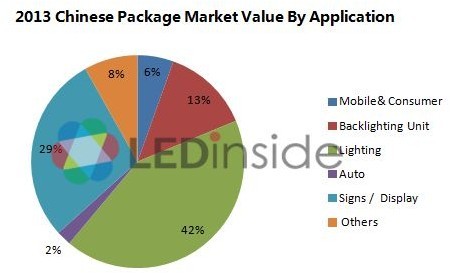

Global market research firm TrendForce's Green Energy Division LEDinside said that, in 2013 Chinese LED packaging market value increased far quicker than the global average. LED lighting is still the largest application field of 2013 Chinese LED packaging market, accounting for 42%. Due to the rapid growth of Chinese LED commercial lighting market demand, Chinese lighting-use LED manufacturers such as MLS Lighting, Honglitronic, CF Lighting got continuously outstanding performance. High-quality indigenous chips greatly improved the competitive position for Chinese LED lighting-use LED packaging industry. According to LEDinside, indigenous chips has accounted for almost 80% in the 2013 Chinese chip market.

Source: LEDinside

For backlight field, LEDinside analyst Allen Yu said that with the support of Chinese TV and mobile phone manufacturers, Mainland package manufacturers gradually replacing that in Taiwan, Japan and Korea in the market has become an irreversible trend. In TV backlight field, Refond, DSBJ, AMTC, Shineon and other manufacturers all got fast-growing performance, and entered into China’s top six TV manufacturers' supply chain. Supplying products for brand manufacturers can not only significantly improve quality control and management capability of Chinese LED package industry, but also help Chinese package manufacturers to accumulate strength for participating in global competition.

For emerging fields such as automotive lighting and Flash LED, the situation of international manufacturers monopolizing the market is expected to be changed, and Chinese package manufacturers are actively penetrating these emerging markets. In the case of lighting, backlight and display markets being almost fully competitive, these emerging fields are expected to become the new battle ground for Chinese packaging manufacturers to compete.

In view of global market, the main challenge for Chinese LED package manufacturers to improve market share in the future still comes from technology. In 2013, EMC lead frame materials, flip chip, CSP and other emerging technologies appeared. ETi and Sanan Optoelectronics have successfully developed flip chip technology, and EMC lead frame also has attracted much attention, Lightning optoelectronic, Smalite Optoelectronics, Honglitronic, Refond, APT and other manufacturers have adopted EMC packaging production line. Although it is not able to reshape the competitive landscape, the impact on existing industry development is still worth noting. It will take some time to verify how the new materials and new technologies will affect the existing industry development in next few years.

Allen Yu points out that LED packaging technology evolution always focuses on the continuing drop in end-use costs. Use of new packaging materials, formation of new packaging specification and emergence of new packaging technology are to reduce the cost per lumen on the premise that the quality is guaranteed. LEDinside expects that the global LED lighting product shipment will grow by 68% in 2014, with the production value reaching 17.8 billion U.S. dollars. Under the situation that the backlight market penetration becomes saturated and other applications are still in emerging progress, how Chinese LED packaging industry seizes the opportunity of rapid development of the global lighting market will become an important factor to the outcome of manufacturers.