1. Industry Development Situation

Packaging machinery refers to the machine which is able to complete all or part of the product and commodity packaging. The packaging process including filling, wrapping, sealing and other associated processes, such as cleaning, stacking and demolition. In addition, the packaging also includes measurement or stamp packages. The use of packaging machinery products can improve productivity, reduce labor intensity, adapt to the needs of large-scale production, and to meet hygiene requirements.

According to GB/T7311-2008 “packaging machinery Classification and Model preparation method”, in accordance with the main function of packaging machinery, packaging machinery of different classification, Common classification of packaging machinery are filling machinery, sealing machinery, wrapping machinery, and multi-function packaging machinery, labeling machinery, cleaning machinery, drying machinery, sterilizing machinery, strapping machinery, setting mounted machinery, the auxiliary packaging machinery and other packaging machinery totaled 13 categories.

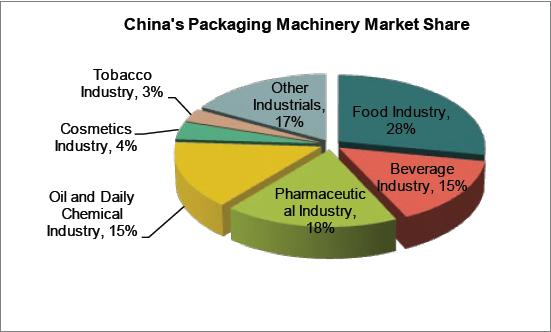

The largest users of packaging machinery are food industry, electronics, chemicals, fertilizers, cosmetics, pharmaceuticals and other industries also have a great demand for packaging machinery. At present, the proportion of China’s packaging machinery market is about: 28% of the food industry, beverage industry is 15%, 18% of the pharmaceutical industry, the tobacco industry is 3%, 4% of the cosmetics industry, 15% of the oil and daily chemical industry, and 17% of the other industrial.

In the next few years, sales of packaging equipment in developing countries and regions will exceed the sales in developed countries and regions (such as Japan, the United States and Western Europe). The largest developing nations - China, whose demand for packaging equipment in 2012 will be more than 3.3 billion US dollars, which surpassed the US to become the world’s largest market. India and Russia, as well as in low-volume markets, such as Ukraine, Iran, Indonesia, Malaysia, Saudi Arabia, Mexico, South Africa and Turkey, the market demands for packaging equipment also have up space.

Although in some developed countries, such as the United Kingdom, Germany, Italy and Japan, the demands for packaging equipment will be relatively slow, but will also have some growth. On the other hand, packaging equipment manufacturing industry will rise faster in developing countries, but the equipment manufacturing capacity is still led by the industrialized countries. In 2012, Western Europe, Japan and the United States will continue to occupy 2/3 of the packaging machinery manufacturing market.

Labeling and coding equipment will set a new record in the packaging market

Labeling and coding equipment will record the biggest sales of all packaging equipment, which thanks to the growing consumer of non-persistent label products, the voice of ensuring food safety rising and more norms of Labeling formulated by the industry. In addition, the market demand for wrapping, bundling and packing equipment is also rising at a higher speed, and the advances in technology improvements, mechanical design also promoted the sales of such devices. Filling and sealing equipment are still the most widely used packaging equipment, which will account for 1/4 in packaging equipment market in 2012.

Pharmaceutical, personal care products market is growing rapidly

Packaging equipment used in the production of pharmaceuticals and personal care products market will maintain rapid growth rate, due to the increase in equipment investment in developing countries, and the increasing use of disposable medical devices and an aging population in developed countries is even more serious. With the rapid increase of drug varieties, the market demand for packaging equipment is rising. Beverage packaging machinery market will show a sound momentum of development, as many developing countries’ consumption in beverage packaging products are growing, and greater use of more efficient, high-end packaging equipment, especially in the industrialized countries. The most interesting is that the field of food processing will continue to be the largest market of packaging equipment, and will account for 43% of global demand for packaging equipment in 2012.

According to the statistics, the global demand for packaging machinery is expected to grow at a rate of 5.3% per year. Packaging equipment manufacturers are mainly concentrated in the United States, Japan, Germany, Italy and China. According to the geographical, the foreign packaging machinery market demand is different.

The German packaging machinery is in the leading position in design, production, technical and other aspects; China is an important importer of packaging machinery for Germany, especially in food processing and packaging machinery. Major importers for German packaging machinery are the United States, Britain, France, China and Russia. German packaging machinery ranked first in the world by the share of 85%.

The development of packaging machinery in The United States is very long, has formed the independent and complete packing machinery system, its varieties and production both rank first in the world. Since the 1990s, the US packaging machinery industry has maintained a good momentum of development. The US packaging machinery factories attached to large packaging materials plant, sales are entirely dependent on the parent company.

Packaging machinery manufacturer in Japan are mainly small and medium enterprises, at present there are more than 200, also, there are more than 100 packaging materials, packaging machinery and related equipment manufacturers, packaging machinery varieties nearly 500 kinds and specifications over 700. Packaging machinery is mainly small and medium-sized single, with small size, high precision, easy installation, convenient operation, high degree of automation advantages.

Italy is the world’s fourth largest producer of packaging machinery, the second-largest exporter of packaging machinery. Italy packaging machinery has the characteristics of excellent performance and elegant appearance, and cheap. The proportion of exports accounted for about 80%; the United States is the largest export market. (Source: China Machinery network of experts)

2. Industry Economic Data

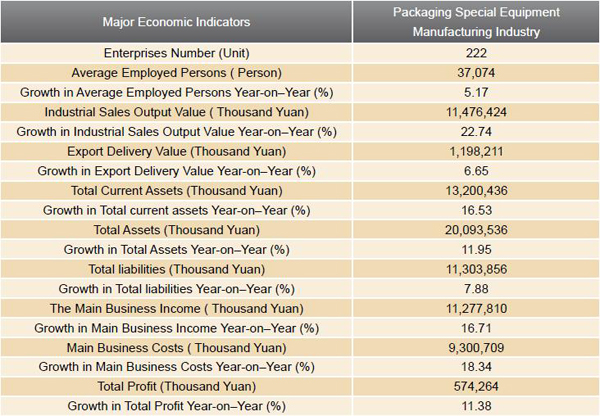

●Packaging equipment manufacturing major economic indicators from Jan. to Jun., 2012

In the first half of 2012, Chinese packaging and special equipment manufacturing industrial enterprises above designated size were 222; the total assets reached 20.09 billion Yuan, a yearon- year growth of 11.95%.

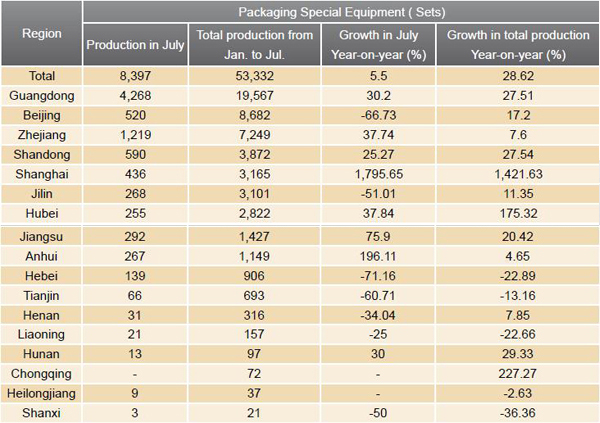

● Major Production Provinces/Cities of China Packaging Special Equipment from Jan. to Jun.,2012

Chinese packaging Special equipment enterprises are mainly located in Guangdong, Beijing, Zhejiang, Shandong, Shanghai and Jilin. The output of China packaging Special equipment was 53000 units in 2012 from Jan. to Jul. Production of Guangdong Province accounted for 36.69% of the national output, ranked the first. Followed by Beijing and Zhejiang, whose production accounted for 16.28% and 13.59% separately of total output. (Source: China industry information network)

3. Chinese Packaging Machinery (HS: 842230) Export Trend Analysis

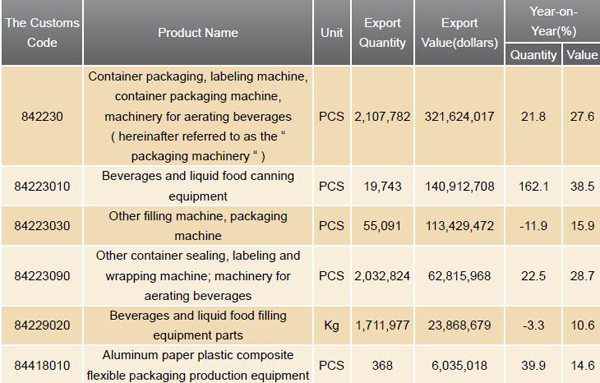

● Exports Situation of the Main Chinese Packaging Machinery Products from Jan. to Aug. in 2012

According to customs statistics, from Jan. to Aug. in 2012, Chinese packaging machinery exports were 322 million dollars, a growth of 27.6% year-on-year. Beverage and liquid food canning equipment exports Were 141 million dollars, an increase of 38.5%, accounting for 43.81%, ranked the first. Followed by other filling machines, packaging machines, whose exports were 113 million dollars, a growth of 15.9% compared with the last year, accounting for 35.27%.

3.1. Chinese Packaging Machinery (HS: 842230) Export Trend Analysis from 2009 to 2011

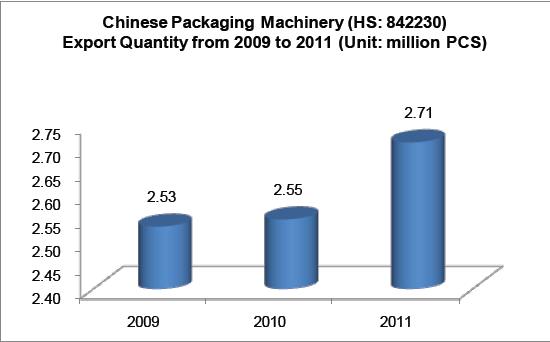

3.1.1. Chinese Packaging Machinery (HS: 842230) Export Quantity Trend from 2009 to 2011

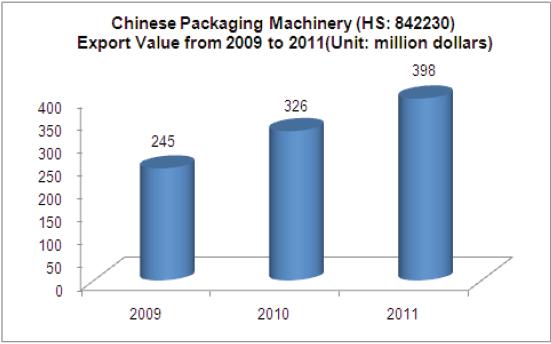

3.1.2. Chinese Packaging Machinery (HS: 842230) Export Value Trend from 2009 to 2011

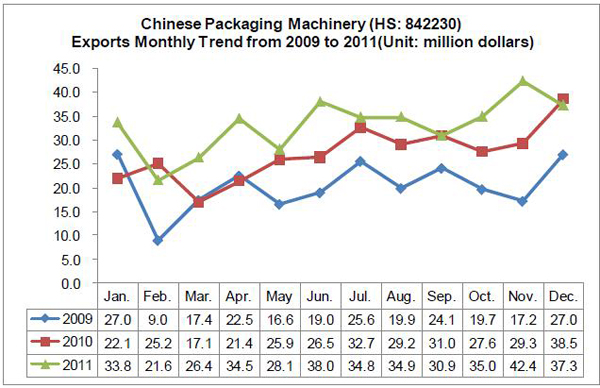

3.1.3. Chinese Packaging Machinery (HS: 842230) Exports Monthly Trend from 2009 to 2011

From 2009 to 2011, China’s total exports of packaging machinery showed a trend of increase, the total export value increased year by year, in 2011 the total exports quantity were about 2.71 million units, an increase of 6.4% year on year; The exports value amounted to approximately 398 million dollars, an increase of 21.8% compared with the previous year.

From the chat can be seen that exports value in the second half of this year was higher than the first half of the year. February and March was the annual export trough.

3.2. China’s Packaging Machinery (HS: 842230) Export Situation in 2012

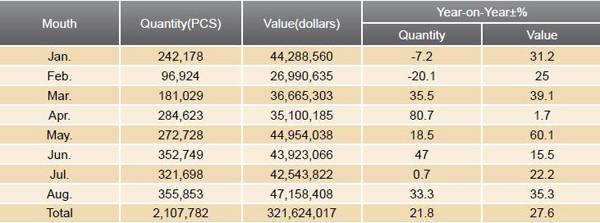

3.2.1. Export Quantity and Value of Chinese Packaging Machinery (HS: 842230) from Jan. to Aug. in 2012

Chinese packaging machinery exports quantity was about 2.11 million units from Jan. to Aug. in 2012, the export quantity increased by 21.8% year-on-year, the value of exports increased by 27.6% year-on-year.

3.2.2. Major Importers for Chinese Packaging Machinery (HS: 842230) from Jan. to Aug. in 2012

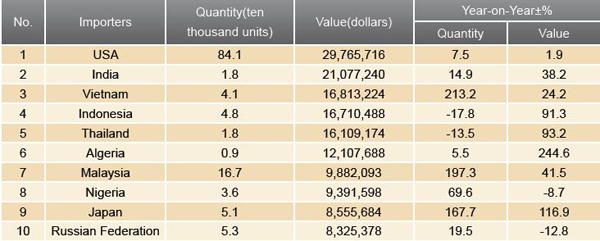

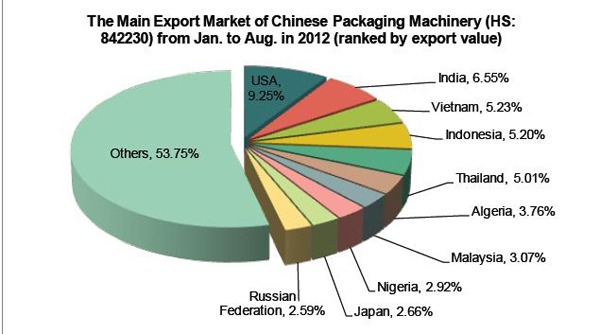

From Jan. to Aug. in 2012, among the top 10 export destination countries, the exports quantity of China’s packaging machinery to eight countries increased, while reduced to the other two countries. From the export quantity compared to the same period, Vietnam (up 213.2%), Malaysia (up 197.3%) and Japan (up 167.7%) increased largely, exports fell in Indonesia (down 17.8%) and Thailand (down 13.5%). From the export value compared to the same period, there had a larger increase in Algeria (up 244.6%) and Japan (up 116.9%), however, the exports value in Nigeria (down 8.7%) and the Russian Federation (down 12.8%) declined. It is noteworthy that Algeria and Japan replaced Hong Kong and Iran; ranked the top ten export destination countries of packaging machinery in China.

3.2.3. Major Export Source of Chinese Packaging Machinery (HS: 842230) from Jan. to Aug. in 2012

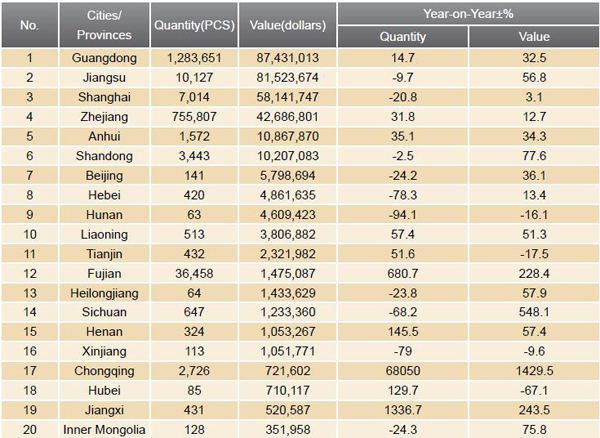

Guangdong, Jiangsu, Shanghai and Zhejiang are the main export source of Chinese packaging machinery, the exports value in this four provinces accounted for 99.75% of total Chinese packaging machinery from Jan. to Aug. in 2012, the exports value of this four Cities/Provinces increased in different degrees, and the largest increase was in Jiangsu, increased 56.8% yearon- year. It is worth noting that the export quantity fell in Jiangsu and Shanghai, and Shanghai’s packaging machinery exports quantity fell as much as 20.8%.

4. Global Packaging Machinery (HS: 842230) Import and Export Situation Analysis

4.1. Global Packaging Machinery (HS: 842230) Annual Import and Export Trend Analysis from 2009 to 2011

4.1.1. Global Packaging Machinery (HS: 842230) Annual Import Value from 2009 to 2011

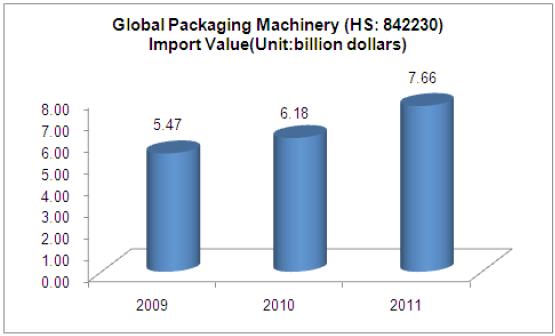

The total imports value grew year by year from 2009 to 2011; the imports value was 7.66 billion dollars in 2011, a growth of 23.9% year-on-year.

4.1.2. Major Importers of Global Packaging Machinery (HS: 842230) from 2009 to 2011

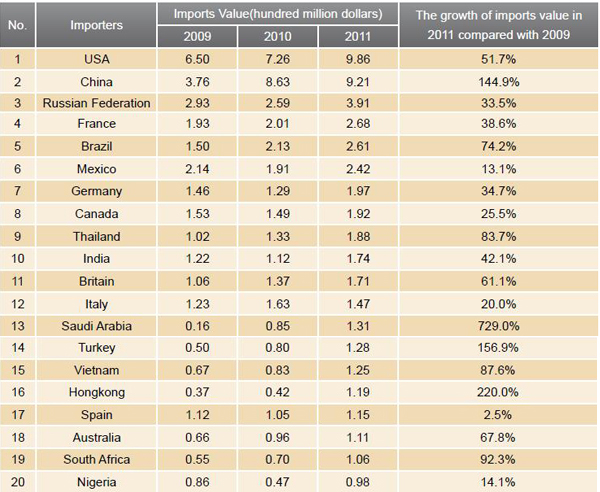

The USA is the world’s largest importing country of packaging machinery, in 2011 the imports value was approximately 986 million dollars, an increase of 35.82% year-on-year. China and the Russian Federation ranked second and third, and the imports value in 2011 increased by 6.67% and 51.02% respectively. Saudi Arabia’s packaging machinery imports value increased 729%,which had the largest increase in 2011 compared with 2009 among the top 20 global packaging machinery importers from 2009 to 2011.

4.1.3. Market Share of Major Global Packaging Machinery Importers (HS: 842230) from 2009 to 2011

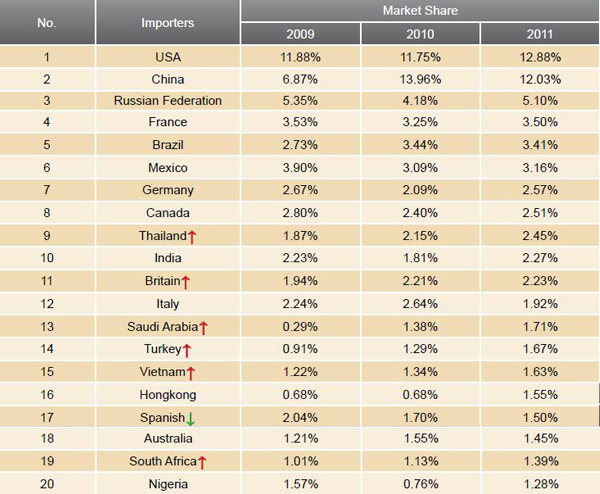

Note: “↑”represents the global imports accounted for the proportion of total imports continued to increase from 2009 to 2011, “↓”represent the imports accounted for the proportion of total global imports declining from 2009 to 2011.

From the market share for the 3 years, the imports value of Thailand, the United Kingdom, Saudi Arabia, Turkey, Vietnam and South Africa all continued increasing, while Spanish continued declining.

4.1.4. Major Exporters of Global Packaging Machinery (HS: 842230) from 2009 to 2011

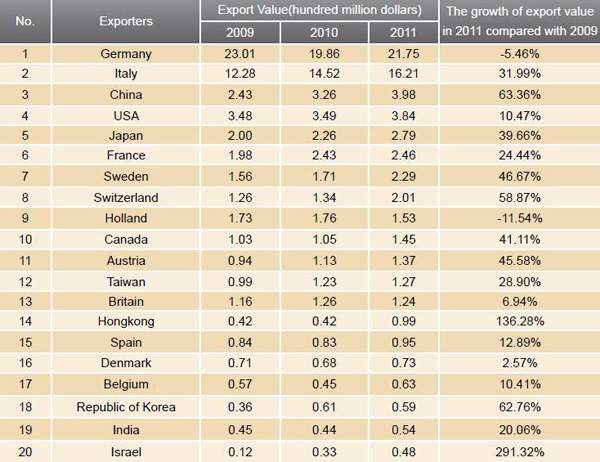

Germany is the world’s largest exporter of packaging machinery, the exports value of packaging machinery in Germany in 2011 accounted for 30.34% of the world’s total exports. Among the top 20 packaging machinery exporters from 2009 to 2011, Israel had the largest growth in exports value in 2011 compared with 2009, increased 291.32%.

4.1.5. The Market Share of Major Global Packaging Machinery Exporters (HS:842230) from 2009 to 2011

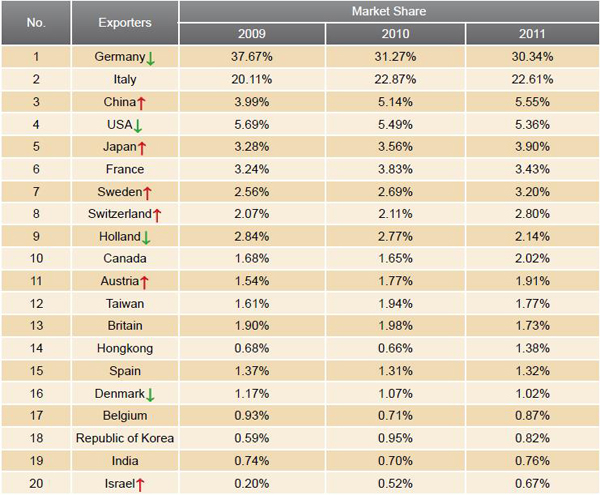

Note: “↑”represents the exports value of total global exports continued to increase from 2009 to 2011,”↓”represents the exports value of total global exports continued to decline from 2009 to 2011.

From the market share for the 3 years, the exports value of Japan, Sweden, Switzerland, Austria and Israel increased continuously, while in Germany, the USA, the Netherlands and Denmark, the exports value declined continuously.

4.2. Main Demanding Countries’ Imports Situation of Packaging Machinery (HS: 842230) from 2009 to 2012

4.2.1. Packaging Machinery (HS: 842230) Imports Situation in the USA

●Packaging Machinery Imports Trend in the USA from 2009 to 2012

The packaging machinery imports value in the USA increased year by year from 2009 to 2011, the total imports was about 986 million dollars in 2011, an increase of 35.82% compared with the last year.

●The USA Packaging Machinery (HS: 842230) Main Imports Countries / Regions from 2009 to 2011

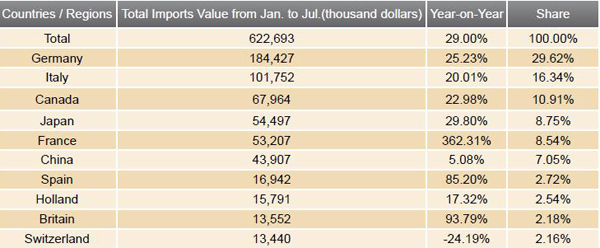

The imports value of packaging machinery in the USA reached 623 million dollars from Jan. to Jul., an increase of 29% compared with the previous year. Germany and Italy were the main imports supply countries of such products, shared 29.62% and 16.34% of the total imports respectively, China ranked sixth, accounting for 7.05% of the market share. It is noteworthy that the first seven months in 2012, the imports of the USA from France increased to 362.31%, significantly higher than the increase of imports in other countries.

4.2.2. Packaging Machinery (HS: 842230) Imports Situation in the France

●Packaging Machinery Imports Trend in France from 2009 to 2011

The imports value of packaging machinery in France showed the trend of increase from 2009 to 2011, the imports value was 268 million dollars, increased 33.24% compared with the last year.

●The France Packaging Machinery (HS: 842230) Main Imports Countries / Regions from 2009 to 2011

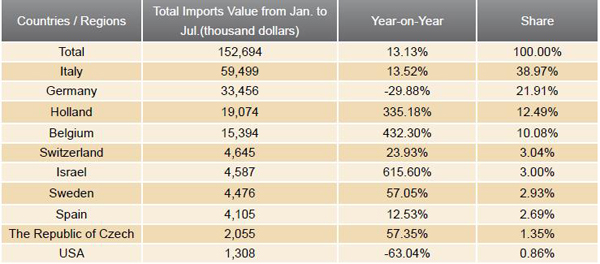

Italy is the largest packaging machinery exporter for France, accounting for 38.97% of the total France packaging machinery imports. It is noteworthy that the first seven months in 2012 the France packaging machinery imports value from the Netherlands, Belgium and Israel up to 335.18%, 432.30% and 615.60% respectively, significantly higher than those from other countries.

4.2.3. Packaging Machinery (HS: 842230) Imports Situation in Japan

●Packaging Machinery Imports Trend in Japan from 2009 to 2011

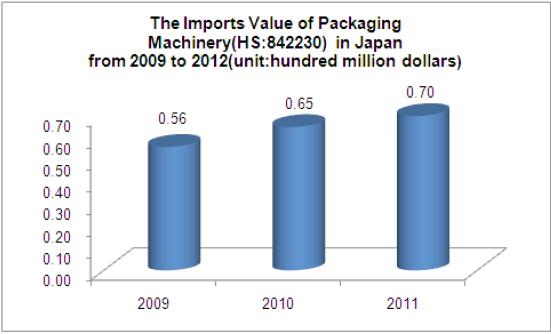

The imports value of packaging machinery in Japan showed the trend of increase from 2009 to 2011, the imports value was 70 million dollars, increased by 7.06% compared with the previous year.

● The Japan Packaging Machinery (HS: 842230) Main Imports Countries / Regions from 2009 to 2011

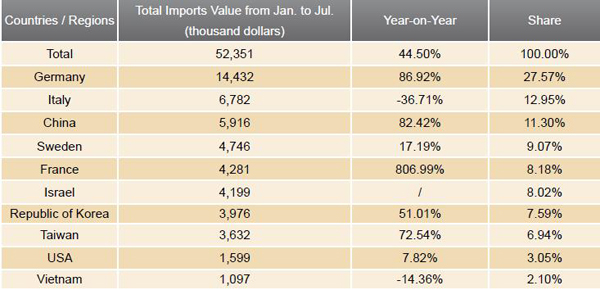

Germany is the largest packaging machinery exporter for Japan, accounting for 27.57% of total Japan packaging machinery imports value, China ranked third, accounted for 11.30% of the total market share. It is noteworthy that the first seven months in 2012, the imports from France increased by 806.99% year-on-year, significantly higher than the other countries.