"It has been a slow path to commercialize smart packaging. Despite strong needs such as the aging population, tougher legislation, huge waste, more demanding consumers and concerns about safety and crime; commercial success has been mixed. The topic encompasses chemical, electrical and electronic features in packaging. By volume, the most successful and sustainable uses have been chemical time temperature indicators (TTIs), mandated on vaccines such as polio and battery testers used on several brands. The new IDTechEx report Smart Packaging Comes To Market: Brand Enhancement with Electronics 2013-2023, discusses and analyses these commercial markets, with 10 year forecasts and company profiles.

Some success but not sustained

There have been many successful products, but most are seasonal - for a promotion or for the lifetime of a particular short-lived product, such as the MWV cigarette carton that lit up (approximately 1 million sold), or liquor bottles with electroluminecent displays, or the McDonalds tray liner with conductive ink to make an interactive game.

Despite these challenges, there are several new factors to take into account:

• Consumer packaged goods (CPG) companies, which have mostly faired extremely well during the recession, with many at all-time high valuations, are actively developing concepts and prototypes of electronic smart packaging

• Suppliers of enabling technologies, such as printed and flexible electronics, are helping CPG companies more by offering more demonstrators and integration services.

This has resulted in more new concepts, demonstrators and activity from the CPG sector and suppliers to it. The drive is to sell more products by offering greater value than the competition, and CPG companies seek to obtain IP where possible to retain the lead.

According to research by IDTechEx in the report, Smart Packaging Comes To Market: Brand Enhancement with Electronics 2013-2023 this creates a market of $75 million in 2013 - the amount of money spent on electrical and electronic smart packaging (excluding chemical smart packaging and RFID). These are still either mature roll outs or many trials of new products - most will begin life in small volumes in a "test" country or location, before brands roll out in volume.

Therein is another issue: If the marketing departments of CPG companies like a concept, they expect high volume manufacturing capability, which may or may not be ready depending on the device offered. To afford the cost of e-packaging, suppliers are looking at higher margin items such as point of sale and point of purchase promotional items or high value products. Others are able to design simple, cheap yet elegant devices such as Printechnologics' Touchcode, with tens of millions of devices already in use.

The $1.45 Billion 2023 opportunity

IDTechEx forecast that it will take another five years for the market for electronic and electrical smart packaging devices to achieve sales of $200 million, but thereafter will grow to $1.45 Billion in 2023. Those winning in 5 years need to put in the development and concept creation now.

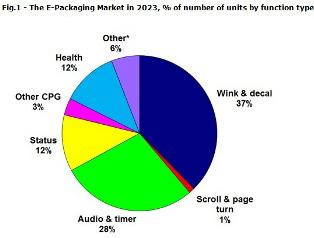

The impartial IDTechEx report Smart Packaging Comes To Market: Brand Enhancement with Electronics 2013-2023 assesses global case studies by brand, successes and failures, progress and roadmaps of enabling technologies, supplier profiles, and forecasts by different types of functionality. It is written by global experts on the topic who interview CPG companies and suppliers.