Recent disappointing results for ventricular assist device companies are raising questions over adoption of the technology—which is meant to assist patients’ weakened hearts with pumping blood.

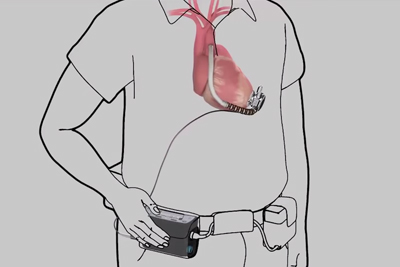

HeartMate II, as shown on Thoratec's website

Thoratec’s profits plummeted in the third quarter of 2014, from $18.9 million one year ago to $2.9 million, the company reported. Revenues slumped as well for the Pleasanton, CA–based company, though not so steeply, down 16% to $105.8 million.

Framingham, MA–based HeartWare didn’t fare as poorly in the third quarter, but its results weren’t great, either. The company reported a net loss of $7.4 million, compared to a net loss of $11.4 million for the same quarter a year ago.

In the case of Thoratec, the company’s HeartMate II left ventricular assist device(LVAD) saw sales drop 19%, to $91.6 million, during the quarter, while sales of its CentriMag product line fell 9% to $11.3 million.

Thoratec president and CEO Keith Grossman acknowledged to analysts on Wednesday that there is a tough market for LVAD devices in general and a bumpy road ahead in market penetration, according to a transcript published by Seeking Alpha. Grossman returned to Thoratec in September after disappointing second quarter results. He previously headed the company from 1996 to 2006.

“I think multiple factors have converged to suppress a recent market growth,” Grossman told analysts. “These of course include an increased discussion of overall adverse events and readmissions associated with LVAD therapy and the resulting potential limitations on both patient referrals and center-by-center treatment capacity.”

In March, Thoratec issued an urgent advisory over four patient deaths related to its HeartMate II device. Five other patients lost consciousness or experienced reduced blood flow when attempting to use backup system controllers for the pump.

The HeartWare VAS system, as shown in this illustration from a company video

The deaths and serious injuries resulted not from device failure, but rather patients and caregivers who were unable to understand instructions.

Grossman said he expected lower earnings going into 2015. Thoratec hadn’t had much competition in the VLAD market, but now it does in HeartWare.

HeartWare, though, had its own challenge in April, voluntarily recalling its Ventricular Assist System based on regulators’ fears about dangers related to a faulty driveline connector that could cause the heart pump to temporarily stop.

“External warning letter remediation cost(s) were approximately $2 million in the third quarter, accounting for the majority of the sequential quarter increase” in R&D expenses, HeartWare’s chief financial officer Peter McAree told analysts, according to a SeekingAlpha transcript. “Addressing the improvement needs highlighted by the warning letter has impacted certain areas of spending, and we estimate allocating approximately $5 million to $6 million in total toward this effort in 2014.”

Godshall had a less gloomy outlook than Thoratec executives. “What I find particularly encouraging from the various surveys that have been done, maybe because it comports with my belief, but no one suggested that that we are expecting growth to remain slow into next year,” Godshall said.