Over 1.5 million fewer Australians aged 14 years and older are drinking packaged fruit juice in an average week compared with 2010, according to findings from market research organisation Roy Morgan Research.

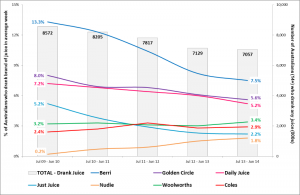

The number of Australians drinking juice in an average week has fallen four years in a row, from 8.6 million in the year to June 2010 (48 per cent) to just over 7 million (37 per cent) today.

Top three brands the same

Roy Morgan Research found that the top three brands have remained the same — and in the same order: Berri, Golden Circle and Daily Juice.

However, compared with 2011, all are now consumed by fewer people each week. Berri is now drunk by 7.5 per cent of Australians, down from 13.3 per cent; Golden Circle by 5.6 per cent, down from 8.0 per cent; and Daily Juice by 5.2 per cent, down from 7.2 per cent.

Home brands becoming more popular

As is the case with many food and beverage categories, the home brands of the two supermarket giants Coles and Woolworths have become more popular.

Each has overtaken Just Juice (2.2 per cent), with 3.4 per cent of Australians now drinking one of Woolworths’ in-store varieties in an average week (up from 3.2 per cent in 2010), and 2.9 per cent drink Coles-brand juice (up from 2.4 per cent).

Nudie juice growing

However, it is not all bad news for juice brands. Nudie is one of the few brands that more of us drink now (1.8 per cent) than four years ago (0.2 per cent).

Angela Smith, Group Account Director, Consumer Products, Roy Morgan Research said different juice drink brands appealed to different consumers, however Berri’s lead was consistent across all of Roy Morgan Research’s Helix Personas consumer demographic groups.

“But among those brands in a close race, there is some variation in which types of people prefer which: Metrotechs are the most likely to drink Nudie, Battlers the most likely to drink Woolworths’ homebrand, and Leading Lifestyles the most likely to drink Daily Juice,” Ms Smith said.

“It is notable that despite the popularity of packaged juice being clearly on the decline, the proportion of Australians now with a juice extractor in the home (26.4 per cent) is virtually unchanged compared with 2010,” Ms Smith said. “Of course, whether or not they use them regularly is a whole other story,” she said.

Drop in consumption of other soft drink in recent years

Australian Food News has followed the decrease in consumption of other soft drinks throughout 2014. In August 2014, Australian Food News reported that market research organisation Mintel had found a quarter of UK consumers reported drinking fewer carbonate soft drinks than six months ago, with 50 per cent citing concerns about sugar content as their reason for drinking less soft drink. In September 2014, Australian Food News reported that US consumers were embracing carbonated water as soft drink sales dropped there too.