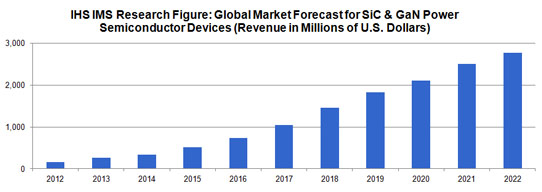

Energized by demand from power supplies, photovoltaic (PV) inverters and industrial motor drives, the emerging market for silicon carbide (SiC) and gallium nitride (GaN) power semiconductors is forecast to grow a remarkable factor of 18 over 10 years, from just $143m in 2012 to $2.8bn in 2022, according to the report ‘The World Market for SiC & GaN Power Semiconductors - 2013 Edition’ from IMS Research (now part of HIS). Market revenue is expected to rise by double digits annually for the next decade.

SiC Schottky diodes have been around for more than 10 years, with SiC metal-oxide semiconductor field-effect transistors (MOSFET), junction-gate field-effect transistors (JFET) and bipolar junction transistors (BJT) appearing in recent years. In contrast, GaN power semiconductors are only just appearing on the market.

The wide-bandgap material GaN offers similar performance benefits to SiC but has greater cost-reduction potential, says IMS. This price/performance advantage is possible because GaN power devices can be grown on silicon substrates that are larger and lower-cost compared to SiC.

“The key factor determining market growth will be how quickly GaN-on-silicon (Si) devices can achieve price parity and equivalent performance as silicon MOSFETs, insulated-gate bipolar transistors (IGBT) or rectifiers,” says Richard Eden, senior market analyst for power semiconductor discretes and modules. “IHS expects this will be achieved in 2019, driving the GaN power market to pass the $1bn mark in 2022.”

SiC Schottky diode revenue exceeded $100m in 2012, making it the best-selling SiC or GaN device currently. But, even though SiC Schottky diode revenue is forecast to grow until 2015, it will decline when lower-priced 600V GaN diodes become available. Still, revenue will recover to approach $200m by 2022, with sales concentrated at voltage ratings of 1200V and above.

By then, SiC MOSFETs are forecast to generate revenue approaching $400m, overtaking Schottky diodes to become the best-selling SiC discrete power device type. Meanwhile, SiC JFETs and SiC BJTs are each forecast to generate less than half of SiC MOSFET revenues at that time, despite their likelihood of achieving good reliability, price and performance. End-users now strongly prefer SiC MOSFETs, so vendors of SiC JFETs and BJTs have a major task ahead in educating their potential customers on the benefits of these technologies, believes the market research firm.

While IHS predicts strong growth for the SiC and GaN power semiconductor market in the years ahead, the forecast has been significantly reduced compared to the outlook from one year ago.

The main reason for the change is the reduced forecasts for shipments of equipment that use power components, resulting from today’s gloomier view of the global economy. SiC adoption forecasts have also been slashed because device prices are not falling as fast as originally assumed a year ago.

In contrast, industry confidence in GaN technology has increased, with more semiconductor firms announcing GaN development projects. For instance, Transphorm has become the first company to achieve JEDEC qualification for its GaN-on-Si devices, the report notes.