Global and China Power Device Industry Report, 2011-2012underlines:

1. power device;

2. global and China power device market;

3. power device industry;

4. IGBT, SiC and GaN market and industry outlook;

5. 18 power device players.

The power device is composed of power IC, power module, and power discrete. The power discrete mainly consists of MOSFET, Diode and IGBT. SiC and GaN, the spotlight in the power device industry, have attracted a great many of venture capital institutions to tap into the market. Compared to silicon semiconductor, the SiC and GaN technologies have more distinct competitive edges.

Thus far, GaN has more distinctive advantages over SiC in terms of optimum operating voltage and optimum operating power. The application of SiC is limited in PFC (Power Factor Correction), smart grid, railcar, offshore wind power, PV and industrial driving field. While in HEV, EV and PHEV markets, SiC is less competitive than GaN. HEV is currently the mainstream in the market and is monopolized by Toyota, which tends to employ GaN instead of SiC. It is very sure that IGBT will remain to hold a dominant position before 2015.

Rail transit is expected to be a big driver for SiC market growth. Leading Japanese SiC enterprises including Mitsubishi, Toshiba and Hitachi are all making desperate efforts to tap into the market and, in particular, Mitsubishi is the quickest to respond. China, as the main battlefield in the rail transit industry, lavished as high as RMB2 trillion investment in it. On September 5, 2012 alone, 2,476 km rail transit project was approved to build in China. Thus far, some 4,300 km rail transit project was approved or under construction. Japanese SiC enterprises will play a leading role in the industry. As for PV Inverter industry, it sank into freeze-up, resulting in producers' rigid grip over cost. So it is unlikely for SiC to access the industry because of the overhigh cost. And IGBT is still the mainstream right now.

In theory, the market concentration of GaN and SiC has significant overlap. However, GaN has wider application including in below 40V consumer electronics, indicating that GaN is expected to see huge potential in the market. But when it comes to SiC, the minimum voltage should exceed 600V when being applied in consumer electronics. The bottleneck of GaN is the low withstand voltage, which is improving gradually. In addition, it still needs to make technical breakthrough in above 600V application market, and which is expected to become a reality in 2013.

The GaN field is witnessing a VC fever. But it is not such a case in SiC field which was dominated by Japanese enterprises. In the GaN market, Transphorm is undoubtedly in the spotlight of investors. Since 2009, Transphorm has obtained investment from Google Ventures (USD20 million) and Soros Fund Management as high as USD104 million. And the latest E round VC finished in early October 2012, valuing USD35 million.? In particular, Innovation Network Corporation of Japan, a official entity which never showed interest in investing foreign enterprises, invested Transphorm as high as USD5 million. In addition, Nihon Inter with INCJ as one of shareholders, is set to offer support to Transphorm for the mass production.

Magnates including Samsung, LG, Intel, Infineon, NXP and STMicro are all optimistic about the GaN market. And there is no exception for Denso affiliated to Toyota which invested heavily in GaN filed. In addition, emerging venders including Canada-based GaN Systems, America-based Nitek and Germany-based BeMiTec are tapping into the market. Moreover, Sanken is projected to team up with Panasonic and Furukawa to realize the mass production of GaN products in 2013.

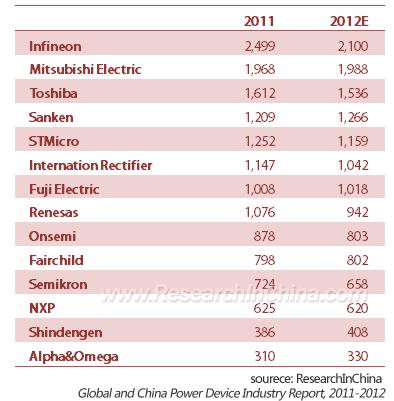

Ranking of Global Leading Power Device Players by Revenue, 2011-2012 (USD mln)