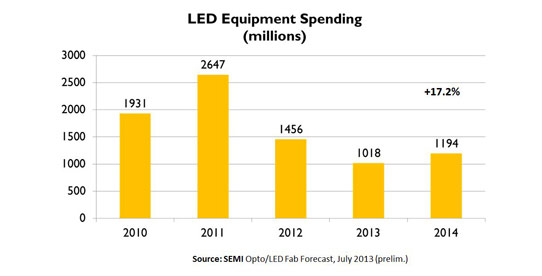

Following declines of 45% in 2011 and 30% in 2013, LED wafer fab equipment spending will rise 17% to nearly $1.2bn in 2014 as the LED industry is working through its over-capacity problems and will renew capital spending and capacity increases in 2014, according to the SEMI Opto/LED Fab Forecast quarterly on high-brightness light-emitting diode (HB-LED) front-end wafer fabrication plants.

Equipment spending trends also reveal a new era in the LED industry, as equipment spending now is concentrated among the industry leaders - and aspiring survivors - rather than widely distributed among new entrants to the industry or new technologies.

Following the explosion in LED interest sparked by the LED TV boom and exuberant optimism for the long-term growth in solid-state lighting (SSL), the LED industry dramatically expanded worldwide capacity over the past three years, fueled partly by lucrative government subsidies in China. Total worldwide capacity rose 49% in 2011 and 39% in 2012 and continued to grow by 19% this year, the report notes. Driven by national and provincial subsidy and incentive programs, China-based LED manufacturing rose from about 100,000 4"-equivalent wafers per month in 2010 to an astounding 620,000 4" wafers per month this year.

Much of this capacity expansion was driven by extremely optimistic forecasts in 2010 and 2011 that the LED market would grow to over $20bn as soon as 2015. However, current market forecasts for the packaged LED market in 2015 hover around $15bn, with a compound annual growth rate (CAGR) below 5%. The principle reasons for the decline in growth forecasts are the greater efficiency (i.e. improved light guides in displays) in using LEDs, the greater efficacy of packaged LEDs, and the minimum size of a replacement market for LED lamps.

According to market research firm Strategies Unlimited, the average cost per kilo lumen has declined from $13 in 2011 to less than $3.65 today. The number of LEDs used in TVs has fallen by one-third, and many SSL luminaires require less than half the LEDs used just a few years ago. LEDs in mobile devices and notebook computers have also declined. Automotive remains a growth market, but represents only around 10% of the market.

With so much new capacity, new entrants and declining growth rates, the prices for packaged LEDs has declined dramatically in recent years, creating severe financial hardship for many, especially new entrants and those restricted to the lower-margin mid- and low-power segments, notes the report. Fab utilization has fallen worldwide, especially in China. Sales for metal-organic chemical vapor deposition (MOCVD) systems - the critical production tool for LED epitaxial operations - plummeted. The leading MOCVD system makers Veeco and Aixtron, who saw sales triple in 2010, watched revenues plummet by nearly the same amount in 2012.

Compensating for some of the decline in packaged LED prices are the steep declines in sapphire wafers, which are used by over 80% of the LED industry. Sapphire prices for 4" wafers are now about $32 (down from their peak of $130 in 2011) and 6" sapphire prices are now below $300 (down from $450 eighteen months ago). Patterned sapphire substrates (PSS) have rapidly become standard at 2" and 4" diameters and are promising for 6" wafers.

Declining sapphire prices and the continued competitiveness of silicon carbide (SiC) have dampened prospects for the penetration of GaN-on-silicon in LEDs (once thought likely, if not inevitable). A new report 'Dimming the Hype: GaN-on-Si Fails to Outshine Sapphire by 2020', by market research firm Lux Research sees SiC and sapphire continuing to dominate the LED market, benefitting from added capacity and continued technology improvements. The report says that "new methods like hydride vapor phase epitaxy (HVPE) will further improve throughput and cut costs, keeping sapphire highly competitive for the rest of the decade".

The global LED industry now appears to be stabilizing as leading manufacturers invest in 6" wafer production systems and associated equipment purchases to deliver improved yield and throughput, reckons the SEMI report. Recent LED manufacturing investment has centered on the move to 6" wafers by Cree (silicon carbide) and Philips Lumileds and Osram (sapphire).

Japan's Nichia continues to invest in capacity and technology improvements, and Taiwan's Epistar, Formosa Epitaxy, and Genesis Photonics all made significant manufacturing investments this year. Nearly all leading manufacturers appear to be modernizing their production systems, with increased investments in metrology, automation, etch and lithography.

China will resume its MOCVD purchasing in 2014 in the absence of government subsidies. SEMI forecasts an increase of nearly 50% in purchases of MOCVD reactors in 2014, up from 150 reactors purchased in 2013. At the same time, many LED fabs will close or be repurposed in China as the market consolidates and non-competitive players disappear, SEMI adds.

China's San'an with over 120 MOCVDs and ETi (Elec-Tech) with 90 reactors are operating at increasing fab utilization rates and appear to be emerging as significant players. Some medium-size LED fabs in China such as Canyang Opto and HC Semitek are also operating at near full capacity and are optimistic for their future. China will represent about 44% of total equipment spending in 2014, up from 33% in 2013. More information will be available at LED Taiwan 2013, which is co-located with the SEMICON Taiwan show in Taipei, on 4-6 September.

In conclusion, says SEMI, the global LED manufacturing market appears to be stabilizing and working through its rapid capacity expansion of 2010-2012. Significant packaged LED price declines have been partially offset by wafer cost reduction, yield improvements and wafer size increases. Global leaders like Nichia, Cree, Philips, Osram and LG Innotek have continued to modernize their production operations for improved yield and throughput. The shakeout of the China market has begun and the survivors look to have staying power for long-term competitiveness.

With the overall LED market appearing to have modest growth rates for the next five years, and with many manufacturers being vertically integrated lighting manufacturers, the incentives for significant investments in manufacturing to gain cost advantage and market share are not high. In addition, many mid-power packaged LEDs are migrating to lighting applications once thought reserved for advanced high-power products, opening up market opportunities for Chinese companies.

However, after many years of dynamic technology change, many lighting manufacturers are looking to reduce parts count (die sizes, package and phosphor types) and stabilizing their product lines, limiting the demand for new suppliers and product-types. It seems that the stakes for success in the LED marketplace have revealed themselves and it remains to be seen how competition drives further manufacturing investments in the coming years, concludes the SEMI report.

Tom Morrow, VP & chief marketing officer at SEMI, is speaking at the conference LEDs and the SSL Ecosystem 2013 in Boston, MA, USA (28-29 October).