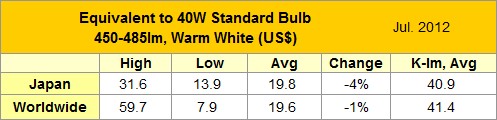

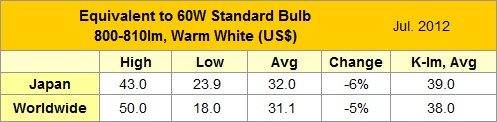

According to the latest price survey by LEDinside, the LED research division of TrendForce, global LED light bulb ASP saw a mild decline in July 2012. 40W equivalent LED light bulb ASP dropped by merely 1.3% in July, while 60W equivalent LED light bulb ASP plunged 4.8%, partially attributed to the new LED light bulb releases in Europe.

40W Equivalent LED Light Bulb Price in UK Dropped below US$10

40W equivalent LED light bulb global ASP fell to US$19.6 in July, with prices in major markets staying flat which saw few new product released. Prices in Japan and Germany slid by 3.5% and 2.7% respectively. ASP in the United States went up by 5.1% to US$17, while ASP in the United Kingdom fell by 4.5% with the lowest price plummeting to US$9.7, making the UK the third country (the first two being Korea and the US) with the lowest price below US$10. ASP in Korea climbed 1.9% in July mainly due to a fall in the exchange rate. No new products hit the Korean market in July.

60W Equivalent LED Light Bulb Global ASP Saw Continuous Decline

60W equivalent LED light bulb global ASP dropped by 4.8% to US$31.1 in July. Prices in major markets continued to dip, and July saw a number of new products hit the European market. ASP in Japan fell by 5.5% to US$32 in July, while ASP in Korea went up due to Won depreciation. ASP in the US stayed flat in July with no new product releases. ASPs in the UK and Germany dipped by 10.5% and 6.8% respectively due to the price cuts of existing products and releases of new low-priced products.

Market Saw Less High-End LED Light Bulb Releases, Companies Aim to Increase Price-Performance Ratio

LEDinside notes that ASPs in European nations saw more prominent declines in July – The lowest price of 40W equivalent LED light bulb in the UK plunged to US$9.7. As of July 2012, prices below US$10 have appeared in Korea, the US, and the UK. Moreover, 60W equivalent LED light bulb ASPs in European countries remained on a decline. July saw the lowest price in the UK and Germany plummet below US$20, which indicates European lighting firms have taken a more proactive stance on acquiring LED light bulb market.

Starting from June 2012, major markets have been seeing less new products with high price-performance ratio releases, with prices of existing products continuing to fall. Instead of engaging each other in a fierce price competition that occurred between late 2011 and early 2012, global first-tier companies are striving to increase their products' price-performance ratios. Despite the persisting price downtrend, companies aim to maintain their products' high quality and efficiency.

LEDinside predicts that major markets will see more and more low-end LED light bulbs' prices drop below US$10, which will make LED light bulbs more cost-competitive in the consumer, construction, and large lighting projects markets.