system installation prices are set to fall to $1.20 per Watt as photovoltaic technology improves.

"Solar costs fall faster than gas prices even in gas-rich regions, as increasing domestic demand and liquid natural gas (LNG) exports counter significant shale development," Lux predicts.

“Utility-scale thin-film [photovoltaics] leads the pack with installed system prices that fall from $1.96 per Watt in 2013 to $1.20 per Watt in 2030, primarily due to increasing module efficiencies,” it adds.

Perhaps inevitably, Lux expects the transition from subsidized to unsubsidized solar electricity to be turbulent as subsidies are phased out. “Turmoil is imminent because standalone solar will not yet be competitive when subsidies start expiring in markets like China, the US and Japan,” says Lux.

That means solar companies will need to diversify geographically – as thin-film cadmium telluride (CdTe) panel maker First Solar is striving to do - and transition to regions with fewer gas resources.

An alternative strategy would be to develop hybrid systems that take advantage of low gas prices and mitigate the intermittency of solar while large-scale battery storage remains too expensive to deploy.

US solar pipeline grows to 43GW

Fellow analyst company Solarbuzz has meanwhile updated its overview of future photovoltaic installations in the US, with the pipeline said to have grown by 7 per cent in the past year as developers race to complete projects before tax credit incentives start to decline in 2017.

“The pipeline of solar photovoltaic projects awaiting completion within the US now exceeds 43 GW, which is enough to power more than six million US households,” says the firm, which is part of the giant NPD consultancy group.

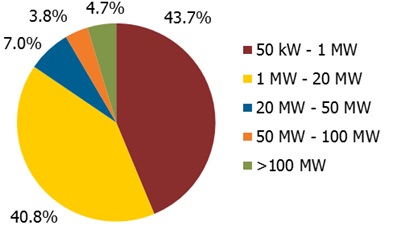

And while the US solar market has in the past been dominated by “mega”-scale projects of more than 100 MW in generating capacity, the emphasis has switched to somewhat smaller developments.

“The increase in new solar PV projects being planned or under construction is driving double-digit annual growth forecasts,” thinks Michael Barker, a senior analyst at Solarbuzz. “Projects of all sizes have become increasingly viable, due to declines in solar PV system pricing in the past year.”

Mega-scale solar farms exceeding 100 MW in scale that are being built in the near term include projects such as Mount Signal Solar, Copper Mountain, Calexico, Desert Sunlight, and Topaz.

They are either under development already or proceeding steadily through planned construction phases, and the ten largest projects account for more than 5 GW of new PV capacity set to come online during the next three years.

However, Solarbuzz believes that the focus of solar PV project developers has now shifted to project sizes below 30 MW. During the past year, the number of such projects in the US pipeline has increased by one-third, to more than 2,100. The key advantage of the smaller PV projects is a shorter planning phases, so they can be completed more quickly.