Quarterly Revenue increased 17% year-over-year to a record $316 million;

Quarterly Net Income increased 26% year-over-year to $16.1 million

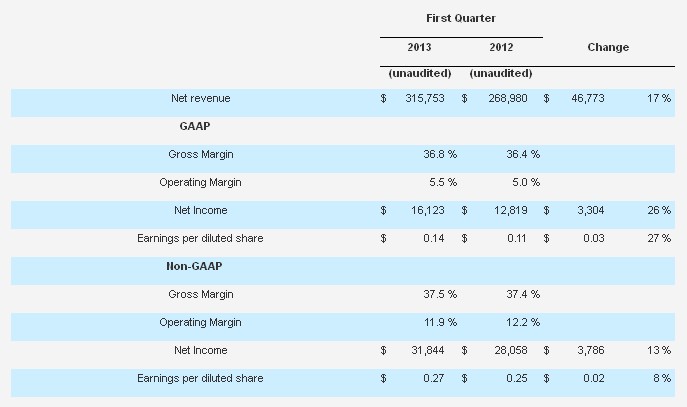

Cree, Inc. (Nasdaq: CREE), a market leader in LED lighting, today announced revenue of $315.8 million for its first quarter of fiscal 2013, ended September 23, 2012. This represents a 17% increase compared to revenue of $269.0 million reported for the first quarter of fiscal 2012 and a 3% increase compared to the fourth quarter of fiscal 2012. GAAP net income for the first quarter was $16.1 million, or $0.14 per diluted share, an increase of 26% year-over-year compared to GAAP net income of $12.8 million, or $0.11 per diluted share, for the first quarter of fiscal 2012. On a non-GAAP basis, net income for the first quarter of fiscal 2013 was $31.8 million, or $0.27 per diluted share, an increase of 13% year-over-year compared to non-GAAP net income for the first quarter of fiscal 2012 of $28.1 million, or $0.25 per diluted share.

"We started the year strong in our fiscal first quarter with record revenue and non-GAAP earnings per share at the high end of our target range," stated Chuck Swoboda, Cree chairman and CEO. "Overall company backlog is stronger than it was at this point last quarter, although visibility is still limited and the macroeconomic environment remains a headwind. Our results are beginning to demonstrate the enormous leverage we have in our fully integrated vertical lighting model."

Q1 2013 Financial Metrics

(in thousands except per share amounts and percentages)

• Gross margin increased 200 basis points from Q4 of fiscal 2012 to 36.8% on a GAAP basis and increased 120 basis points to 37.5% on a non-GAAP basis.

• Cash and investments increased $71.8 million from Q4 of fiscal 2012 to $816.3 million.

• Accounts receivable (net) increased $10.0 million from Q4 of fiscal 2012 to $162.3 million, with days sales outstanding of 46.

• Inventory decreased $9.2 million from Q4 of fiscal 2012 to $179.7 million and represents 81 days of inventory.

Recent Business Highlights:

• Introduced a new 10-year warranty covering the industry's broadest range of products;

• Announced THE EDGE® High Output LED luminaires delivering game-changing performance and savings for area and flood light applications;

• Extended our leadership with the introduction of the new XLamp® XP-E2 LED, delivering higher lumens per watt and more lumens per dollar to lower system costs;

• Announced that Oyster Bay, New York, is installing 4,000 LEDway® street lights and expects to save $200,000 yearly in energy and maintenance costs.

Business Outlook:

For its second quarter of fiscal 2013 ending December 30, 2012, Cree targets revenue in a range of $320 million to $340 million with GAAP gross margin targeted to be 37.5%+/- and non-GAAP gross margin targeted to be 38.5%+/-. GAAP gross margin targets include stock-based compensation expense of approximately $2.6 million, while our non-GAAP targets do not. Operating expenses are targeted to increase by +/- $7 million on a GAAP basis and +/- $5 million on a non-GAAP basis. The tax rate is targeted at 22.0% for fiscal Q2. GAAP net income is targeted at $13 million to $19 million, or $0.12 to $0.16 per diluted share. Non-GAAP net income is targeted in a range of $31 million to $36 million, or $0.27 to $0.31 per diluted share. The GAAP and non-GAAP net income targets are based on an estimated 116 million diluted weighted average shares. Targeted non-GAAP earnings exclude expenses related to the amortization of acquired intangibles and stock-based compensation expense of $0.15 per diluted share.