The Australian dollar's moves yesterday reflected the differing pressures on the currency as a major international bank, HSBC, yesterday expressed concern about its long-term strength.

The dollar broke through the $US1.05 level in trading yesterday morning, from Monday's close of $US1.0472, fuelled by the continued strength in the world iron ore price, which has risen to $US150 a tonne on strong buying from China.

But it fell back to close at $US1.048 by the end of the day on news of a larger-than-expected November trade deficit.

While many Australian economists expect the dollar to at least retain its current strength over the next six months, HSBC yesterday delivered a bearish report on the currency, predicting that it would finally begin to ease back this year.

In its annual currency outlook, HSBC says the dollar faces a "difficult year" as concerns about the global economy subside, interest rates fall and Australia's foreign investment inflow slows down.

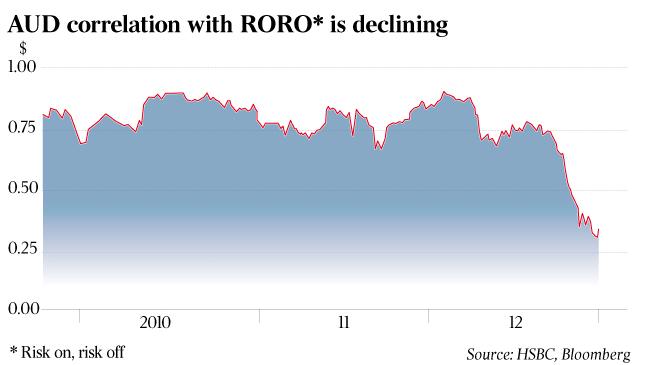

The report says the resilience of the dollar has been largely due to its strong relationship with "risk on, risk off" factors, with investors seeing the currency as a safe haven in times of concern about volatility in the world economy. But it argues that these factors will become less relevant this year with the European economies stabilising and the US making its way through its fiscal cliff and debt issues.

"The Australian dollar remains vulnerable to any 'risk off' scenario," HSBC says.

"While risk appetite will continue to be an important factor for the Australian dollar, this year we might begin to see domestic factors having a greater influence on the currency's performance.

"Fresh headwinds face the currency at home."

The report warns that foreign capital inflows into the mining industry, which have helped to hold up the dollar, are expected to peak by the middle of the year and level off after that.

"The cushion of support that foreign direct investment has provided is dwindling," it says.

UBS economists are expecting the dollar to move towards parity with the US dollar by December.

"We continue to see the Australian dollar drifting lower as offshore bond demand wanes and the 'carry' narrows," UBS economist Scott Haslem said in his latest economic report. Mr Haslem is predicting that the dollar will be at parity with the US dollar by the end of the year and then ease further to US95c next year.

"There would seem to be more downside risk . . . (to the Australian dollar)," JB Were says in a report to clients, outlining the reasons to invest in offshore equities.

"The Australian dollar is expensive and could have significant downside risk should current support dissipate."

But other economist believe the dollar will remain strong this year, with ANZ economist Warren Hogan calling on the Reserve Bank to cut interest rates by as much as 100 basis points to take the pressure off the dollar.

Mr Hogan has called for a discussion on whether the Reserve Bank should intervene to help push the dollar down to take pressure off the economy.

ANZ's foreign exchange strategist, Andrew Salter, said yesterday that the bank was expecting the dollar to stay at about $US1.05 this year.

"We don't see it depreciating," Mr Salter said.

He said the November trade figures reflected a much lower price for iron ore than today's prices.

Mr Salter said he expected foreign investment into Australia would continue to be strong, with many foreign central banks and sovereign wealth funds now putting money in Australia as a safe-haven economy with relatively high yields.

He said any easing off in foreign investment in the resources sector would be offset by foreign investment in other sectors, including real estate.

"There has been a step-up on other foreign direct investment flows," Mr Salter said.

"The Australian housing and commercial property markets are pretty stable and there hasn't been an overdevelopment as in many other markets."

CommSec economist Craig James said the dollar could rise towards $US1.12 during the year.

"Over 2013 a range of $US1-$US1.12 could be assumed," Mr James said.

"In the first half of 2013 we can envisage a scenario where European issues recede, US economic recovery consolidates and Chinese growth lifts.

"If the good news eventuates, then the Australian dollar could push through the high end of the range. Overall, business must work on the premise that the Aussie generally holds above parity in 2013."