Business-to-business payment times have fallen by five days since the height of the global financial crisis(GFC),however,cash flow pressures remain prevalent as firms are being forced to wait more than three weeks longer than standard terms to receive payment for goods and services.

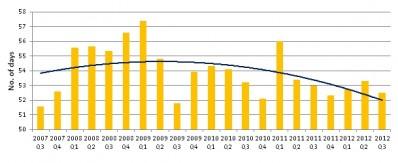

These findings are from the latest Dun&Bradstreet(D&B)Trade Payments Analysis,which examines the millions of accounts receivable records contained on the D&B database.The analysis reveals that average payment times have dropped from the ten-year peak of 57.4 days,seen in the first quarter of 2009,to 52.5 days.However,payment times have not reached the low of 47.1 days which was recorded in the second quarter of 2003.

The analysis also indicates payment times have not fallen below the fifty day mark in eight years and that payment times typically increase by around two days in the first quarter of each year(post-Christmas).

Average payment times,2007-2012.

According to Dun&Bradstreet CEO Gareth Jones while payment terms remain significantly above the standard 30-day term,the trend towards lower payment times that has occurred over the past few years indicates that the cash flow position of firms has improved.

"It is certainly a positive that Australian firms have cut their payment times by close to a week since the height of the financial crisis,and despite a slight deterioration in the June quarter of 2012,the trend has generally been encouraging,"said Mr Jones.

"However,trend data shows that payment times traditionally rise post-Christmas.This means a rise in payment days is likely during the March quarter 2013 and could result in increased cash flow pressure for businesses."

In comparison,New Zealand–Australia's close neighbour and one of its top ten trading partners–recorded payment times of 40.3 days during the September quarter.Payment times for Kiwi firms,which were nearly two weeks shorter than their Australian counterparts,reached their lowest level in nearly a decade.

This trend towards quicker payments aligns with recent Australian Business of Statistics(ABS)data indicating ongoing economic growth.Gross domestic product(GDP)rose by 3.7 per cent in the year to June 2012 and is forecast by Treasury and the Reserve Bank to remain around trend at three per cent in both 2012-13 and 2013-14.

According to Stephen Koukoulas,economic advisor to Dun&Bradstreet,there is a number of external threats to the Australian economy over the next year.

"The recession in the Eurozone shows no signs of ending,and there is no firm evidence that the Chinese slowdown has reached the bottom.If the economy slows further than is currently forecast,payment times could rise.Offsetting that is the prospect of more interest rates cuts from the RBA."

Firms with fewer than 200 employees took the shortest time to pay their bills during the September quarter–those with 50 to 199 staff averaged payment times of 48.8 days,followed by firms with six to 19 employees at 50 days.The slowest payers were firms with more than 500 staff at 55.3 days.

According to Mr Jones,the length of time businesses take to pay their bills has a significant bearing on the broader economy.

"Trade credit makes up a large portion of short-term finance for firms and as a result,it is one of the most important indicators of individual business health as well as overall economic health.Small and medium businesses in particular,are often more reliant on trade credit than bank credit;thus a reduction or increase in payment times can have a significant impact on their cash flow cycle."

A significant number of industries also reduced their payment times,particularly the forestry sector,which cut the time taken to pay their bills by six days to 54.2 days year-on-year;this was followed by firms in the fishing industry(down 2.5 days year-on-year).Fishing firms were also one of the fastest payers at 50.6 days.

The quickest payers were those in the agriculture and transportation industries,recording payment times of 49.3 days and 49.8 days respectively.Both industries improved their payment times by nearly two days each quarter-on-quarter and on par with figures 12 months ago.

Mining companies were the slowest payers at nearly 56 days,representing a marginal increase in the past 12 months,despite accounting for around eight per cent of total GDP.This was followed by firms in the finance,insurance and real estate sector and the electric,gas and sanitary services sector at 54 days each.

"Favourable prices and growing conditions are no doubt behind the lower payment times in agriculture,while lower global mineral prices and slower growth in profits is likely to be dampening the mining sector,"Mr Koukoulas says.

"Based on the most recent payments data,no particular sector of the economy is performing poorly which fits with the scenario of the economy evening out in recent quarters."(143)