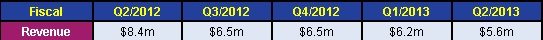

For fiscal second-quarter 2013 (to end-September 2012), Advanced Photonix Inc of Ann Arbor, MI, USA (which designs and makes silicon, InP- and GaAs-based APD, PIN, and FILTRODE photodetectors, HSOR high-speed optical receivers, and T-Ray terahertz instrumentation) has reported sales of $5.6m, down 33% on $8.4m a year ago and down 10% on $6.5m last quarter.

Although up slightly from 34.2% last quarter to 35.3%, gross margin is still down on 42.7% a year ago. Price pressures in the high-speed optical receiver (HSOR) product line prior to cost-reduction efforts and lower volumes affected the rate and gross margin dollars, says the firm.

Although cut from on $3.9m a year ago (47% of revenue) and level with $3.2m last quarter (49% of revenue), operating expenses of $3.2m comprised as much as 58% of revenue this quarter.

Compared to +$469,000 a year ago, adjusted EBITDA (earnings before interest, taxes, depreciation, amortization and stock compensation) has worsened from negative $416,000 to negative $717,000.

“As with the other telecommunications suppliers, we have seen weakness in network spending recently. This has caused us to be more cautious in our total year outlook,” says CEO Richard Kurtz.

“Our recent success in securing increased 100G business from one of our large OEM's for calendar year 2013 is a positive sign amid general softness we have seen from China and Europe due to challenging macro economic conditions,” Kurtz adds. “Our terahertz (THz) product platform is continuing to gain traction in industrial process control markets and we expect this growth to continue during the balance of the fiscal year and beyond.”

“However, due to the more challenging international macroeconomic environment, reduced US military activities, and the looming US fiscal cliff and their corresponding impact on our customer’s expansion plans in the industrial and defense markets, we are projecting a more cautious outlook for the fiscal year,” Kurtz continues. “Due to these conditions we are changing revenue growth for the second half of our fiscal 2013 to a range of 15-25% higher than the first half [cut from the prior forecast of 35% higher],” he adds. However, “We continue to believe that our fiscal 2013 will have a much better second half.”