After decades of steady and predictable market conditions, iconic food and beverage leaders are struggling to adapt to a new, innovation-dependent era of growth, according to a new report from Hartman Strategy, an innovation and strategy consultancy serving major food and beverage companies.

The report, entitled Post-Modern Strategies for Growth in the U.S. Market, is authored by James Richardson , a top executive at Hartman Strategy. Written specifically for top executives within the consumer packaged goods (CPGs) industry, the 11-page report provides industry data and expert insights that reveal:

• A small but very powerful group of affluent and educated U.S. consumers who are driving and, ultimately, re-structuring the future of packaged goods in the U.S.;

• Why the very top and bottom tiers of the food market, and not the middle, represent the greatest sustainable growth opportunities for CPGs;

• Why, in a mature market with weak growth in most categories, food and beverage leaders need to innovate new lines of business to sustain any growth; and

• The need for major CPGs to adopt new models of corporate strategy and governance to allow for a brand agnostic, fund manager mindset to spread throughout their organizations.

"The food and beverage industry has clearly entered a period of disruptive change and some of its largest players not only need to innovate but re-balance their portfolios to sustain growth for their stakeholders," says Richardson.

In the U.S. market today, the top 10 branded food companies only control about 30% of the packaged food retail revenue; The rest of the revenue is produced by hundreds of other companies, focused on branded products, private label products, or both. Almost 40% of retail packaged food revenue stems from thousands of smaller branded businesses (< $140M annual revenue).

Other key data and findings

The new report also provides expert commentary and analysis on current data and reports circulating within the industry including:

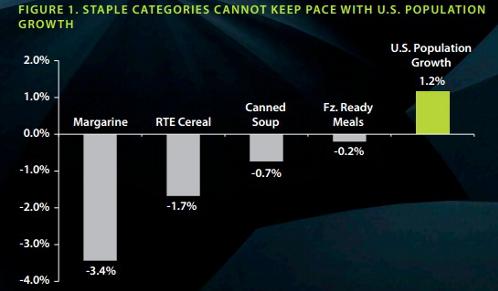

• 70 percent of all food and beverage categories failed to generate sustained volumetric growth in the U.S. over the past two years;

• A relentless decline in dozens of staple food categories including frozen entrees and canned soup, despite sustained population growth;

• What long term social trends data reveal about the upper middle class and its economic impact on both the "old" and "new" world food and beverage economies;

• The structural underdevelopment of innovative upmarket offerings at the retail level, leading to the need for greater partnership between CPG manufacturers and mainstream retail customers;

• the industry's excessive interest in downmarket, value-oriented growth strategies is neither sustainable, financially, nor sufficient to sustain topline growth.

"Historically, the largest food and beverage companies have been slow-moving and methodical - in large part because that was the safe way to operate in a market with multiple, structural tailwinds," says Richardson. "The tailwinds of yesteryear are gone. That era is clearly over and these same companies now need to become more strategic and nimble, more like the investors they give their earnings call to each quarter. We believe that this report will be a catalyst for change among major CPGs."