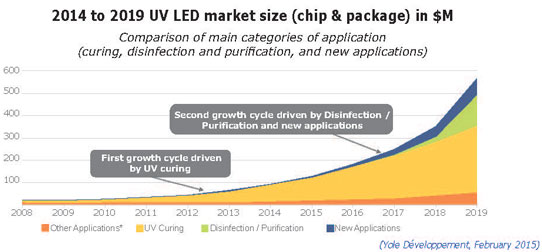

Due to their compactness and low cost of ownership, UV LEDs continue to penetrate the booming UV curing business, through replacement of incumbent technologies such as mercury lamps, according to 'UV LED - Technology, Manufacturing and Application Trends 2015' report by Yole Développement, which says that the market for ultraviolet light-emitting diodes (UV LEDs) increased at a compound annual growth rate (CAGR) of 28.5% from just $20m in 2008 to about $90m in 2014.

Such growth is likely to continue as LED-powered UV curing spreads across ink, adhesive and coating industries, forecasts the market research firm. By 2017/2018, the UV LED market should also see part of its revenues coming from UVC disinfection and purification applications, for which device performance is not yet sufficient, it adds. The UV LED business is therefore expected to grow from $90m in 2014 to about $520m in 2019.

But this is only if we take into account standard applications, where UV LEDs replace UV lamps. The potential is even greater if we consider the ability of UV LEDs to enable new concepts in areas like general lighting, horticultural lighting, biomedical devices, and in fighting hospital-acquired infections (HAIs). Even this is just scratching the surface of the real potential of UV LEDs, says Yole. While the new applications do not yet have a strong impact on market size, Yole expects them to possibly count for nearly 10% of the total UV LED market by 2019.

Entry of visible LED giants to speed UV LED industry maturation

In 2008, fewer than ten companies were developing and manufacturing UV LEDs. Since then, more than 50 firms have entered the field, over 30 of these between 2012 and 2014, mostly attracted by the high margin when overcapacity and strong price pressure from the 'LED TV crisis' had taken its toll on the visible LED industry.

These firms were mostly small and medium enterprises (SMEs), but recently some big companies from the visible LED industry – namely Philips Lumileds and LG Innotek – have also secured a foothold in the UV LED business.

The entry of these two giants will help to further develop the industry, the market and the technology based on their strong experience of the visible LED industry, reckons Yole. A good example of this is that they have made a nearly full transition of their process to 6" sapphire substrates. Compared to a process based on 2" substrates, this can provide an overall productivity increase of at least 30%, which would help to further reduce manufacturing cost.

In addition, front-end and packaging expertise will help to increase UV LED device performance and provide invaluable improvements in terms of $/W, says Yole.

UV LED chip making a bottleneck for high-performance devices

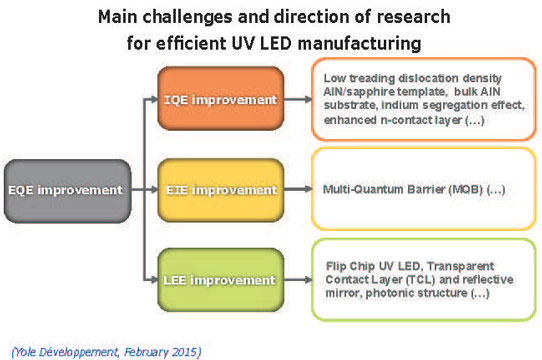

With the external quantum efficiency (EQE) of UV LEDs ranging from a few percent in UVC LEDs to 40-50% in UVA and near-UV LEDs, R&D directed at efficient chip manufacturing will be key for the development of UV LED markets, says Yole. Indeed, such issues have a direct impact on the technology's penetration, mostly in the UVC range where UV LED performance is not yet sufficient to trigger adoption in the main purification and disinfection applications.

To increase EQE, manufacturers need to develop techniques for each efficiency parameter: internal quantum efficiency, electron injection efficiency and light extraction efficiency.

Approaches such as flip-chip and photonic structures can be taken directly from the visible LED industry and its decade-plus of experience. However, UV LEDs also have specific challenges arising from their In/AlGaN-based epilayers that require dedicated R&D at the substrate and epitaxy levels.

In addition to the low power output of UV LEDs, their low efficiency creates additional difficulties at the packaging level. With most of the input power being transformed into heat, thermal management represents a key topic for reliability in devices and associated systems. Here too, expertise developed in the visible LED industry will help to accelerate UV LED development, concludes Yole.